UK house price latest 2026: what's happening to property values near you

Read on to see what's happening to house prices in your area.

Feeling a bit lost with so many house price reports out there?

The HomeOwners Alliance House Price Watch looks at all the information from the various property indices to give you one easy-to-digest round-up of everything you need to know.

So, let's look at how prices have changed over the past month and year.

What’s going on with house prices?

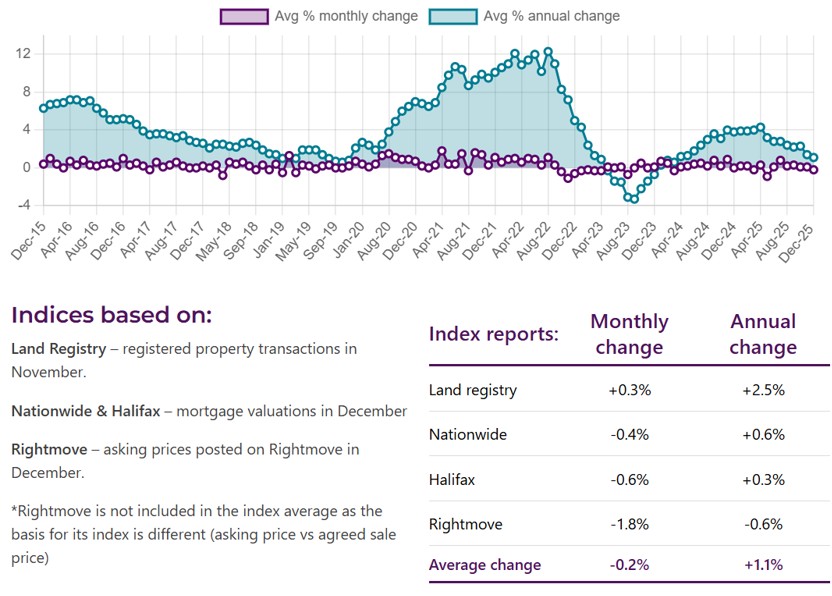

When you average out the latest figures reported by all the major indices, prices fell 0.2% in the last month, but are up 1.1% over the last 12 months.

It means the typical home now costs £271,000, which is around £3,000 higher than a year ago.

What will happen to prices in 2026?

House prices are expected to see modest growth this year, according to Nationwide analysis.

“We expect housing market activity to strengthen a little further as affordability improves gradually via income growth outpacing house price growth and a further modest decline in interest rates," the building society noted.

“We expect annual house price growth to be in the 2% to 4% range next year.”

7 reasons why no one is buying your house

What's happening to house prices near me?

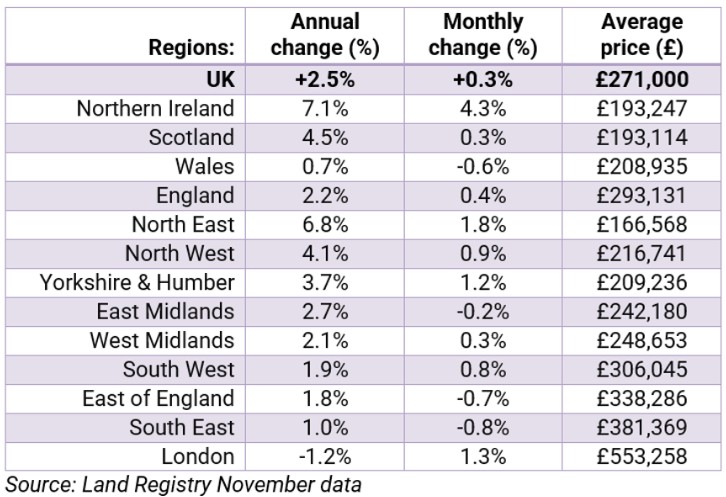

Land Registry has the most comprehensive data regarding housing stock, and it provides a handy regional breakdown of house prices across the UK.

This data takes slightly longer to compile, so it isn't quite as up-to-date as the other property indices – its latest prices cover up to November 2025 – but it nonetheless provides an interesting insight into how areas are faring relative to each other.

In the 12 months up to that point, prices increased in all regions except London.

The housing market in Northern Ireland has proved the most buoyant over that period, with prices jumping 7.1% annually, while the North East of England (6.8%) also saw sizeable gains.

At the other end of the scale, London saw prices fall by 1.2% during the same period.

See the table below for a full breakdown of prices by region.

What the indices say

HomeOwners Alliance

“Transactions in 2025 are on track to reach 1.2 million, broadly in line with the 10-year average. House price inflation was modest, with prices up 1.1% year on year.

“A clear North–South divide persists, with stronger price growth in Northern England than in the South.

“Market activity was uneven across the year: transactions surged in March as buyers brought purchases forward to avoid higher Stamp Duty, while uncertainty ahead of the November Budget from August onwards weighed on activity in the second half.

“With affordability improving and ample homes for sale, momentum is expected to rebuild in 2026. We forecast gradual house price growth of around 2% as affordability continues to improve.”

Rightmove

“Average new seller asking prices fall by 1.8% (-£6,695) this month to £358,138.

“This larger-than-usual December drop means that prices are 0.6% (-£2,059) lower at the end of 2025 than in 2024.

“The uncertainty and gloom caused by rumours of property tax rises in November’s Budget from as early as August contributed to more subdued activity and pricing in the second half of the year.

“The number of new sellers coming to market in the first half of 2025 was 9% ahead of the first half of 2024, which reversed to 4% below 2024 across the second half of this year.

“Buyer demand was 3% ahead of 2024 across the first half of the year, but 6% behind in the second half.

“It’s still been a more positive year overall for sales, with the number of sales agreed 3% higher than in 2024.

“Improved buyer affordability and plenty of choice for buyers suggest a market more like the encouraging first half of this year rather than the second half in 2026, with Rightmove predicting that new seller asking prices will rise by 2%.”

Nationwide

“UK house prices ended 2025 on a softer note, with annual price growth slowing to 0.6%, from 1.8% in November, the slowest pace since April 2024.

“The high base for comparison can partly explain the slowdown (annual price growth was 4.7% in December 2024), although prices fell by 0.4% month on month, after taking account of seasonal effects.

“Despite the softer end to the year, the housing market in 2025 was ‘resilient’. Mortgage approvals remained near pre-Covid levels.

“April Stamp Duty changes created volatility. Activity spiked in March as purchasers brought forward transactions to avoid paying additional tax, leading to some softness in the following months.

“With price growth well below the rate of earnings growth and a steady decline in mortgage rates, affordability constraints eased somewhat, helping to underpin buyer demand.

“Indeed, the first-time buyer share of house purchase activity was above the long-run average.

“Looking ahead, we expect housing market activity to strengthen a little further as affordability improves gradually via income growth outpacing house price growth and a further modest decline in interest rates.

“We expect annual house price growth to be in the 2% to 4% range next year.”

Halifax

“Average house prices fell by -0.6% in December, down £1,789 compared to November, with a typical property now costing £297,755, the lowest since June 2025.

“On an annual basis, growth slowed to +0.3%, down from +0.6% in November. While this may feel like a subdued close to the housing market in 2025, overall activity levels were resilient over the last year and broadly in line with the pre-pandemic average.

“While affordability pressures persist, the house price to income ratio was at its lowest in over a decade in December, striking a positive note for those looking to purchase their first home.

“On this basis, and recognising the headwinds that may affect buying power – such as the slowing of wage inflation and flattening employment rates – we expect a modest rise in house prices during the year of between 1% and 3%.”

Zoopla

“Housing sales on track to hit 1.2m in 2025, 9% higher than last year and in line with the 10-year average.

“While there are more home moves, this is not translating into faster levels of headline house price inflation. UK house prices are just 1.1% higher than a year ago.

“House prices are still adjusting to higher borrowing costs and increased buying costs after Stamp Duty reliefs changed in April. There is a clear North-South divide in price inflation and this is set to remain in 2026

“Budget speculation reduced housing market activity in the final quarter of 2025 with the sharpest decline since the 2022 mini budget (demand -12% lower than a year ago and new sales agreed down -9%). It’s too late for the drop in sales agreed to hit 2025 housing transaction numbers – this will become apparent in housing transaction numbers in Q1 2026.

“Mortgage rate stability, higher incomes and mortgage affordability improvements support sales. First-time buyers are the largest buyer group in 2025 (39% of sales).

“House prices are projected to increase 1.5% over 2026 as housing affordability continues to steadily reset.”

RICS

"The December 2025 RICS UK Residential Market Survey reveals that market activity remains subdued, with both buyer demand and agreed sales continuing to register negative readings.

“However, there are encouraging signs of a shift in sentiment, as respondents express greater optimism around the outlook for sales, both over the near-term and for the year ahead.

“This improved confidence appears to be underpinned by expectations of further monetary policy easing, alongside the removal of Budget-related uncertainty which had weighed on the market in recent months.

“For the year ahead, the balance of contributors are of the opinion that prices will return to growth.”

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature