Cryptocurrency explained: what is it and how does it work?

Is crypto really the future of money?

The world's first cryptocurrency Bitcoin was created in 2009. The idea of digital money was born out of the global recession when distrust of centralised banks was at an all-time high. But 13 years and thousands of new cryptocurrencies later, how far has the technology come? Read on to find out everything you need to know about Bitcoin, Ethereum, stablecoins... and the recent crypto crash that's cost the market $1 trillion (£829bn). All dollar values in US dollars.

What is cryptocurrency?

What are stablecoins?

Stablecoins are a particular type of digital asset that's designed to bridge the gap between cryptocurrency and fiat money. One of the biggest risks of cryptocurrency is its volatility; as this year has shown, it's possible for the market to lose billions or even trillions of dollars in the space of a few months. Stablecoins, as the name suggests, are theoretically immune to this. That's because their value is tied to the price of a more stable asset. This is normally the US dollar but can be any fiat currency or even a commodity such as gold.

Sponsored Content

What are stablecoins?

Unfortunately, it's not always that straightforward. The recent crypto crash was triggered in part by the collapse of a previously little-known stablecoin called TerraUSD. Unlike most other stablecoins, Terra maintained its $1 (£0.84) value thanks to an algorithm. When the algorithm suddenly failed, for reasons that haven't yet become clear, the price of TerraUSD plummeted – taking investor confidence across the crypto market as a whole down with it. According to CoinMarketCap.com, TerraUSD is now worth less than $0.06 (£0.05).

What are the pros of cryptocurrency?

For many people, the big draw of cryptocurrency is the fact it's not overseen by a central organisation or authority. Classic cryptocurrencies such as Bitcoin generate new units and verify transactions through a process called Proof of Work (PoW) mining. A decentralised network of computers works on a series of complex mathematical puzzles. Once these equations are solved, new tokens are produced and transactions verified on a public ledger called a blockchain. Because it's practically impossible to modify the blockchain, this makes cryptocurrency extra-secure – in theory.

What are the cons of cryptocurrency?

Cryptocurrencies are often disparaged for being completely anonymous, making them appealing to criminals such as tax evaders, drug dealers, and hackers. But while some bend over backwards to conceal users' identities, most cryptocurrencies are recorded on public ledgers and are actually pseudonymous rather than anonymous, meaning users can often be traced. That said, criminals often now demand ransoms in cryptocurrency as they're hard to track down. For example, the hackers of the Colonial Pipeline in the US last year were paid $4.4 million (£3.1m) at their request.

Sponsored Content

What are the cons of cryptocurrency?

Another serious downside to cryptocurrency is that PoW mining is incredibly energy-intensive. Estimates from Digiconomist suggest that mining a single Bitcoin can require 1,721.96 kWh, the equivalent of around $26,000 (£21.5k). Over the course of a year, this means that Bitcoin uses roughly the same amount of energy as the entirety of Sweden!

And it's not just mining cryptocurrency that can be contentious; storing it comes with serious risks too. For example, if the key that accesses a cryptocurrency wallet is lost, then the assets contained inside are gone forever too – there is literally no recourse. Ditto if an exchange collapses. Unlike fiat money bank deposits, which are covered up to a certain amount in many countries, cryptocurrencies have zero such protections.

Now let's take a look at some of the most popular cryptocurrencies and stablecoins...

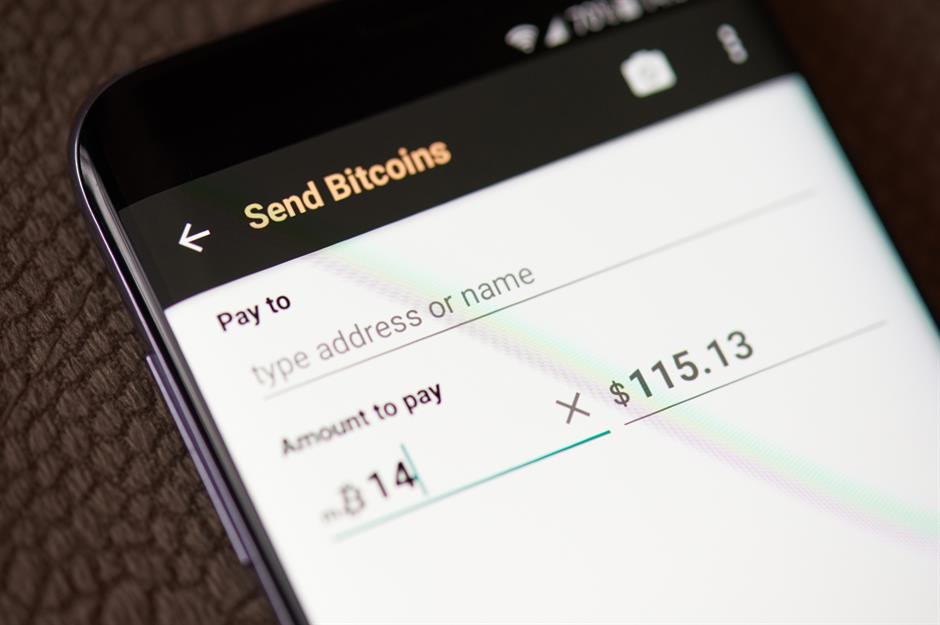

Bitcoin (BTC)

The first-ever cryptocurrency, Bitcoin was created in 2009 by the mysterious Satoshi Nakamoto, an alias for an individual or group who has never been identified.

Bitcoin's journey to the top has been a roller-coaster ride marked with controversy, from the so-called king of cryptocurrency's voracious appetite for energy to its extreme price volatility. The token was worth next to nothing at the time of its launch, but the price per BTC spiked 1,927% in 2017, peaking at $19,783.21 on 18 December before plummeting to $6,569.32 by April 2018.

The price skyrocketed again last year as major investors flocked to buy into the increasingly accepted cryptocurrency. (Tesla CEO Elon Musk was one of its biggest cheerleaders at the time). This contributed to Bitcoin's record price of $67,567 (£44.5k) in November 2021. But Musk and his firm turning against Bitcoin, combined with China's attack on Bitcoin and other cryptocurrencies, has seen its value fall...

Bitcoin (BTC)

Currently, Bitcoin is priced at just over $19,700 (£16.3k) and its overall market value is around $377 billion (£311bn). Some analysts have predicted the asset's prodigious energy use could be its downfall, especially in the face of a global energy crisis and soaring electricity costs.

Bitcoin has also attracted controversy because of its limited supply. Unlike many subsequent cryptos, the number of BTC tokens that can ever be in circulation has been capped at 21 million. The network is designed so that anyone who successfully adds a new block to the blockchain, which is done by processing and confirming the legitimacy of transactions, is rewarded in Bitcoin. Every four years the reward for mining Bitcoin transactions is halved, a process known as Bitcoin halving (or halvening). This prevents too many BTC from being issued too quickly. Although this means we're unlikely to reach the 21 million limit any time soon, many people believe this is a fatal flaw that makes the asset unsustainable in the long term.

Sponsored Content

Ethereum (ETH)

The Ethereum blockchain was launched in July 2015. The brainchild of young programmer Vitalik Buterin, the platform's USP is its smart contract functionality, which allows for the building of decentralised apps. This makes its network much more flexible than that of Bitcoin. For instance, Ethereum has been the key driver of the recent boom in non-fungible tokens (NFTs), digital assets such as artworks or video clips. This has been an important factor fuelling the rise in value of its native token, the Ether (ETH).

Ethereum (ETH)

Unlike Bitcoin, there is an unlimited supply of Ether, but the amount released each year is capped. The Ethereum network can process trades much faster and uses more than 10 times less power per transaction than rival Bitcoin and, while it uses a similar energy-guzzling PoW model, the people in charge have pledged to cut the blockchain's power consumption by 90%. Plans are already afoot to migrate to transactions being verified using a Proof of Stake (PoS) consensus algorithm, which requires a fraction of the energy PoW mining consumes, up to an estimated 99% less. The second incarnation of Ethereum is slated for release later this year.

The price of one ETH is currently just over $1,100 (£918) and its market cap is $134.7 billion (£112.5bn).

Tether (USDT)

First issued in July 2014 as RealCoin, Tether's USDT is the leading stablecoin and the third-biggest cryptocurrency by market cap. Despite being pegged to the US dollar, its value can actually change. However, this unlimited supply cryptocurrency is less volatile now than it was during its early days when the price fluctuated between $0.92 cents and $1.21 (£0.77–£1). USDT is now priced at just under $1 (£0.84).

Sponsored Content

Tether (USDT)

Tether doesn't issue a public audit, which makes it less transparent. As a result, its path to becoming one of the top cryptocurrencies has been rocky, with lawsuits, security issues, and other controversies littering the way. In fact, Tether and its parent company Bitfinex are banned from doing business in New York after having to pay $18.5 million (£13m) in fines after hiding losses.

In spite of this, Tether has gone from strength to strength and has been especially popular in China. The USDT stablecoin is legal to purchase with yuan in the country, while Bitcoin isn't, so Chinese investors have been snapping up USDTs and using them to buy Bitcoin, boosting the former's value, which has been soaring skywards since last August. The USDT cryptocurrency's overall market cap is currently just over $66 billion (£55.2bn).

USD Coin (USDC)

As you might guess from the name, the USD Coin is backed by the mighty US dollar. Like Tether, however, its value can deviate slightly from one buck...

USD Coin (USDC)

Launched in September 2018 by regulated financial company Circle and crypto exchange Coinbase, USD Coin is audited by a trusted accounting firm and even accepted on the Visa network. Now the world's second-biggest stablecoin by market cap, USD Coin is frequently easier, cheaper, and faster to get hold of than fiat dollars. This makes it a popular inflation hedge among investors in Nigeria, Argentina, and other countries with unstable currencies and fiat dollar purchase restrictions. Currently, the price of one USD Coin is exactly $1 (£0.84) and its market cap is just over $55.8 billion (£44.6bn).

Sponsored Content

Binance Coin (BNB)

Binance Coin is the cryptocurrency used to make transactions on the Binance crypocurrency exchange, which is now the world's number one by trading volume. The altcoin (a term used to describe alternatives to Bitcoin) was released on the Ethereum blockchain in June 2017 by crypto veteran Changpeng Zhao, before moving to the Binance exchange when it launched later that year.

Binance Coin (BNB)

BNB's price is currently just over $226 and its market cap is around $36.9 billion (£30.8bn). Its value shot up at the start of last year and it's now the fifth-biggest crypto by market cap. Although there is a maximum supply of BNB, the limit is capped at 200 million – significantly higher than Bitcoin's 21 million, of which over 18 million have already entered circulation. Binance also carries out quarterly currency 'burns' to keep the price of its token high, which can be a big draw for speculative investors.

The prominence of Binance within the crypto world is also seen as a positive for Binance Coin. However, its reputation hasn't always been squeaky clean. Regulators in the UK, Netherlands, Italy, Singapore, Germany, Thailand, Japan, Hong Kong, Malaysia, and Lithuania have all issued formal warnings against the use of Binance, claiming it's being run without proper authorisation. Although French regulators have recently decided to register the exchange, members of the European Parliament have urged the authorities to reconsider in the wake of money laundering accusations.

Dogecoin (DOGE)

Dogecoin (pronounced 'dohj-coin') was launched in 2014, using the Shibu Inu pooch from the popular Doge online meme as a mascot. It was created by software engineers Billy Markus and Jackson Palmer to poke fun at over-the-top speculation in the cryptocurrency industry, but ionically catapulted in value thanks to the support of the so-called 'Dogefather' Elon Musk. The Elon effect has been a powerful driver of Dogecoin's value, yet also proved to be something of a double-edged sword...

Sponsored Content

Dogecoin (DOGE)

After Musk called it “a hustle” while hosting the US TV show Saturday Night Live on 8 May last year, Dogecoin lost a third of its value, dropping from a record high of $0.74 (£0.62). It's now worth around $0.07 (£0.06) but remains one of the world's top 10 cryptocurrencies by market cap, according to CoinMarketCap.com.

If the market rebounds from the current slump, a factor that potentially bodes well for Dogecoin's future is its energy efficiency: its PoW blockchain uses just 1/6,000 of the electricity Bitcoin consumes per transaction.

Now read about the race to become the world's largest electric carmaker

Ripple (XRP)

First released in 2012, Ripple XRP stands out from the other cryptocurrencies on this list because it was designed for banks and businesses rather than everyday users. By sending large cross-border payments in XRP on the RippleNet network, companies can send funds between countries without having to worry about changing exchange rates or high processing fees. Another benefit to using Ripple XRP is the fact it's so fast. The platform can process more than 10,000 transactions in just one second, making it much more convenient than wire transfers.

Ripple (XRP)

With a fixed supply of 100 billion units, XRP is pre-mined, and the consensus algorithm that enables transactions to be verified uses much less energy than other cryptos. In fact, XRP consumes less electricity per transaction than any other cryptocurrency – a tiny 0.0079 kWh – and Ripple has even pledged to go carbon-neutral by 2030.

Its regulatory record isn't as clean as its eco-credentials, however. In December 2020, the US Securities and Exchange Commission (SEC) sued the founders of Ripple Labs, the company behind RippleNet, over the sale of XRP. According to SEC, XRP is an unregistered security offering, but the founders have disputed this claim. The lawsuit is currently ongoing, but Ripple Labs CEO Brad Garlinghouse has said he will move the company out of the US if SEC wins the case.

Sponsored Content

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature