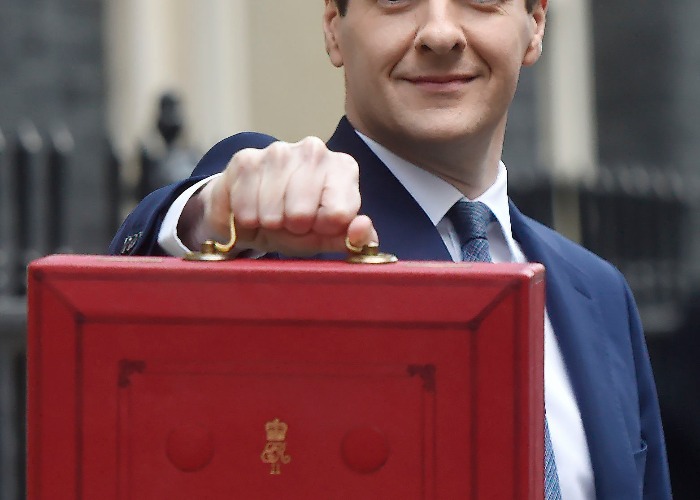

Budget 2016: what the Chancellor didn’t say

There are plenty of interesting changes hidden within the small print of the Budget document.

As always with the Budget, just as interesting as the announcements that make it into the speech are the ones hidden away in the little red book. Here are some of the interesting snippets we’ve found.

A pensions dashboard

Pension saving can become “confusing”, the Budget document acknowledges. As a result it will work with the industry to ensure that a pensions dashboard is launched by 2019. This will mean you can view all of your retirement savings in one place.

Financial advice

In order to improve the financial advice available to most people, the Government will increase the current £150 Income Tax and National Insurance relief for employer-arranged pension advice to £500.

In addition, it is to consult on introducing a Pensions Advice Allowance. This will allow people under 55 to withdraw up to £500 tax-free from their pension in order to cover the cost of financial advice.

Earn 5% interest from your current account

Housing

The Budget document announces the launch of the Starter Homes Land Fund prospectus. Around £1.2 billion of funding is available for local authorities to convert brownfield land for housing, in order to deliver at least 30,000 start homes.

The document also confirms plans to move to a more streamlined, ‘red line’ planning system, which it claims will speed things up.

On top of that, it will work with local authorities to release land with the capacity for at least 160,000 homes, while the Homes and Communities Agency will work with Network Rail to provide land around stations for housing, commercial development and regeneration.

Wine to get more expensive

Duty on most wines and higher-strength sparkling cider will rise by the Retail Price Index measure of inflation (currently 1.3%) from 21st March.

Extending parental leave to grandparents

The Government will launch a consultation in May on how to extend its shared parental leave and pay to grandparents.

ISAs

The Government will legislate to ensure that the ISA savings of a deceased person continue to enjoy tax advantages during the administration of their estate.

Tax

From 2018, businesses, self-employed people and landlords who keep their records digitally will be able to adopt pay-as-you-go tax payments.

There will also be investment into HMRC to improve the service it offers. This includes moving to a seven-day service by 2017 with extended hours and Sunday opening on phone lines. Eight hundred new staff will be hired into HMRC call centres in order to improve its telephone services.

Selling off Lloyds shares

The Government had planned to sell off its remaining stake in Lloyds Banking Group at the start of this year, but postponed the sale following the turbulence in the international stock markets.

The Budget red book commits to launching that retail sale in 2016-17, but there is no further detail on when that will be.

Breakfast clubs

Some of the money raised from the Sugar Levy will go towards expanding breakfast clubs held in schools. Around £10 million a year will go towards setting these up in 1,600 schools from September 2017, which are aimed at ensuring more children enjoy a nutritious breakfast.

Apprenticeships

Back in the Autumn Statement, the Chancellor revealed that an apprenticeship levy will be introduced in April 2017. The Budget document confirms that employers will receive a 10% top-up to their monthly levy contributions, which will be available for them to spend on apprenticeship training through their digital account.

Further details will be set out in April.

Further education

From 2018-19 loans of up to £25,000 will be available to any English student without a Research Council living allowance who can win a place to study for a doctorate at a UK university.

The Government will also extend the eligibility of master’s loans to include three-year part-time courses with no full-time equivalent.

Disability employment reform

New peer and specialist support will be offered to those suffering from mental health conditions and young disabled people.

A White Paper will be published later this year detailing exactly what can be done to support disabled people getting into, and then staying in, work.

Salary sacrifice

The Government says it is “concerned” about the growth of salary sacrifice schemes, with clearance requests for such arrangements to HM Revenue & Customs jumping by more than 30% since 2010. As a result, the Government is considering limiting the range of benefits that enjoy tax benefits when provided through salary sacrifice.

However, the likes of pension contributions, childcare and health-related benefits like Cycle to Work will continue to benefit from Income Tax and National Insurance relief for now.

Smuggling and the hidden economy

The Home Office will receive £31 million of funding to form a group of border officers tasked with cracking down on the most prolific smuggling routes and intercept smugglers. It will also consult on a range of measures to address the ‘hidden economy’.

Cars

The Government wants to establish the UK as a “global centre for excellence in connected and autonomous vehicles”. This includes trials of driverless cars on the strategic road network by 2017 and consulting on how to enable driverless vehicles on England’s major roads.

Trials of comparative fuel price signs on the M5 will be held this spring, in a bid to drive fuel price competition and help motorists save money.

Broadband

A new cost comparison measure for broadband and other telecoms services will be developed by Ofcom this year.

Cold calls

A new "tougher" regulatory regime for claims management companies will be introduced, with the FCA taking over regulation. All firms will need to apply for reauthorisation. Industry experts have suggested this crackdown may dent the number of cold calls we receive about making spurious claims for whiplash.

Picture credit: Hannah McKay / PA Wire/Press Association Images

Earn 5% interest from your current account

More on the Budget 2016:

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature