Industries that will boom after the COVID-19 pandemic

Industries likely to see post-pandemic profits

COVID-19 brought the world to a standstill and, as a result, many businesses have struggled to stay afloat. However, some industries have actually seen profits increase and are likely to continue to enjoy similar levels of prosperity post-pandemic, while other industries that have suffered are set to flourish once the crisis is over.

As much of the world tentatively emerges from the grip of the pandemic, read on to discover the sectors that are going to boom, or continue to boom, as life returns to something approaching normal. All dollar amounts in US dollars.

Streaming services

The pandemic meant many industries shifted as best they could to online, and the film industry was no exception. As cinemas around the globe shut their doors and people prepared to spend months inside their homes, online streaming became an obvious way to pass the time – as well as a vital way to keep film studios afloat.

Disney, Marvel, and Warner Bros all released films straight to streaming services rather than delaying until the cinemas reopened, with hits such as Mulan and Black Widow debuting online.

Streaming services

The cinemas that survived the pandemic may have reopened but it seems that many people have become accustomed to watching the latest releases from the comfort of their own homes. Data from movie industry website The Numbers suggests that significantly fewer people are now venturing out to the cinema, with annualised figures claiming 511 million tickets could be sold this year, down from over a billion in 2019.

By contrast, the demand for streaming services is skyrocketing. A study from Grand View Research has shown that the video streaming sector will experience a compound annual growth rate (CAGR) of 21%, meaning it will hit a market value of $223.98 billion (£164bn) by 2028.

Sponsored Content

Online meeting platforms

Virtual meetings brought an element of normality to working from home, with Zoom at the forefront of the industry. The California-based software company boomed during the crisis and saw its stock price surge.

Meanwhile, Google made the premium features of its Google Hangouts platform free until the end of September 2020, and Microsoft saw daily users of its software Teams jump from 32 million to 44 million during March that year. And although many workers have now returned to the office, it's likely that these platforms won't disappear...

Online meeting platforms

Now that most companies have had to adapt to allow employees to work from home, it's likely that there'll be more flexibility for remote working in the future. Having honed their home-working space and enjoyed the lack of a commute, many workers may opt to WFH more frequently.

According to 2022 data from Owl Labs, more than half of all global employees now work from home at least once a week, while over two-thirds (68%) of employees work from home at least once a month. With that in mind, platforms provided by Microsoft, Google, Zoom and others are likely to stay in high demand to keep colleagues connected, even if everybody else opts to return to the office.

Dating apps

.jpg)

Dating apps have become the go-to means of finding a partner in the modern world, and there was a global slowdown in app downloads as it shifted from a new craze to the norm. In fact, there was a 32.5% growth in dating app users in 2016, but this decelerated to just a 5.3% increase in 2019.

As the COVID-19 outbreak prohibited nearly all face-to-face meet-ups, however, there was a new surge in downloads and interactions through the likes of Tinder, Bumble, and Hinge. On 29 March 2020 alone, Tinder users across the world swiped through three billion possible matches, which is more than any other day on record. In the US, the number of app daters was set to hit 26.6 million by the end of 2020, an 18.4% increase on 2019 according to eMarketer.

Sponsored Content

Dating apps

There’s a good argument that this growth trend may be set to stay. Real-life dates can be expensive, and so vetting a person through an app first is a cheaper and more efficient way to work out whether the relationship is worth pursuing, which could be a big factor in the post-pandemic economic fallout.

In 2019, it was already predicted that more people would be meeting their partner online than in real life by 2035, and it seems the current crisis has only amplified our dependence on the virtual world when it comes to finding "the one".

Cybersecurity

Cybersecurity is always big business but an increasing dependency on digital tools such as virtual meeting platforms means that our data is more susceptible to the advances of hackers than ever before.

COVID-19 has proven to be a huge threat to cybersecurity, with scammers quick to take advantage of the world’s uncertainty around the pandemic. Spam email campaigns have been particularly popular; in the UK, for example, hacking attacks targeted at people working from home comprised 12% of malicious email traffic before the first lockdown, but that figure rose to 60% just six weeks later. According to cybersecurity company Proofpoint, many attackers have used the names and logos of trusted companies and bodies, such as the World Health Organization (WHO), to encourage users to click on dangerous links.

Cybersecurity

The pandemic pushed companies to move their services online and, for many, that move was rushed, meaning that not all the necessary steps were taken to ensure that important data, such as customer details, were adequately protected. Cybersecurity budgets were already increasing year-on-year before the spread of coronavirus, and the continuing threat posed by the COVID-19 outbreak is only going to accelerate the trend of businesses spending more on their online safety measures.

According to research firm Gartner, cybersecurity spending in 2021 was 11% higher than in 2020, while PricewaterhouseCoopers' 2022 Global Digital Trust Insights report found that almost 70% of companies expect to increase their cybersecurity budgets again this year.

Sponsored Content

Online teaching

Many parents had to become teachers overnight as schools across the world closed their doors – and online learning resources boomed in response. In China, technology was already an increasing part of the traditional education system, with AI resources supplementing, and in some cases, replacing real-life teachers. The restrictions put in place as a result of the pandemic forced the education system to move online.

Now that the initial step has been taken, many of those temporary alterations to the traditional classroom experience will become permanent changes, according to a global study conducted by Pearson Education.

Online teaching

It wasn’t only schoolchildren that were left high and dry, as most university students were sent home to continue their studies remotely. After returning for the 2020/2021 academic year, many universities saw outbreaks of COVID-19 on campus, and a lot of institutions committed to online lectures for the whole year.

When asked about the future of technology in education, 63% of university leaders predicted that prestigious universities would have full university courses available for online study by 2030, according to a survey carried out by Times Higher Education. Although the return to in-person teaching has been welcomed, the convenience of being able to access learning resources online could democratise higher education – or, at the very least, allow students to rewatch lectures in bed.

Video games

The pandemic has offered existing gamers plenty of time to hone their skills, as well given non-gamers an opportunity to see what all the fuss is about.

In March 2020, Nintendo's newly-released Animal Crossing: New Horizons saw higher sales than all of the series’ previous games combined. Similarly, game streaming platform Twitch saw a 10% increase in its global usage in the same month. Video games sales are definitely on the rise thanks to the pandemic, and it’s possible that gamers could find it difficult to shake the habit as the world edges closer to normality.

Sponsored Content

Video games

The pandemic has also "popularised and legitimised" esports – a form of gaming that centres around playing sports competitively via a console. At the start of the pandemic, it was suspected the esports sector would suffer, as many games rely on live sporting events; historically, 75% of esports revenue had come from advertising and broadcasting. However, when live sports stopped, esports offered fans a way to keep their favourite games going. The craze is only set to expand, with sports leagues using the gaming world to engage with younger fans.

Overall, the future of the video games industry is bright, and it's predicted to keep growing from its current market size of $167.5 billion (£129bn) to $291.16 billion (£224bn) by 2027.

Children's toys

With children across the world having spent large chunks of 2020 and 2021 at home, toys haven’t seen the dip in sales that other industries have suffered. In the US, for example, there was a 16% growth in toy sales in the first six months of 2020. Games and puzzles were the biggest sellers, making up 37% of the market, while outdoor toys, building sets, and arts-and-crafts sets were also popular.

In the UK, toymaker Hornby, which makes its eponymous model train sets and also owns toy car brands Scalextric and Corgi, saw a 33% boost in sales during the same period. More than a third of Hornby's sales came from outside the UK thanks to online shopping, and the previously ailing firm made a return to profitability. And the boom seems set to continue after the pandemic…

Children's toys

.jpg)

In a bid to limit their children's screen time during lockdown, many parents have been investing in non-digital toys and games, and this looks to be a trend that will continue after restrictions have been fully lifted. As a result, the global toys market is on-track to expand by 4% every year between 2019 and 2025, and is forecast to grow by $30 billion (£22.7bn) in the same period.

Sponsored Content

Online supermarket deliveries

Grocery delivery slots quickly became like gold dust during lockdown. As well as coming to the aid of customers, home delivery services have also helped to strengthen business for supermarkets such as Walmart in the US, as well as the UK's online-only Ocado.

After reporting a loss of £44.4 million ($61m) in 2018, Ocado has experienced bouts of such high demand during the pandemic that it had to turn away orders when its website became overrun with customers. The virtual supermarket then raised its full-year profit expectations from £40 million ($52m) to £60 million ($78m) in November 2020 as it continued to thrive during the COVID-19 crisis. The following month, it increased the figure again, to £70 million ($94m).

Online supermarket deliveries

It’s expected that the industry will continue to grow, with studies by British supermarket Waitrose suggesting that the changes to grocery shopping habits are "irreversible". Even before the pandemic, data compiled by OneSpace claimed that around 10% of all grocery sales will be made online in 2022, the equivalent of $133.8 billion (£99bn). And it isn’t just conventional supermarkets that are profiting from the appetite for grocery deliveries: there has also been a boom recently in start-ups offering super-fast delivery services that drop supplies to your door within minutes of ordering.

Although some shoppers might have looked forward to returning to their favourite grocery stores once lockdown ended, it seems many people who started online shopping are keen to continue the habit in post-pandemic life.

Food delivery

As well as groceries, deliveries of ready-to-eat food soared due to the pandemic. Many restaurants and cafés scrambled to facilitate takeaway orders so they could continue operating after lockdown forced them to close, while delivery businesses such as Uber Eats waived delivery fees for independent eateries to help keep them afloat. Anything from pizzas to pulled pork was ferried from commercial kitchens to people unable to leave their homes.

Sponsored Content

Food delivery

After trading at limited capacity, many bars and restaurants are maintaining their takeaway and delivery services for those who have grown accustomed to avoiding the washing up without having to leave the house. The food delivery industry was set to be worth $41 billion (£31.5bn) in 2021, but thanks to the pandemic it hit $45 billion (£34.6bn) in 2020, according to investment banking company Morgan Stanley. The ongoing crisis has accelerated a trend that was already in motion, and food delivery is now set to make up 21% of the restaurant market by 2025, whereas pre-pandemic it was predicted to account for 15% of the market by the same year.

One particular success story in the sector is Finnish food delivery start-up Wolt, which saw its revenue triple to $345 million (£252m) in 2020. It now operates across 23 countries around the globe, including Germany and Japan, and 180 cities. It has since raised $530 million (£386m) in funding, and is planning to go public this year off the back of its pandemic success.

Online shopping

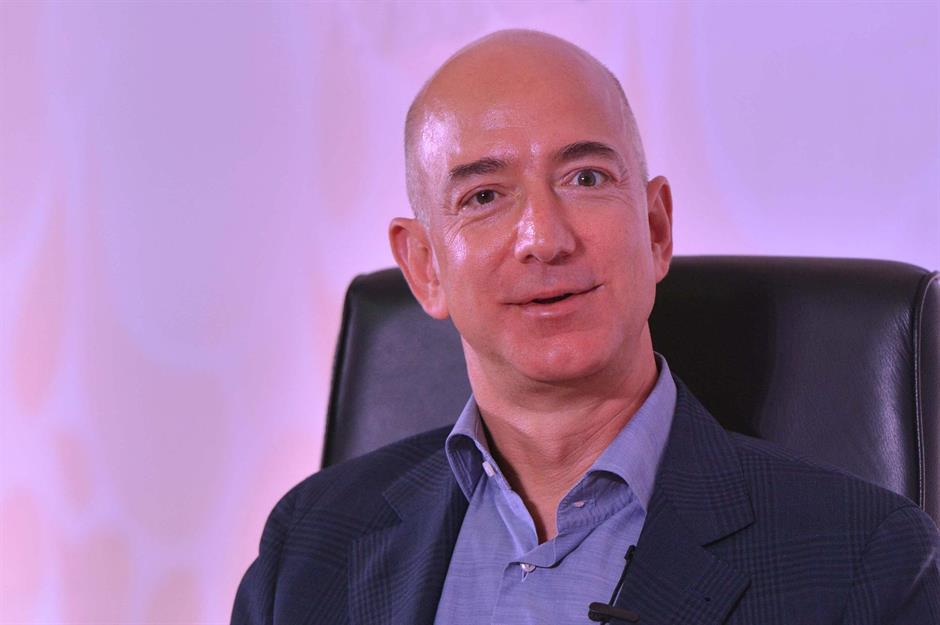

Unsurprisingly, home delivery services such as Amazon are also benefitting from the pandemic. When people were stuck at home, online orders were the only way to shop for non-essential items, and Amazon's share price went through the roof as a result.

At one point, online shoppers were spending around $11,000 (£9k) a second on the site, and the money spent by customers will likely help the international delivery giant expand even further.

Online shopping

This increase in sales has added to the already eye-watering wealth of Jeff Bezos, Amazon's founder and former CEO. Less than a month after the start of the pandemic, Bezos' net worth had grown by a whopping $24 billion (£17.7bn), and at the time of writing his fortune amounts to $189.2 billion (£143.4bn).

Although Amazon’s growth has slowed somewhat now that the world is reopening, online shopping currently makes up 19.6% of retail sales worldwide. This figure is estimated to rise to 22.3% by 2023, with our love of shopping in just a couple of clicks not set to end any time soon.

Sponsored Content

Packaging

The global demand for packaging was already on the rise before the pandemic, with more and more people switching to the convenience of online shopping. Despite this, the packaging sector has had a tumultuous time in the last two years. The increase of online sales caused a surge in demand for the likes of cardboard boxes, but other sectors that are big users of packaging, such as hospitality and catering, were shut down, meaning that their suppliers were left with surplus stock.

Single-use packaging also came back to the fore after years of being shunned for environmental reasons, as it was considered to be more hygienic than reusable products.

Packaging

Now that online deliveries are continuing to grow and the hospitality industry is beginning to bounce back, it’s anticipated that the global packaging market will increase by 3% each year to reach a value of $1.2 trillion (£862bn) by 2028.

The type of packaging used by companies is set to change in the next decade, however, with many big businesses pledging to use 100% reusable, recyclable, or compostable packaging only by 2025. These include L’Oréal, PepsiCo, and Walmart.

Major supermarkets

While Amazon may have been swooping in on the business of smaller retailers hit by the pandemic, other big brands are holding their own. Having thrived during the 2007-20088 recession, it’s perhaps unsurprising that Walmart is one of the big retail winners of the pandemic, with the business enlisting around 150,000 new members of staff to handle the spike in shoppers.

The company’s foray into e-commerce has also been a success, with online purchases increasing by 70% from 2020 to 2021, according to Statista. Fellow American retailers Kroger and Costco have also seen similar increases in customer demand, as have other general stores across the world.

Sponsored Content

Major supermarkets

Keeping American homes well-stocked throughout the crisis comes with additional perks, as it's also done wonders for Walmart's reputation.

In a survey carried out by BrandSpark International in 2021, Walmart was rated as the most trusted supermarket in America, and it's likely that the nation will stay loyal to the grocer and continue shopping there long after the pandemic is over.

Walmart: facts and figures about the world's biggest retailer

Pharmaceuticals

Billions of dollars have been pumped into the pharmaceuticals industry, with companies such as Pfizer, Moderna and AstraZeneca racing to produce the vaccines that would immunise the world against COVID-19.

Now that several coronavirus vaccines have been created, the importance of continuing infectious disease prevention and treatment research is still huge, meaning that the world can be prepared for any future pandemics.

Pharmaceuticals

The drug discovery market continues to climb in value. In fact, it could be worth a colossal $71 billion (£54.6bn) by 2025, more than double its 2016 value, according to Statista. Shares in biotech companies have also shot up, with COVID-19 demonstrating to the world just how crucial the pharmaceutical industry is.

Sponsored Content

Cleanliness products

Shelves were cleared of antibacterial hand gels and soaps as soon as it became apparent that an infectious disease was spreading, and it's safe to say that we're not all experts in the art of hand-washing. Good hygiene practices have become such an intrinsic part of our day-to-day routine that going back now seems impossible for many.

In the UK, sales of hand sanitiser were up fourfold against pre-pandemic levels by the end of 2021, suggesting it has become an everyday essential now that the world is reopening.

Cleanliness products

Looking through history, previous pandemics and epidemics have changed how people behaved at the time, especially when it came to personal hygiene. For example, the 14th-century Black Death outbreak, which is the most fatal pandemic in recorded history, prompted authorities to look at improving street cleaning and water maintenance practices.

Fast-forward to 2022 and most businesses and public places have hand sanitising stations installed, meaning it's safe to say that cleanliness brands are unlikely to go out of business anytime soon.

Remote medical services

Hospitals across the world saw a massive slump in the numbers of patients seeking emergency medical attention. It's understandable that people preferred to avoid visits to hospitals and doctors at the height of the pandemic, and while medical staff urged the sick to seek help as they normally would, many instead relied on remote medical services for advice.

In fact, the US and Australian governments have approved reimbursement for video-link consultations to keep people away from hospitals, while the UK's National Health Service launched a chatbot for coronavirus advice.

Sponsored Content

Remote medical services

Systems such as NowGP in Europe and Teladoc Health in the US are seeing people flock to their platforms, with users enjoying the ease of accessing medical resources from any location. Remote diagnosis and treatment service Zipnosis reported a staggering 3,600% increase in its usage as a result of the pandemic, while the use of telehealth services more generally has increased 38-fold compared to the pre-pandemic baseline, according to consulting firm McKinsey & Company.

Governments are recognising the importance of offering virtual treatment where possible, and in March 2020 the US government announced that there would be an expansion of such services across America. This is likely to become a global trend, and the telemedicine sector is set to grow to $16.7 billion (£12.8bn) by 2025.

Electric cars

The traditional car-making industry was already in trouble before COVID-19, largely due to growing awareness surrounding the environmental impact of diesel and gasoline.

The pandemic has merely served to boost the green argument, as satellite imagery from the European Space Agency showed a dramatic decrease in the amount of air pollution across the world in spring 2020 when many were in lockdown compared to the same time in 2019. So it's safe to imagine that cars built on green technologies may have better luck…

Electric cars

Electric car producer Tesla saw its stock price go up by 49.2% in April 2020, and its CEO Elon Musk has seen his net worth follow a similarly astonishing upward trajectory. Musk is currently the richest person in the world, according to Forbes, with a net worth of $267.6 billion (£202.8bn) at the time of writing.

Plenty of other car manufacturers are also getting in on the action, and German-based car-maker Audi has even created a new department called Artemis that is focused solely on getting its electric vehicles to market quicker than planned. It’s evident that people are increasingly putting "better for the environment" on their car-hunting checklist, and this trend is only likely to continue as governments move towards prioritizing greener transportation.

Sponsored Content

Electric scooters

Before the pandemic, electric scooters were already seeing an increase in usage, even overtaking docked bikes in popularity in the US by mid-2019. But coronavirus could be the real making of the electric scooter industry. Despite past controversies surrounding their safety, cities around the world have given electric scooter companies such as Bird, Lime, and Voi the green light.

Since the pandemic led many areas to impose social distancing measures that restricted the number of cars on the road, the perfect storm for scooter rental companies was created – and people who chose scooters over public transport while the virus was at its peak may never go back.

Electric scooters

Rome authorised electric scooters on 1 March 2020, just as the pandemic was taking hold. When the country came out of lockdown over the summer, the city was awash with scooters with citizens keen to avoid public transport and making the most of clearer streets. The Italian authorities also see the scooters as a viable greener alternative to cars and motorbikes in the future.

Other cities are also expecting a boom, and London launched a series of rental scooter trials in June 2021. As the English capital has now created the biggest car-free zone in Europe, electric scooters are predicted to remain popular post-pandemic. In fact, the global value of the electric scooter market is tipped to soar past $30 billion (£23.1bn) by 2025.

Cycling

For similar reasons, the cycling industry has benefitted hugely over the last two years. In the UK, hundreds of bike stores were forced to shut up shop in 2019. However, 2020 saw sales of bikes and cycling accessories grow by 45%, adding a staggering £1 billion ($1.4bn) to the market.

The same trend was visible across the Atlantic, with Americans buying 62% more bikes between January and October 2020 than during the same period in the previous year.

Sponsored Content

Cycling

The trend is set to continue after the pandemic, with governments around the globe actively encouraging the use of bikes. In America, New York has closed 140 miles of streets to cars to allow for bikes and pedestrians, while Seattle has permanently shut 20 miles of roads.

In the UK, prime minister Boris Johnson pledged £2 billion ($2.6bn) to the cycling cause, offering £50 ($65) vouchers for bike repairs via his Fix Your Bike scheme, as well as bike lessons for all. The fund will also finance the introduction of thousands of miles of new bike lanes across the country. As with scooters, electric bikes (e-bikes) are also seeing a boom. The global market, worth $15.42 billion (£11.7bn) in 2019, is predicted to grow by 7.49% every year between 2020 and 2025.

Private jets

Not everyone has been switching to greener transport methods though. Social distancing concerns and the disruption to commercial air travel have caused the private jet sector to skyrocket – both literally and figuratively.

In fact, October 2021 was the industry's most successful month on record according to reports, while online searches for the phrase "if you wanted to take a private plane" reportedly increased by a whopping 1,100% between November 2020 and November 2021.

Private jets

There are various reasons why the popularity of private jets is likely to outlast the pandemic, despite the industry's environmental impact. The number of high and ultra-high net worth individuals (HNWI and UHNWI) in the world has boomed over the last two years, with a record-breaking 493 new names joining Forbes' Billionaires List for the first time in 2021.

This means the industry's target market is larger than ever. People who have enjoyed the new-found luxury of flying by private jet during the pandemic may be unwilling to return to commercial flights, especially since many airlines have been hit by disruptions due to staff shortages and low earnings.

Sponsored Content

Gardening

The pandemic saw those staying at home turn their attention towards their gardens, providing a boost in sales for home and garden retailers. Even city dwellers were making the most of their space, with balcony gardens and vegetable patches lavished with care and attention.

Everyone from gardening YouTubers to horticultural-themed apps felt the benefit of the world's focus on all things green. Seed companies also bloomed, with online ordering allowing customers to indulge their new-found passion without leaving their homes. According to Statista, "garden furniture" was one of the most Googled homes-related search terms during lockdown.

Gardening

During the UK's first lockdown, British garden centres saw a boost in online sales, with gardeners across the country having more time on their hands to spend tending to their plants and crops. Good spring weather also undoubtedly played its part, too. This trend continued once shops reopened, with garden centres and DIY stores contributing towards the 12% rebound in retail sales in May, after an unprecedented fall of 18.1% in sales in non-food stores in April.

As lockdowns have reignited gardeners' passion for time outdoors and given non-gardeners the bug, the industry is set to do well post-pandemic. Around 60% of homeowners plan to do more gardening in 2022, according to research by Axiom, and the gardening tools market is set to reach $105.53 billion (£81bn) by 2025 at an annual growth rate of 4.2%, according to Market Research Future.

Arts and crafts

With millions of people around the globe searching for new activities to keep them busy at home, the arts and crafts sector began to boom.

According to UK craft supplier Hobbycraft, the number of online visitors its "online ideas" page received tripled between March and May 2020. And people weren't just crafting for fun; a global shortage of PPE encouraged everyone from amateur crafters to global fashion brands to make facemasks and scrubs for frontline workers.

Sponsored Content

Arts and crafts

More than just a fad, creative pursuits such as knitting, crochet, and painting have continued to find favour among a whole new generation of crafters, partly thanks to social media. For example, celebrated diver Tom Daley (pictured) became a poster boy for relaxing hobbies when he was photographed knitting at the Tokyo 2020 Olympics.

The global arts and crafts market is projected to reach a value of $50.91 billion (£37.6bn) by 2024. That's an increase from $38.96 billion (£28.8bn) in 2019, showing that while many people might have picked up the knitting or crochet needles due to the pandemic, the popularity of crafting isn't likely to unravel any time soon.

Experiences

.jpg)

"What’s the first thing you’ll do once everything’s back to normal?" is the question that was bandied around the world’s dinner tables at the height of the pandemic. Having so much time on our hands meant more time for thinking about the things we’d rather be doing, and as coronavirus has been a striking reminder that life is short, many will have been keen to start crossing items off their bucket list once restrictions started to ease.

Just as the virus was beginning to spread in late February 2020, there was a surge in ticket sales for Virgin Galactic’s inaugural space flights. But space isn't the only destination that people are eyeing up for after the pandemic...

Experiences

As well as once-in-a-lifetime experiences, smaller local attractions have gained popularity, with research showing that people are more likely to stay closer to home and take trips to nearby zoos and theme parks.

From spaceships to ferris wheels, it's clear that the novelty of leaving the house and making memories is not set to wear off anytime soon.

Now take a look at the industries facing the toughest comebacks after COVID

Sponsored Content

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature