From Dutch East India Company to General Electric: the most valuable companies of all time

Big businesses worth record-breaking amounts

The most valuable companies of all time have been worth unfathomable sums of money at the peaks of their success.

From historic trading enterprises to 21st century tech corporations, the businesses on this list all have one thing in common: monster market caps that, at points, have even exceeded the GDPs of some modern developed countries.

Now that Apple has become the first publicly traded company to close at a value of $3 trillion (£2.4tn), we reveal the 20 firms that have held the highest valuations in history, with pre-2022 figures adjusted for inflation. All dollar amounts in US dollars.

ExxonMobil: $741.8 billion (£583bn)

American oil and gas titan ExxonMobil enjoyed a stellar 2007, making what was then a record profit of $40.6 billion (£31bn).

As a result, the energy company's share price soared, giving the Texas-based corporation a best-ever valuation of $505.7 billion in October 2007, equivalent to $741.8 billion (£583bn) today.

In fact, ExxonMobile was the world's most valuable firm for much of the early 2000s.

ExxonMobil: $741.8 billion (£583bn)

ExxonMobil's luck was in again during the early 2010s when global oil prices went through the roof. However, the company's value was never able to regain the breathtaking heights of October 2007.

The oil glut of 2014 resulted in lower prices for the commodity, which hasn't helped ExxonMobil's current market cap, which currently stands at a respectable $431.06 billion (£337bn).

However, the US remains one of the world's biggest oil producers, with demand rocketing due to factors such as Vladimir Putin's war with Ukraine and the subsequent sanctions on Russian oil.

Sponsored Content

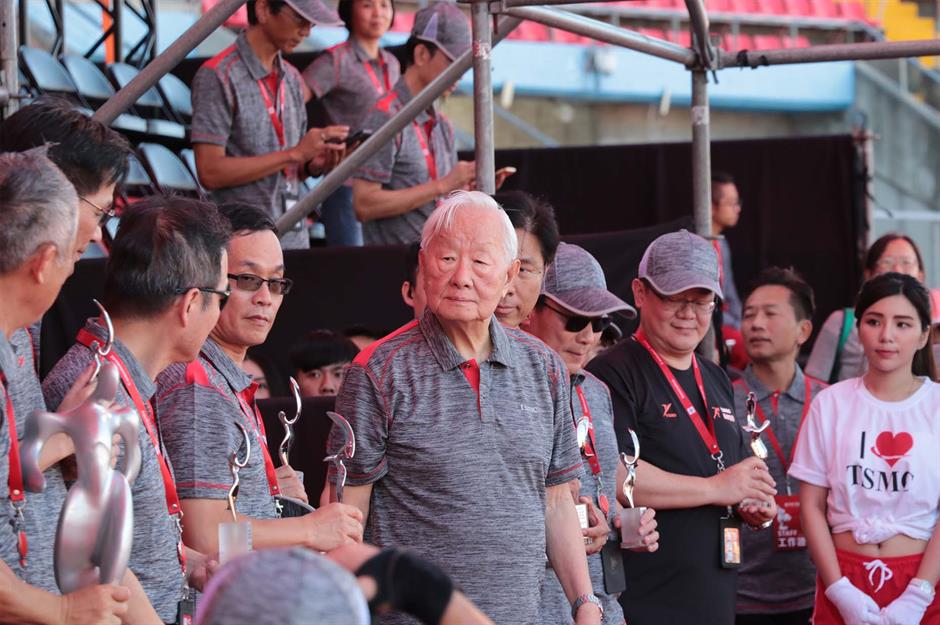

TSMC: $729.5 billion (£556bn)

Taiwan Semiconductor Manufacturing Company (TSMC) is among the top semiconductor manufacturers in the world.

Now retired, Morris Chang (pictured), the company's billionaire founder and former chairman and CEO, worked for Texas Instruments before founding TSMC in 1987.

Under his guidance, the business became the first Taiwanese company listed on the New York Stock Exchange.

TSMC: $729.5 billion (£556bn)

TSMC's competitors include Intel and Samsung, although the Taiwanese firm is the hands-down winner when comparing total market value. Its valuation has more than doubled since 2018, reaching a high of $729.5 billion (£556bn) in January 2022.

However, TSMC's stock has fallen since the start of 2022. Some analysts have pinned this on Russia's invasion of Ukraine, with investors potentially worried that the conflict could inspire a Chinese takeover. As of 2 August 2023, the company has a valuation of $511.27 billion (£400bn).

Industrial and Commercial Bank of China $770.3bn (£606bn)

Founded in 1984, the Industrial and Commercial Bank of China Limited (ICBC) is currently the world's largest bank.

In 2022, it reported a whopping $49.9 billion (£39bn) net profit, as well as assets worth more than $5.8 trillion (£4tn).

Sponsored Content

Industrial and Commercial Bank of China $770.3bn (£606bn)

The bank's market value spiked at $525.15 billion (£400bn) in October 2007, which is $770.3 billion (£606bn) in today's money.

Over the next decade, this figure stayed mainly in the $300 billion (£228bn) range, with another dramatic jump in 2018 to $574 billion (£438bn), which is around $695.4 billion (£547bn) in 2023 dollars.

However, the corporation's shares plummeted in summer 2020 when it lost its first-place position as China's most valuable public company. Now valued at $219.44 billion (£172bn), it's struggled to rally over the last few years.

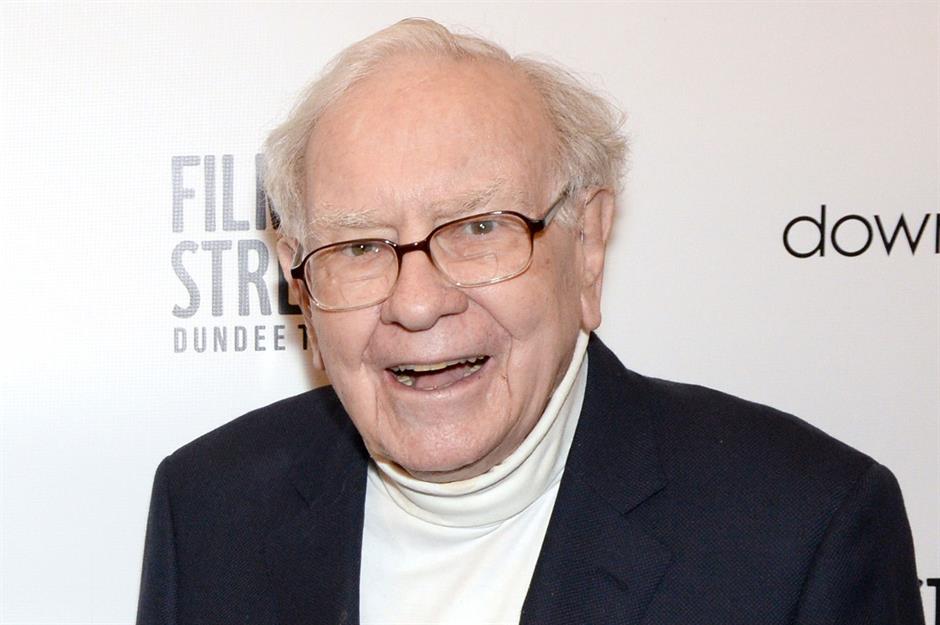

Berkshire Hathaway: $794 billion (£625bn)

Berkshire Hathaway owns an assortment of famous names and has major interests in Kraft Heinz, The Coca-Cola Company, and Bank of America, among others.

Headed up by investment genius Warren Buffett (pictured), the Nebraska-based conglomerate is famed for having the highest share price in history.

Berkshire Hathaway: $794 billion (£625bn)

At the time of writing, each Berkshire Hathaway Class A share is worth a jaw-dropping $534,400 (£418k), giving the group a current valuation of $769.79 billion (£603bn).

But even this staggering amount falls short of the company's all-time record; in March 2022, Berkshire Hathaway's valuation hit $794 billion (£625bn).

Sponsored Content

Alibaba: $984.5 billion (£774bn)

Chinese e-commerce colossus Alibaba was founded in 1999 by former chairman Jack Ma (pictured), who stepped down in September 2019.

The hugely successful conglomerate, which encompasses everything from electronic payment services to search engines and cloud computing, hit a peak valuation of $837.8 billion (£639bn) in October 2020. That's $984.5 billion (£774bn) today.

Alibaba: $984.5 billion (£774bn)

China's answer to Amazon, the Hangzhou-based group's stock price surged during the COVID-19 pandemic, with lockdown forcing citizens to head online to shop and work.

Since May 2021, however, US-China trade war jitters have sent the conglomerate's stock price on a downward trajectory, and its valuation is currently trailing at $256.50 billion (£201bn).

Tencent: $1 trillion (£787bn)

Chinese multinational Tencent was founded in 1998. Since then, it's become the world's largest gaming company, one of the biggest social media firms on the planet, and a global leader in entertainment and artificial intelligence.

Its valuation peaked at just over $916 billion (£698bn) in February 2021, which is just over $1 trillion (£787bn) today.

Sponsored Content

Tencent: $1 trillion (£787bn)

For a while, tighter gaming regulations stalled the conglomerate's growth and depressed its share price.

Tencent lost out to Alibaba, which overtook it as China's most valuable business, although it's since become the most valuable public company in the country.

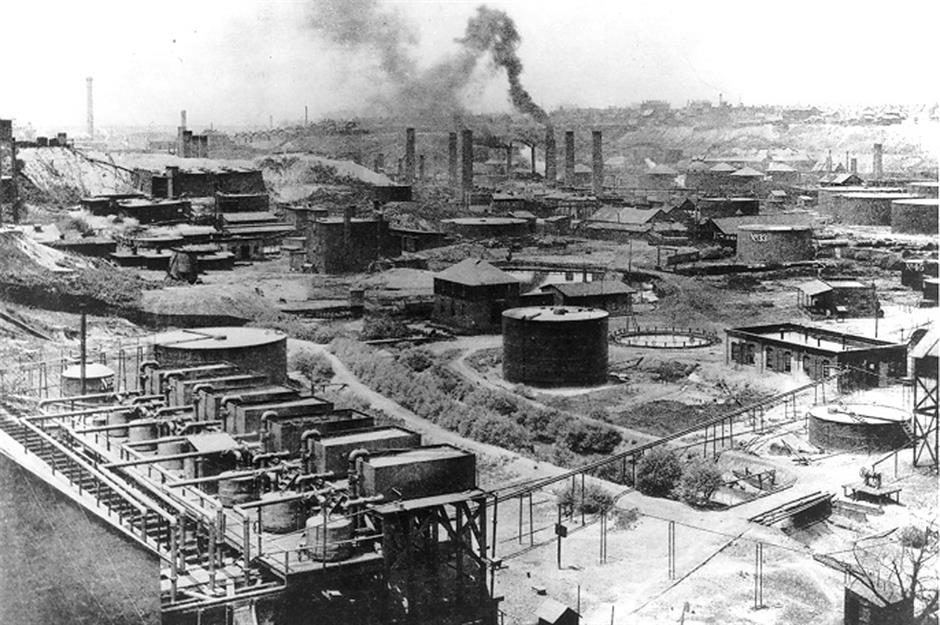

Standard Oil: $1 trillion+ (£787bn+)

Established in 1870 by Gilded Age tycoons John D. Rockefeller and Henry Flagler, Standard Oil ruled the roost in the early 20th century.

Thanks to the success of the firm, which monopolised the oil industry in the US, Rockefeller amassed almost unimaginable wealth, becoming one of the richest people of the 20th century.

Standard Oil: $1 trillion+ (£787bn+)

Needless to say, Standard Oil was worth big bucks, and then some. Some experts estimate its inflation-adjusted value during the early 1900s at $1 trillion (£787bn) or greater.

In 1911, the US Supreme Court ruled that Standard Oil was an illegal monopoly, resulting in it being broken up into a number of smaller firms. Nonetheless, several of the so-called "baby Standards" operate to this day, including the extremely valuable ExxonMobil.

Sponsored Content

General Electric: $1.05 trillion (£825bn)

Dating back to 1892, General Electric (GE) thrived throughout the 20th and early 21st centuries.

The US conglomerate, which spans consumer electronics, energy, aviation, healthcare, manufacturing, and more, peaked in value at the turn of the millennium, with its valuation reaching $594 billion in August 2000. That's the equivalent of around $1.05 trillion (£825bn) in today's money.

General Electric: $1.05 trillion (£825.3bn)

GE fared well until the global financial crisis of 2008, which hit the business particularly hard.

The share price went south again in 2017, with the industrial conglomerate faltering as its profitability tanked. It's barely stabilised since and at the time of writing, GE's market cap is a relatively disappointing $123.22 billion (£96bn).

NVIDIA: $1.15 trillion (£900bn)

NVIDIA is one of the globe's largest computer chip developers and its graphics processors are widely used for gaming.

In the business world, its technology helps power computer-assisted design and other graphics applications.

Sponsored Content

NVIDIA: $1.15 trillion (£900bn)

The California-based company saw its value more than double in 2021, hitting $822 billion (£627bn) that November.

At the time, CEO Jensen Huang described demand for NVIDIA chips as "exceptional" and attributed it to increases in artificial intelligence and voice recognition software.

The company has continued to go from strength to strength since. In the first six months of 2023, NVIDIA's value has increased by around 200%, with the business officially joining the $1 trillion (£787bn) club in late May. Its valuation is currently at an all-time high of $1.15 trillion (£900bn).

Facebook: $1.2 trillion (£943bn)

Founded in 2004 by Mark Zuckerberg in his Harvard dorm room, Facebook has conquered the globe.

The social media giant, now known as Meta Platforms, pulled in revenues of $55.8 billion (£44bn) in 2018 and its valuation peaked at a then-record $629 billion (£489bn) in July that year.

However, its upward trend wasn't to continue for long, as the Cambridge Analytica data scandal rocked investor confidence and sent its share price through the floor. But after a brief slump at the start of 2020, the tech giant more than recovered, if only temporarily...

Facebook: $1.2 trillion (£943bn)

In September 2021 – and just weeks before announcing its rebrand to Meta Platforms – Facebook saw its market value tip over the trillion-dollar threshold to peak at $1.07 trillion (£820bn), which amounts to around $1.2 trillion (£943bn) today. Just three months earlier, it had become the fifth US company to hit the trillion-dollar market cap milestone.

As of August 2023, however, its valuation sits at around $816 billion (£639bn).

Sponsored Content

Tesla: $1.38 trillion (£1.08tn)

Tesla co-founder and CEO Elon Musk is currently the richest person in the world, so it's not surprising that the electric car manufacturer is the world's seventh most valuable company.

Musk hopes to revolutionise how people travel, and accelerate the world's transition to sustainable energy. Roadster, the firm's first car, launched in 2008, and Tesla revealed designs for truck and SUV models in 2019.

Tesla: $1.38 trillion (£1.08tn)

The manufacturer's share price soared in October 2021 after it announced a $4 billion (£3bn) deal to sell 100,000 cars to rental company Hertz.

These gains saw the company's valuation pass the one-trillion mark, peaking that November at $1.23 trillion (£940bn), or $1.38 trillion (£1.08tn) today.

Tesla stayed in these upper echelons for several months before seeing its value dip to its current $818 billion (£640bn).

PetroChina: $1.6 trillion (£1.3tn)

The state-run PetroChina was the world's first business to surpass a trillion-dollar valuation.

A frenzy of speculation following the company's flotation on the Shanghai stock market in early November 2007 pushed its share price skyward and its valuation peaked at a staggering $1.1 trillion. That's the equivalent of $1.6 trillion (£1.3tn) in 2023.

Sponsored Content

PetroChina: $1.6 trillion (£1.3tn)

Wary stock market experts, including Warren Buffett, warned that the rash of speculation wouldn't last – and they were right.

PetroChina's share price nosedived in mid-November 2007 and continued to slide until early 2009. Over that period, the price dropped by over 70%.

Today, the company is still worth just a fraction of what it was in early November 2007, with a current valuation of just $198.77 billion (£156bn).

Amazon: $2.1 trillion (£1.65tn)

Another company that has hit the heady heights of $1 trillion is Amazon.

Founded in 1994 by Jeff Bezos, who is currently the third-richest person on the planet according to Forbes, the e-commerce and cloud computing juggernaut enjoyed a valuation of $1 trillion (£787bn) for a brief time back in September 2018, when the company's share price fleetingly spiked during intraday trading.

Amazon: $2.1 trillion (£1.65tn)

Its valuation has since skyrocketed, reaching a record-breaking $1.88 trillion (£1.38tn) in July 2021, which equates to around $2.1 trillion (£1.65bn) today.

After soaring in value during the COVID-19 pandemic, Amazon is still riding high. Its current valuation is around $1.35 trillion (£1tn), making it the fifth-most valuable company on our list.

Sponsored Content

Alphabet: $2.2 trillion (£1.7tn)

It will probably come as little surprise that the world's number one search engine is worth awe-inspiring sums of money.

The value of Google's parent company Alphabet hit a trillion-dollar valuation in January 2020, making it the fourth American company to do so – and it didn't stop there...

Alphabet: $2.2 trillion (£1.7tn)

The business saw its valuation peak at an all-time high of $1.98 trillion (£1.4tn) in November 2021, the equivalent of $2.2 trillion (£1.7tn) in today's money.

Its valuation is currently hovering around the $1.66 trillion (£1.3tn) mark, so it will be interesting to see if 2023 holds any more record-breaking results for the tech conglomerate.

Microsoft: $2.8 trillion (£2.2tn)

Microsoft became the world's most valuable publicly-traded company at the height of the dotcom boom in late December 1999, when its valuation rose to an impressive $613 billion, or $1.2 trillion (£943bn) in today's money.

In recent years, however, it's smashed that valuation...

Sponsored Content

Microsoft: $2.8 trillion (£2.2tn)

The tech giant, which was founded in an Albuquerque garage by Bill Gates and Paul Allen back in 1975, saw its market value climb to the magic milestone of $1 trillion at the end of April 2019, making it the third US company to do so. That's the equivalent of just under $1.2 trillion (£943bn) in today's money.

Microsoft then went on to see its valuation peak at $2.5 trillion (£1.9tn) in November 2021, which is $2.8 trillion (£2.2tn) in 2023. As of August 2023, its valuation is still hovering around the $2.5 trillion mark.

Apple: $3.08 trillion (£2.4tn)

Apple first reigned supreme as the world's most valuable company between 2013 and 2016.

In August 2018, it became the first American non-state-run firm to reach a market value of $1 trillion (£786.6bn), which amounts to around $1.2 trillion (£943bn) in today's dollars.

Apple: $3.08 trillion (£2.4tn)

The tech giant behind the iPhone and Apple TV went one better when its market value fleetingly jumped to a record-breaking $3 trillion (£2.2tn) during intraday trading in January 2022.

Apple sealed the deal in June 2023 when it officially became the first company to close with a valuation above $3 trillion.

Currently worth $3.08 trillion (£2.4tn), Apple is officially the world's most valuable company – for now, at least.

Sponsored Content

Saudi Aramco: up to $5 trillion (£4tn)

Saudi Arabia's national gas and petrol enterprise is worth considerably more than its counterparts in China and elsewhere.

Based on the company's first disclosure of earnings, which were reported in April 2019, Saudi Aramco was lauded as the world's most profitable firm. And it's little wonder – the corporation is reportedly the largest producer of crude oil on the planet.

Saudi Aramco: up to $5 trillion (£4tn)

The company's value peaked in line with the spike in global oil prices. In 2010, Sheridan Titamn, a finance professor at the University of Texas, estimated that Saudi Aramco was worth somewhere between $2.2 trillion and $3.6 trillion, the equivalent of $3.07 trillion (£2.4tn) and $5 trillion (£4tn) today.

If Titman was correct, Saudi Aramco potentially could have pipped Apple to the $3 trillion post – although Apple is the first company to have officially reached the milestone. Saudi Aramco is currently valued at $2.081 trillion (£1.6tn).

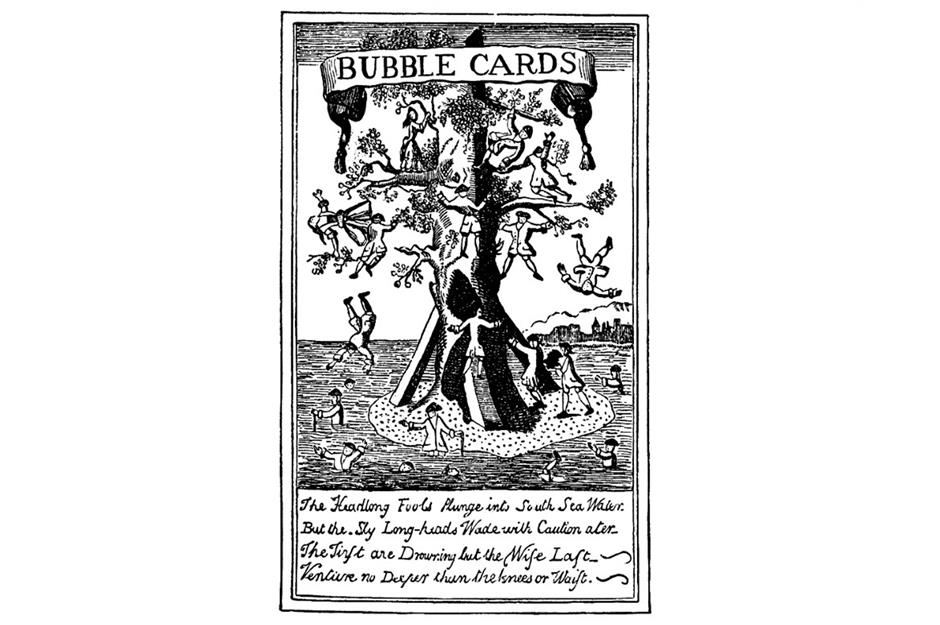

South Sea Company: $5.3 trillion (£4.2tn)

A British joint-stock firm, the South Sea Company was formed in 1711 and granted a monopoly over all trade in South America and islands in its vicinity.

Fuelled by "extravagant rumours" (according to Intelligent Investor), investors rushed to put their money into the enterprise, which was poised to offer sensational returns. The company share price soared.

Sponsored Content

South Sea Company: $5.3 trillion (£4.2tn)

By mid-1720, shares had climbed to £1,000 each (up from £100 earlier in the year), which gave the company a market value of as much as £420 million ($551m).

Online sources suggest the business would have been worth $4.3 trillion in 2017 dollars, which is the equivalent of $5.3 trillion (£4.2tn) in 2023.

But then the whole thing came crashing down. The prospect of bountiful trade was, as it turned out, wishful thinking and the bubble burst catastrophically in September 1720, bankrupting many of the shareholders.

Company of the Indies: $8 trillion (£6.3tn)

Originally called the Mississippi Company, the Company of the Indies created a bubble around the same time as the South Sea Company. Founded in 1684, the French firm held a monopoly over trade in North America and the West Indies.

Enticed by exaggerated claims of wealth in Louisiana from the economist John Law (pictured), speculators poured staggering sums of money into the company in 1719.

It's interesting to note that the word "millionaire" was reportedly coined around this period to describe the speculators who were investing in the corporation.

Company of the Indies: $8 trillion (£6.3tn)

Within a year, the company's share price rose by 1,900% and the firm's value increased to an estimated $8 trillion (£6.3tn) in today's money.

However, when investors began to demand payment in silver or gold instead of paper certificates, France entered a period of steep inflation.

In late 1720, when investors realised that the supposed trove of wealth in Louisiana would not materialise, the bubble popped once and for all.

Sponsored Content

Dutch East India Company: at least $9 trillion (£7tn)

The most valuable firm of all time, the Dutch East India Company (also referred to as VOC), had a monopoly on the spice trade in Asia. The business was effectively the first-ever to conduct an IPO, which took place in August 1602, just five months after the firm was initially established.

The company's value ballooned outrageously in 1634 after its ships carried the tulip bulbs that sparked the infamous "tulip mania" in Holland.

Dutch East India Company: at least $9 trillion (£7tn)

The value of the bulbs reached ridiculously high levels and pushed the company's share price up by 1,200%.

Prior to the bubble bursting in 1637, the Dutch East India Company was reportedly worth 78 million Dutch guilders. That's at least $9 trillion (£7tn) today, which, according to figures obtained via World Bank, is comfortably more than the combined GDPs of the Netherlands, France, and Germany today.

From Facebook to Red Bull, discover the businesses that have produced the most billionaires

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature