CPI jumps to 3.6%: the best inflation-beating savings accounts

Beating inflation should be the absolute minimum target for our savings, but a staggering £660 billion is sitting in accounts that fail to do so. Here are your top options to stop your money losing value in real terms.

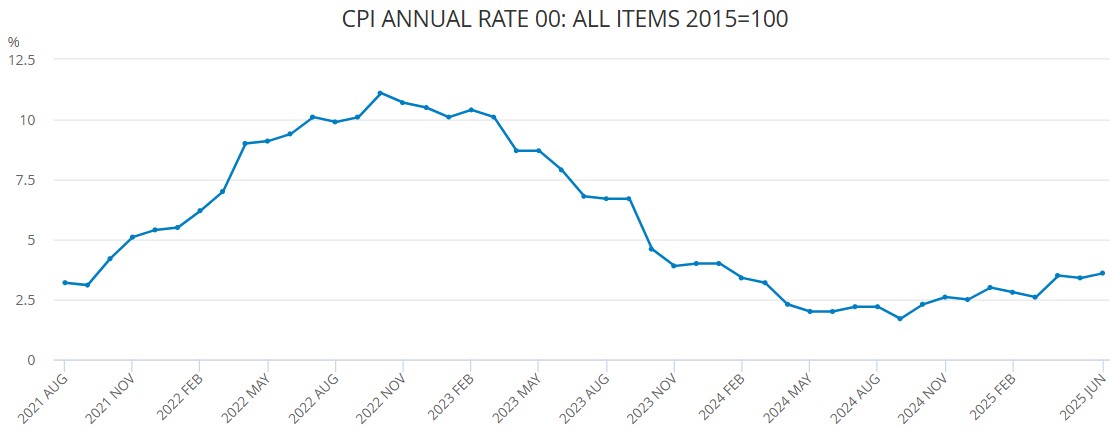

Inflation jumped unexpectedly from 3.4% to 3.6% in June, heaping more pressure on household budgets.

Sharp increases in food and fuel prices helped push the CPI measure of inflation to an 18-month high.

Analysts had predicted that inflation would either remain unchanged or tick up to 3.5%, so it represents a slightly bigger jump than forecast and means inflation is now even further from the Bank of England's stated target of 2%.

High inflation isn't going away

Frustratingly for households struggling to keep on top of rising costs, high inflation is quickly becoming the norm: CPI has only dipped below the aforementioned 2% target for one month in the last four years.

Indeed, inflation is unlikely to fall anytime soon, said Sanjay Raja, Deutsche Bank’s chief UK economist.

“Looking ahead, upward pressures are likely to push annual inflation higher through the year," he said.

"We see headline inflation peaking at 3.8%, before slowing through 2026."

This view is perhaps unsurprising, given we are almost certain to see a Base Rate cut next month – something that inevitably ramps up inflation – with a possible second reduction coming later this year.

Manage all your savings accounts in one place with Raisin, the simple savings service

Savers need to keep ahead of the curve

The latest jump in inflation ratchets up the pressure on savers, as it means many more will be losing money in real terms.

Analysis by savings app Sprive has found that a total of £660 billion is now languishing in savings accounts paying a rate lower than inflation, having jumped £185 billion in the last five months alone.

Clearly, many savers need to move their money to more generous homes to stop their pots being eroded by inflation.

If you're among them, here are the best rates you can get right now.

Best fixed-rate savings accounts - up to 4.58%

If you’re looking to lock your money away for a shorter term, GB Bank pays the best rate on a one-year fix at 4.58%.

The account can also be opened with a £1,000 deposit.

The best two-year fixed-rate bond is from DF Capital (min. deposit £1,000) and pays 4.44%.

Looking for a long-term home for your savings? The best five-year fix on the market right now is also from DF Capital and pays 4.47% (£1,000 minimum).

Best access accounts - up to 5%

Access accounts are pretty generous at the minute.

The best of the lot is the Chase Boosted Saver Account, which pays a rate of 5% and has a minimum deposit of just £1.

Sadly, you can only get access to the account if you open a Chase current account first.

Unless you're moving a large sum of money, you might feel that's not worth your time.

The best access rate that is open to everyone is from Atom Bank and pays a rate of 4.6%.

|

PROMOTION

|

||

|

Best tax-free accounts - up to 4.98%

For those looking to shield their returns from the taxman, the top Cash ISAs are also particularly generous right now: Both Plum and Chip have access accounts that pay a rate of 4.98%.

Manage all your savings accounts in one place with Raisin, the simple savings service

Best notice accounts - up to 4.7%

While we are sceptical about the value of such accounts, we recognise some people find these accounts suitable for their needs, so we thought we'd give them a quick mention as well.

RCI Bank has the best notice account on the market, with its 95-Day Notice Account paying 4.7%.

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature