From Facebook to Marriott: the biggest data breach fines companies have had to pay

The steepest data protection penalties ever

In the cyberage, personal data is easier to share than ever, but that also makes it more vulnerable to hackers who want to profit from it. In response, authorities across the world have been cracking down on data breaches. The EU’s General Data Protection Regulation (GDPR) rules allow fines of €20million ($21.9m/ £7m) or 4% of the company’s turnover, while the USA and Canada have tightened regulations, so that a serious hack can cost a company more than some disgruntled customers. From British Airways's record-breaking $230.3 million (£183.4m) fine to the supersized settlement Facebook faces following the Cambridge Analytica scandal, here are the heftiest data breach fines ever...

BlueCross BlueShield of Tennessee (BCBST), USA – $1.5 million (£1.15m)

Healthcare organisations are among the worst offenders when it comes to putting users' data at risk. In 2012, medical insurer BCBST was fined $1.5 million (£1.15m) by the US Department of Health and Human Services' Office for Civil Rights (OCR) following the theft of 57 unencrypted hard drives in 2009. More than a million individuals had their details stolen.

Norwich Union, UK – $1.7 million (£1.3m)

The British insurance company Norwich Union, which merged with Aviva in 2009 and is now defunct, was rapped in 2007 by the Financial Services Authority (FSA) for its woefully inadequate cybersecurity that resulted in several significant frauds. Criticised by the FSA for letting down its customers, the firm was fined $1.7 million (£1.3m).

Sponsored Content

Concentra Health Services, USA – $1.7 million (£1.3m)

Jackson Health System, USA – $2.15 million (£1.6m)

CVS Pharmacy, USA – $2.3 million (£1.8m)

CVS shocked customers in 2009 when it revealed the company had thrown paperwork containing confidential records in dumpsters, unshredded and available to criminals. Following the revelation, the OCR hit the drugstore and clinic chain with a $2.3 million (£1.8m) fine for violating Health Insurance Portability and Accountability Act (HIPAA) regulations.

Sponsored Content

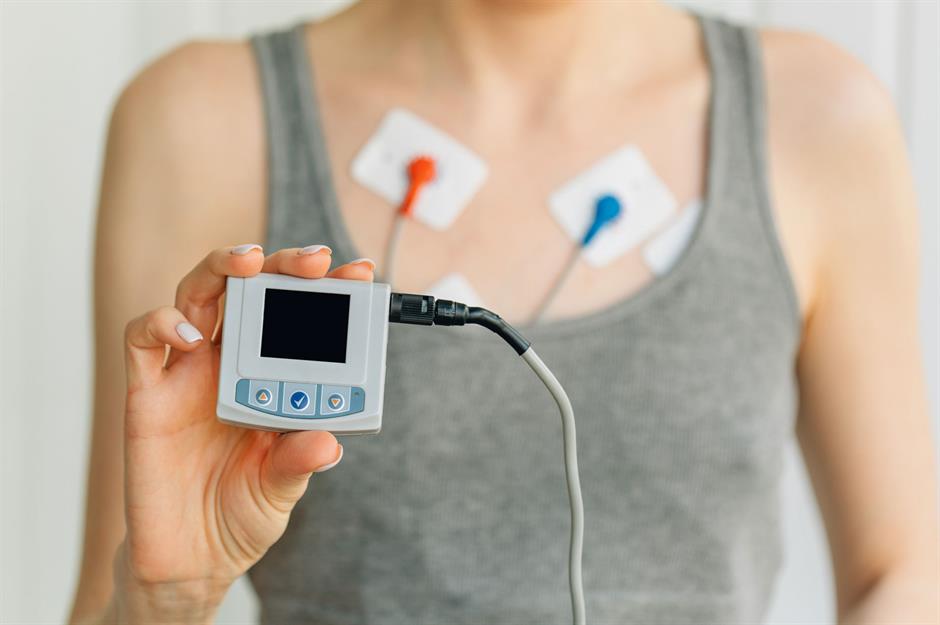

CardioNet, USA – $2.5 million (£1.9m)

Scottrade, USA – $2.6 million (£2m)

Oregon Health & Science University (OHSU), USA – $2.7 million (£2.1m)

Sponsored Content

PG&E, USA – $2.7 million (£2.1m)

University of Mississippi Medical Center (UMMC), USA – $2.8 million (£2.2m)

Not long after issuing a $2.7 million (£2.1m) fine on the Oregon Health & Science University (OHSU), the OCR went one better and imposed a penalty of $2.8 million (£2.2m) on the University of Mississippi Medical Center (UMMC). Again, the data breach concerned the theft of an unencrypted laptop, putting the data of over 10,000 patients at risk.

Cottage Health, USA – $3 million (£2.3m)

Sponsored Content

Touchstone Medical Imaging, USA – $3 million (£2.3m)

University of Rochester Medical Center, USA – $3 million (£2.3m)

Fresenius Medical Care North America (FMCNA), USA – $3.5 million (£2.7m)

Sponsored Content

TerraCom and YourTel, USA – $3.5 million (£2.7m)

HSBC, UK – $4 million (£3.1m)

The University of Texas MD Anderson Cancer Center, USA – $4.3 million (£3.3m)

Sponsored Content

New York-Presbyterian Hospital and Columbia University, USA – $4.8 million (£3.7m)

Nationwide Mutual Insurance, USA – $5.5 million (£4.2m)

Having failed to patch up a serious security vulnerability, Ohio's Nationwide Mutual Insurance was targeted in 2012 by hackers who stole Social Security numbers, credit information and other confidential data. An investigation led to the Attorney Generals of several states chastising the company for the breach. A settlement of $5.5 million (£4.2m) was reached in 2017.

Advocate Health Care, USA – $5.6 million (£4.3m)

Eclipsing the record-breaking penalty imposed on New York-Presbyterian Hospital and Columbia University, Advocate Health Care was slammed with a $5.6 million (£4.3m) OCR fine in 2015 after the theft of four unencrypted computers containing confidential patient details on 14 July 2013. The massive data breach affected 4 million individuals.

Sponsored Content

Sigue Global Services, Italy – $6.6 million (£5.1m)

Before the GDPR came into force in Europe in May 2018, the Italian Garante held the record for issuing EU's largest data breach fine. The regulatory body imposed the $6.6 million (£5.1m) penalty in 2017 on a British money services company that used customers' personal details without their knowledge to transfer money to China, potentially exposing the information to criminals.

Stanford Hospital & Clinics, USA – $7 million (£5.4m)

1&1 Telecom GmbH, Germany – $10.9 million (£8.3m)

Sponsored Content

ChoicePoint, USA – $15 million (£11.5m)

The US Federal Trade Commission (FTC) came down hard on consumer data broker ChoicePoint in 2006 after the company admitted that the personal information of 163,000 customers had been sold to businesses that were later found to be fraudulent and exploited by criminals. ChoicePoint was ordered to pay $15 million (£11.5m) for the breach.

Anthem, USA – $16 million (£12.2m)

Target, USA – $18.5 million (£14.2m)

Sponsored Content

Tesco Bank, UK – $20.6 million (£15.8m)

AT&T, USA – $25 million (£19.1m)

AT&T drew the ire of America's Federal Communications Commission (FCC) in 2015 for a data breach the previous year that exposed the confidential details of 280,000 customers. Contracted call centre agents in Mexico, Colombia and the Philippines had sold on the data to unscrupulous third parties. AT&T was found at fault and the FCC slapped the telecoms titan with the biggest fine it has ever issued.

Read about AT&T's merger with Time Warner and the other biggest business mergers of all time

British Airways, UK – $26.5 million (£20m)

British Airways (BA) was in hot water in 2018 after a breach of customers' data was exposed. BA's computer systems were exposed to hackers who harvested data for two months, before the company was informed by a third party and reported it to the UK's Information Commissioner's Office (ICO). The harvested data included log-in details, payment card data and personal information, and a further investigation by the ICO found that appropriate security measures had not been in place at the time. As a result of the breach, which affected more than 400,000 customers, BA was fined £20 million ($26.5m) by the ICO.

Sponsored Content

Comcast, USA – $33 million (£25.3m)

Yahoo, USA – $35 million (£26.8m)

Google, France – $56.4 million (£43.2m)

European regulators have been emboldened since the new GDPR came into force in 2018 and the Commission Nationale de l'Informatique et des Libertés (CNIL), France's data watchdog, is no exception. The regulatory body penalised Google for breaching data protection laws and fined the search engine a painful $56.4 million (£43.2m). Google made it too difficult for users to find understandable information on its data use policies, CNIL said.

Now read about the scariest online hacks and scams of 2019

Sponsored Content

Marriott, UK – $124.4 million (£95.2m)

While France's data regulator has been dishing out enormous fines, its counterpart in the UK has been even more zealous. Most recently Britain's Information Commissioner’s Office (ICO) announced that it is in the process of imposing a $124.4 million (£95.2m) fine on American hotel chain Marriott for a 2014 data breach that involved the personal details of 383 million customers.

Uber, USA – $148 million (£113.2m)

Home Depot, USA – $179 million+ (£137m+)

Sponsored Content

Equifax, US – up to $700 million (£536m)

In 2017, credit reporting agency Equifax announced that it had exposed the personal information of 147 million people. The mistake led to the a global settlement with the Federal Trade Commission, the Consumer Financial Protection Bureau (CFPC) and 50 states, of at least $575 million (£401.7m), which could reach up to $700 million (£536m). This will compensate those impacted by fraud or theft as a result of the leaks.

Facebook, USA – $5 billion (£3.8bn)

But there is one breach that tops the rest by a mile. In 2019 the US Federal Trade Commission (FTC) approved a staggering $5 billion (£3.8bn) fine on Facebook to settle the infamous Cambridge Analytica scandal, which compromised the data of 87 million users. The penalty is by far the biggest ever imposed on a company for a major data breach.

Now read about governments who have challenged the world's biggest companies

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature