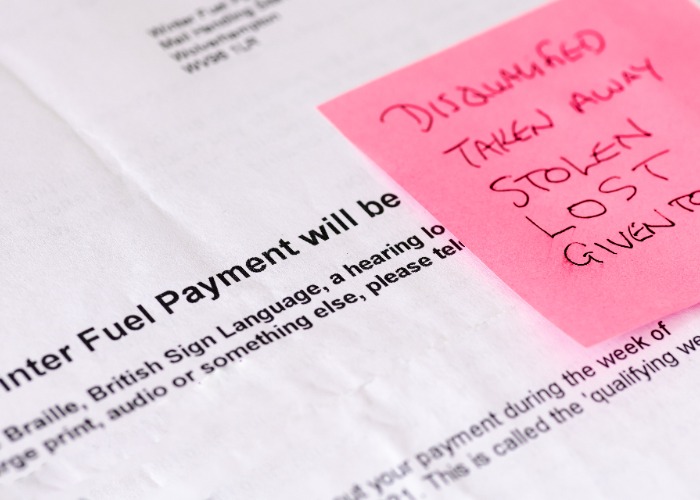

Government backtracks on Winter Fuel Payments amid ongoing criticism

Prime Minister reveals more pensioners will get the vital help, but it’s unclear whether the changes will be implemented in time for this Winter.

The Government looks set to water down its Winter Fuel Payment crackdown following months of intense criticism.

Speaking at Prime Minister’s Questions yesterday, Keir Starmer said he wanted more pensioners to be eligible for the vital help, which is worth up to £300 to retirees.

Labour had sparked widespread anger by announcing last year that only low-income households in receipt of Pension Credit would get the payment, meaning millions of retirees missed out.

It saved the Government more than £1 billion in 2024, but fierce public criticism of the move has not died down.

Indeed, many Labour canvassers reported it was a key talking point amongst the public in the build-up to recent local elections.

Watch out for Winter Fuel Payment scams: how to stay safe

Winter Fuel Payment: what’s changing? And when?

Details of the Government’s plans are thin on the ground, with the Prime Minister saying more would be revealed at the next big fiscal event, likely the Autumn Budget later this year.

But we are unlikely to see the Government enact a complete U-turn on its Winter Fuel Payment policy.

Instead, expect to see the rules loosened slightly so that a larger proportion of low-income households qualify.

Another key point to be clarified is whether the change will be implemented in time for this Winter, or whether retirees will have to wait until 2026 to benefit.

Winter Fuel Payments are paid out automatically in November and December.

While we don’t know the date of the Autumn Budget, this usually takes place in late October or early November.

If retirees are to benefit this year, changes will likely need to be announced as part of that event and then enacted with immediate effect.

If you are a retiree on a low income and haven’t checked whether you qualify for Pension Credit, it is definitely worth doing so now.

Not only could this ensure you get the Winter Fuel Payment regardless of what the Government decides, but it will also entitle you to a host of other vital lifelines.

Government is raking in far more tax

As mentioned earlier, it’s estimated that the decision to scrap the Winter Fuel Payment for all but those receiving Pension Credit saved the Government £1.3 billion last year.

But it’s worth noting that the Government's coffers are being significantly boosted by its various tax raids.

Driven largely by its new NI hike for employers and the ongoing freeze of tax thresholds, new figures released this week show April revenues for Income Tax and National Insurance are almost £4 billion higher than the same month last year.

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature