Companies making billions from COVID-19 vaccines

Firms profiting from COVID-19 vaccines

Manufacturing and distributing effective vaccinations against COVID-19 has been heralded as the only way out of the pandemic and the race is on to get as many doses produced as possible. With demand through the roof, producing these life-saving drugs has become a lucrative business, and the global coronavirus vaccine market will reach an enormous value of $35 billion (£25.1bn) in 2021 and is expected to grow to $42 billion (£30.6bn) by 2022, according to Arizton. But who is that money going to? Click or scroll through to find out which companies are making billions from producing COVID-19 vaccines, ranked in order of the number of doses they are set to produce.

Vaxart and Emergent BioSolutions Inc.: doses TBC

US biotechnology company Vaxart specialises in oral vaccines, rather than the more common injections, and in March 2020 it announced that it was working on a tablet that would immunise patients against COVID-19. Vaxart has joined forces with biopharm company Emergent BioSolutions Inc., and the companies plan to pool their knowledge. This project was given the US Government stamp of approval with inclusion in the flagship Operation Warp Speed initiative, but the Vaxart-Emergent BioSolutions vaccine only published positive results of its Phase 1 testing in January this year, so its vaccine won’t be part of the mass vaccination programme any time soon.

Vaxart and Emergent BioSolutions Inc.: doses TBC

However, Emergent BioSolutions is already making plenty of money from the vaccine race. In April 2020 it signed a $135 million (£98.4m) deal with Johnson & Johnson to reserve manufacturing capacity, which was followed up in July by a five-year deal worth $480 million (£350m) for the first two years alone to produce its one-shot vaccine. In June, it agreed a $628 million (£480m) deal with America's Operation Warp Speed initiative to scale production of vaccine candidates, and in the same month the company also signed a $87 million (£67m) manufacturing deal with AstraZeneca, followed by a further $174 million (£134m) deal in late July. In October Emergent BioSolutions also joined forces with Novavax to assist with rolling out the latter's vaccine. Across all of its partnerships and deals with other companies, Emergent BioSolutions estimates that it can produce one billion COVID-19 vaccine doses annually.

Take a look at the companies changing their business to fight coronavirus

Sponsored Content

Valneva: 100 million confirmed doses before 2023

French biotech company Valneva has yet to finish trials of its vaccine candidate, but in September it gave the UK the option to order up to 190 million doses in the run-up to 2025. The UK has since ordered 60 million doses to be delivered this year, and 40 million for 2022. The company is also in talks with the European Commission to supply up to 60 million doses to the EU. If trials prove to be successful, Valneva’s VLA2001 vaccine will be produced in Livingston in Scotland, and filled and finished in the company's Swedish facility in Solna.

Inovio Pharmaceuticals: 100 million doses for China in 2021

Inovio is another company that is still trialling its COVID-19 vaccine, but that doesn’t mean the company has been left short-changed. In January it was announced that the pharmaceutical company expects to start late-stage testing in the second quarter of 2021, in partnership with China-based Advaccine Biopharmaceuticals Suzhou Co Ltd. The companies entered a licensing agreement that would give Advaccine exclusive rights to distribute the Inovio vaccine in China, for which Inovio received $3 million (£2.2m). In total Inovio will receive $108 million (£77.6m) as part of the deal if all the milestones are hit on time, including supplying China with 100 million doses of the vaccine this year. Inovio will also receive royalties from the sales.

CureVac: 280 million doses in 2021

German biopharmaceutical company CureVac, in partnership with Novartis, will manufacture up to 50 million vaccine doses by the end of the year, and a further 200 million in 2022. Novartis is currently expanding its facilities in Switzerland to allow for mass production of the CureVac vaccine. The company also has deals in place with other manufacturers, including fellow German pharmaceuticals company Bayer, bringing its estimated production for 2021 to 300 million doses. It also announced a deal with Switzerland-based biopharmaceuticals manufacturer Celonic on 30 March this year to create 100 million doses per year, with 50 million doses expected by the end of this year. However, as it stands, CureVac's vaccine has not been fully developed.

Sponsored Content

CureVac: 280 million doses in 2021

CureVac launched its human trials in December last year, and hopes its vaccine will be ready by this autumn. Many countries have already cut deals with CureVac, and in November the EU confirmed it had ordered 225 million doses of the CureVac drug for distribution across its 27 member states, with the potential to buy a further 180 million doses depending on results from the European Medicines Agency (EMA)’s review of the vaccine’s safety and effectiveness. The review actually started in Febuary on a rolling basis as the EMA tries to speed up the process of getting the vaccine to market. In February, the UK ordered 50 million CureVac doses, and has plans to assist in the development of drugs effective against emerging variants of coronavirus. Switzerland also purchased 5 million doses in February. The amount of revenue CureVac is hoping to yield from its vaccine is unknown, but it will be priced at a profit as investors are expecting a return, according to reports by the Guardian.

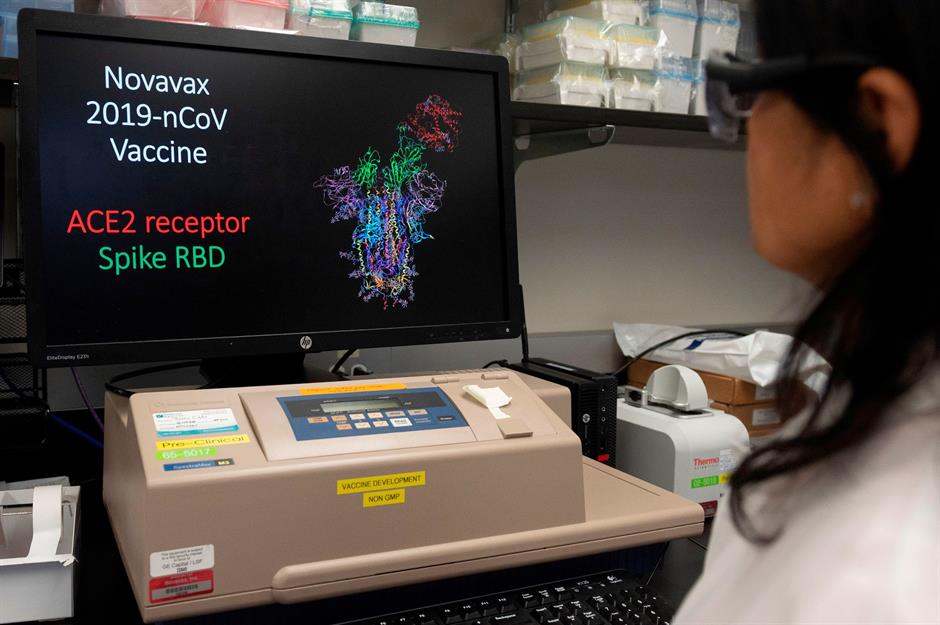

Novavax: 418.7 million doses worldwide

US biotech firm Novavax has never brought a vaccine to market in its 33-year history, but the company recently released data that shows its COVID-19 vaccination provides 100% protection against hospitalisation and death from coronavirus. Results also showed high levels of efficacy against the strains originally detected in Kent in the UK. Based in Maryland in the US, Novavax received $1.6 billion (£1.1bn) in funding as part of the US government’s Operation Warp Speed scheme and, while it is still waiting for approval of its vaccine, the company hopes to supply the country with 110 million doses as early as July.

Novavax: 418.7 million doses worldwide

Novavax signed a deal with the Canadian government in February to allow for the drug to be manufactured at a plant that is currently being built in Montreal. The contract also reportedly stated that the company would provide Canada with 52 million doses of the vaccine, with the option to purchase 24 million more if the drug receives regulatory approval. Novavax’s research chief Gregory Glenn says that the company could produce up to 150 million doses per month from May or June when the infrastructure is fully up and running, and the company has agreed to supply 418.7 million doses worldwide so far as of 26 March. Novavax sees “the potential for several billion dollars in revenue in the next 12 months”, according to a recent earnings call. This sum will only increase if Novavax hits its target of producing two billion doses annually by mid-2021.

Sponsored Content

CanSino Biologics Inc. and Beijing Institute of Biotechnology: 500 million doses worldwide annually

Convidecia, the one-shot COVID-19 vaccine created by CanSino Biologics, was granted approval for emergency distribution within the Chinese military in June last year, just as it was gaining approval for voluntary human trials in other countries such as Canada. After positive clinical trials in India, the Indian government approved the vaccine for emergency domestic use in January. Indonesia also gave the one-shot vaccine the go-ahead, and has ordered 15,000 doses so far. In February it was found that the vaccine has a 65.7% protection rate for preventing symptomatic cases and is 90.98% effective at stopping severe disease, based on analysis from late-stage trials. A vaccine needs to achieve a 50% protection rate to be considered effective.

CanSino Biologics Inc. and Beijing Institute of Biotechnology: 500 million doses worldwide annually

In February the Convidecia vaccine was authorised for use among the general public in China with Mexico one of the first countries to follow suit, approving the drug for emergency use on 10 February and ordering at least eight million doses. Pakistan did the same on 12 February and has ordered 20 million doses, while Hungary approved the drug for emergency use on 22 March and currently has 46.5 million doses ordered. CanSino Biologics anticipates that it can produce 500 million doses of its single-dose vaccine annually.

Take a look at Industries that will boom after coronavirus

GlaxoSmithKline and Sanofi: at least 732 million doses

Sanofi and GlaxoSmithKline are two of the best-known names in Big Pharma, but the companies were forced to restart Phase 2 trials of their joint coronavirus vaccine in February after volunteers were accidentally given lower doses than intended due to a miscalculation in the manufacturing process. Before the trial error was uncovered, the companies had hoped to produce 100 million usable vaccine doses in 2020 and one billion doses in 2021. Delivery estimates will now be re-adjusted based on results from the trials currently underway.

Sponsored Content

GlaxoSmithKline and Sanofi: at least 732 million doses

.jpg)

Several governments had already secured large quantities of the vaccine before the setback. On 29 July the UK confirmed a deal for 60 million doses of the vaccine at a cost of £500 million ($650m), while on 31 July the US government bought 100 million doses of the vaccine, with the option to secure 500 million more, for $2.1 billion (£1.6bn). A similar deal was reached with the Canadian government. Sanofi is also making money from the success of the Pfizer-BioNTech vaccine, as the company announced in January that it would be helping to manufacture 125 million doses of the rival vaccine starting in the summer.

Moderna Therapeutics: up to 1 billion doses worldwide in 2021

The two-dose Moderna vaccine, which has to be stored at -20°C (-4°F), was approved for use in the US on 19 December, by which point the country had already ordered 200 million doses. It has since ordered 100 million more. Because development of the vaccine was subsidised by the US government, America is paying $15 (£10.80) per dose while the EU, which approved the drug on 6 January, is paying $18 (£12.90). The EU has secured 310 million doses so far. The deal included an option to order another 150 million doses for delivery in 2022. UK regulators quickly followed suit and approved the drug for use on 8 January. The country ordered 17 million doses, and rollout of this vaccine will start in April. Singapore was the first country in Asia to approve Moderna’s vaccine in February, and the Philippines jumped on the bandwagon on 22 March and ordered seven million doses. Government approval is still being sought in countries such as Japan and Thailand.

Moderna Therapeutics: up to 1 billion doses worldwide in 2021

In January Moderna announced that it expects to produce 600 million doses in 2021 – 100 million more than its initial base-case estimate – with the potential to make up to one billion doses this year as it continues to invest in its infrastructure and add staff to its teams. Moderna has said that it anticipates sales will reach $18.4 billion (£13.2bn) in 2021, while one Barclays analyst has forecasted sales of $19.6 billion (£14.1bn) this year, $12.2 billion (£8.8bn) in 2022 and $11.4 billion (£8.2bn) in 2023, assuming that recurring vaccinations will take place. Most of the US company’s vaccines are produced at the Moderna base in Cambridge, Massachusetts, but agreements are also in place with Lonza biotech company, which has sites in the US and Switzerland; Recipharm, which manufactures in France; and Rovl in Madrid, Spain, which provides vial filling and packaging services.

Sponsored Content

Johnson & Johnson: 1 billion doses worldwide in 2021

Johnson & Johnson is the biggest pharmaceutical company in the world, and is valued at a staggering $434.42 billion (£315bn) as of 31 March. Last year the pharma behemoth’s Janssen Pharmaceutica division turned its attention to finding an effective COVID-19 vaccine, and on 28 February this year its drug became the third to be approved for use in the US. The World Health Organization approved the Johnson & Johnson vaccine on 12 March, which allows for it to be distributed to low- and middle-income countries through initiatives such as COVID-19 Vaccines Global Access (COVAX). The COVAX programme has ordered 100 million doses from J&J, with the option to buy an additional 100 million this year and 300 million in 2022.

Johnson & Johnson: 1 billion doses worldwide in 2021

The Johnson & Johnson vaccine is cheaper than most as it's a single-dose vaccine. Research and development of the drug was partly funded by the US government, which went on to sign a deal with Johnson & Johnson to secure 100 million doses at $10 (£7.20) per shot, as reported by Fierce Pharma. Around 20 million of those doses should have been delivered by the end of March. Data published by medical journal The BMJ suggests that the EU will pay $8.50 (£6.10) per dose. Production of the Johnson & Johnson vaccine is a transatlantic affair, as it is manufactured by Catalent in the US and in Anagni, Italy. Johnson & Johnson aims to make one billion doses this year – COVAX alone has ordered 500 million – which would generate $10 billion (£7.2bn), according to the Guardian.

Sinopharm: 1 billion doses worldwide in 2021

Sinopharm is the Chinese state-owned company behind the country’s most widely-used vaccine. The United Arab Emirates and Bahrain were the first countries to give full approval to the two-dose vaccine in mid-December, after final-stage testing suggested that it was 86% effective. China then approved the vaccine on 30 December when the company announced a 79.34% efficacy rate, and Egypt followed on 3 January. Before trials were complete, the head of Sinopharm suggested that the company’s vaccine would be considerably more expensive than its rivals, saying it was expected to cost “a couple hundred yuan” (around $31/£22) for one shot, and “less than 1,000 yuan” ($155/£111) for both required doses.

Sponsored Content

Sinopharm: 1 billion doses worldwide in 2021

In February, Chinese media sources reported that more than 43 million Sinopharm vaccines had been administered, including more than 34 million within China. The UAE recently announced that it would also be producing the Sinopharm vaccine from April. The Chinese government offered to supply participants in the postponed Tokyo 2020 Olympics with the Sinopharm vaccine. This comes as questions arise about the practicalities of inviting 11,000 athletes plus staff from across the world to compete during a pandemic. Sinopharm says it hopes to have capacity to produce one billion vaccines in 2021.

Gamaleya Institute: 1.4 billion doses outside of Russia

The Sputnik V vaccine produced by Russia’s Gamaleya Institute was the first registered COVID-19 vaccine in the world after it gained approval for mass rollout across Russia in August last year. The vaccine was developed and produced domestically, and there was some scepticism as to its safety as mass vaccinations began in September before it had completed the three critical development phases strictly adhered to by the rest of the scientific community. Interim data published in February indicated that Sputnik V – the name of which was specifically chosen to invoke the space race of the 1950s – is 91.6% effective in preventing symptomatic COVID-19.

Gamaleya Institute: 1.4 billion doses outside of Russia

The vaccine is now being produced in countries outside of Russia, including Brazil and Kazakhstan, and Indian companies are leading the way with plans to produce 752 million doses of Sputnik V this year. Russia is also seeking to produce the drug in Italy, as overseas demand for the vaccine has surged following the positive efficacy results published by medical journal The Lancet. The European Medicines Agency (EMA) started a rolling review of the vaccine in early March.

Sputnik V is approved for use in 57 countries, including Hungary, the UAE, Mexico and Argentina as of 29 March. The wealth fund managing the vaccine’s distribution reported having signed contracts in 10 countries to produce 1.4 billion jabs, according to the Financial Times. The drug is considered an affordable option at less than $10 (£7.18) per dose. Vaccine hesitancy is an issue in Sputnik's home country, however, with only 30% of Russians wanting the jab, according to a Levada Center poll. President Vladimir Putin received his vaccination on 23 March, but it’s not known whether he received Sputnik V or one of Russia’s other two vaccines: EpiVacCorona and CoviVac.

Sponsored Content

Sinovac: 2 billion doses annually by June

Sinovac is one of three Chinese companies to have produced a widely-used coronavirus vaccine, called CoronaVac, although it is still awaiting approval from the World Health Organization. China authorised the drug for emergency use in high-risk groups in July last year and expects to reach an annual production capacity of two billion doses by June. Sinovac anticipates that it will produce one billion doses in 2021, which will likely make the company billions of dollars, but there are no official estimates as to exactly how much.

Sinovac: 2 billion doses annually by June

In January, Turkey started mass vaccination of its population using Sinovac’s CoronaVac drug and it hopes to receive 105 million doses by the end of May. As of the beginning of 2021, Indonesia had secured 125.5 million Sinovac doses, and the country’s president Joko Widodo even received his shot live on television. The Philippines had locked in 25 million doses of CoronaVac as of January, and 600,000 of those doses were expected to arrive in February, according to Bloomberg. Algeria and Ukraine have also secured batches of the vaccine, with the latter having procured five million doses in March. Brazilian company Butantan fills and finishes doses of the Chinese-made CoronaVac and the vaccine was approved for emergency use in the country in mid-January.

Pfizer and BioNTech: 2.5 billion doses worldwide in 2021

.jpg)

The Pfizer-BioNTech partnership was the first to bring a vaccine to the market that showed positive Phase 3 clinical trial data. After aiming to produce 100 million doses last year, the companies scaled projections back to 50 million vaccines by the end of 2020. This year, US-based Pfizer and German pharmaceutical company BioNTech plan to produce 2.5 billion doses, up from the previous goal of 1.3 billion, and they anticipate making €10 billion ($11.7bn/£8.5bn) in revenue this year alone. An analyst from UK bank Barclays predicts sales will in fact reach $21.5 billion (£15.4bn) this year, $8.6 billion (£6.2bn) next year and $1.95 billion (£1.4bn) in 2023. Recent reports have suggested that the partnership between Pfizer and BioNTech may not last for much longer, however, as Pfizer’s CEO Albert Bourla believes his company now has the expertise to work without BioNTech, according to a Wall Street Journal report.

Sponsored Content

Pfizer and BioNTech: 2.5 billion doses worldwide in 2021

Raw materials and drug substances for the Pfizer-BioNTech vaccine are manufactured at two sites in the US and then formulated and placed in vials at centres in Michigan, which mainly caters for the US market, and Purrs in Belgium, which distributes to the rest of the world. By mid-February, at least 44 countries had approved the Pfizer-BioNTech vaccine, including the UK, US, Canada and Australia, and South Africa’s drug regulators are the latest board to have given the vaccine the green light. Because the EU financially supported the development of this vaccine, European countries pay $14.70 (£10.56) per dose, whereas the US pays $19.50 (£14) per dose, as reported by The BMJ.

University of Oxford and AstraZeneca: 3 billion doses worldwide

The vaccine produced by the University of Oxford and British-Swedish pharmaceutical company AstraZeneca was first approved for use on 30 December in the UK. From the beginning of March, contracts for the two-dose vaccine were in place that accounted for enough doses to fully vaccinate 1.5 billion people globally, according to Bloomberg, which is more than any other vaccine. The UK has secured 100 million doses, most of which are being manufactured at two sites in England, apart from 10 million produced by the Serum Institute in India. This has only recently been publicised, as the UK’s vaccine rollout is due to slow in the coming weeks as its Indian partner was instructed to keep its doses of the jab for local use, rather than export. India has ordered 100 million doses, and 300 million doses apiece have also been ordered by the EU and US. But there have been several controversies along the way, including fears of blood clots that prompted 21 countries to temporarily halt its rollout in March.

University of Oxford and AstraZeneca: 3 billion doses worldwide

Tensions have also arisen between the EU and AstraZeneca, as the company failed to deliver the 120 million doses expected to arrive in European countries by the end of March, which it blamed on production delays in Belgium and the Netherlands. The EU has accused AstraZeneca, which is part British, of giving the UK preferential treatment. According to Politico, AstraZeneca's contract with the UK contains "punishment clauses" if there are delays, but the EU waived its right to sue the company if this happened. AstraZeneca has underlined that the UK is not receiving vaccines from EU production sites apart from a "tiny" batch from its Leiden plant in the Netherlands.

The Oxford-AstraZeneca vaccine is currently approved for use in more than 100 countries and its production is reliant on supply chains across 15 different countries. This vaccine was an early member of the COVAX initiative to ensure that low- and middle-income countries are also vaccinated, which will receive the Oxford-AstraZeneca vaccine at a maximum cost of $3 (£2.15) per dose. More generally, AstraZeneca promised not to profit from its new drug “during the pandemic”, however the company has the right to declare that the pandemic is at an end as early as July 2021, according to reports by the Financial Times, and profit thereafter. Analysts at investment bank SVB Leerink are forecasting sales of $1.9 billion (£1.4bn) in 2021, increasing to $3 billion (£2.2bn) in 2022.

Now see which countries that have bought the most COVID-19 vaccine

Sponsored Content

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature