How to access your pension: pros and cons of key strategies and what to avoid

Confused about how to access your pension? We reveal the benefits and drawbacks of different strategies, the tax implications and major mistakes to avoid.

Sections

- The importance of planning

- How can you access your pension?

- What’s the most popular strategy?

- Watch out for MPAA

- Withdrawing cash (partial/full): pros and cons

- Annuities: pros and cons

- Drawdown: pros and cons

- What’s the best strategy for me?

- How you can (legally) avoid paying Income Tax

- What are the biggest mistakes retirees are making?

The importance of planning

People are encouraged throughout their lives to contribute as much as they can to their pension pots to ensure they have a comfortable retirement.

But once someone retires, what are the different ways to access their pension and what are the financial implications?

It’s important to understand your options, so you can avoid a huge tax bill or running out of money during retirement.

This guide will discuss the different options for accessing your pension and reveal everything you need to know, so you can plan ahead effectively.

Secrets of a successful pre-retirement plan

How can you access your pension?

First, it’s vital to point out that you normally can’t access your pension pot before the age of 55 and you’ll likely have to pay tax on money from your pot.

One of the ways you can access your pension is to take up to 25% as a tax-free lump sum – but then you’ll have six months to start taking the remaining 75%, which you’ll usually pay tax on.

You can take some or all of your pot as cash, but you may not be able to withdraw smaller amounts if you’ve saved over £1 million in pension schemes over your lifetime or have some form of Lifetime Allowance protection.

You also might not be allowed to withdraw money if it’s bigger than the amount of Lifetime Allowance you have left and are under the age of 75.

If you’re interested in securing a guaranteed income for life, you can opt for an annuity.

In a nutshell, an annuity is a form of insurance product where the provider commits to paying you regular payments for either a set period of time or for the rest fo your life. Generally people use their pension pot to pay for an annuity.

However the amount that you will receive from the annuity can vary significantly from person to person as it depends on several factors, including:

- Your age and gender;

- Interest rates;

- Where you expect to live when you retire;

- The size of your pension pot;

- Your health and lifestyle;

- The type of annuity, income options and features

There are various types of annuities to choose from.

For example, some are for a specified period of time, while others continue to make payments to your partner or spouse after you die.

You can also link your annuity to the stock market or a measurement or inflation, so that it increases each year and helps combat rising prices.

It's a good idea to get financial advice before plumping for an annuity, so you understand exactly how the type of annuity you are interested in will work for you.

An alternative option is to take your tax-free lump sum, and then move the remainder of your pot into a drawdown product where it is invested in the stock market. You can then dip into it as and when you need the money.

You could even mix approaches, by using some or all of the lump sum to purchase a short-term annuity,

In other words, there are all sorts of different routes you can take, which is why it can be a really good

idea to get financial advice first.

There are many benefits, drawbacks and tax implications for each strategy, which will be explored later in this article.

Income drawdown: will new FCA rules help or hinder retirees?

What’s the most popular strategy?

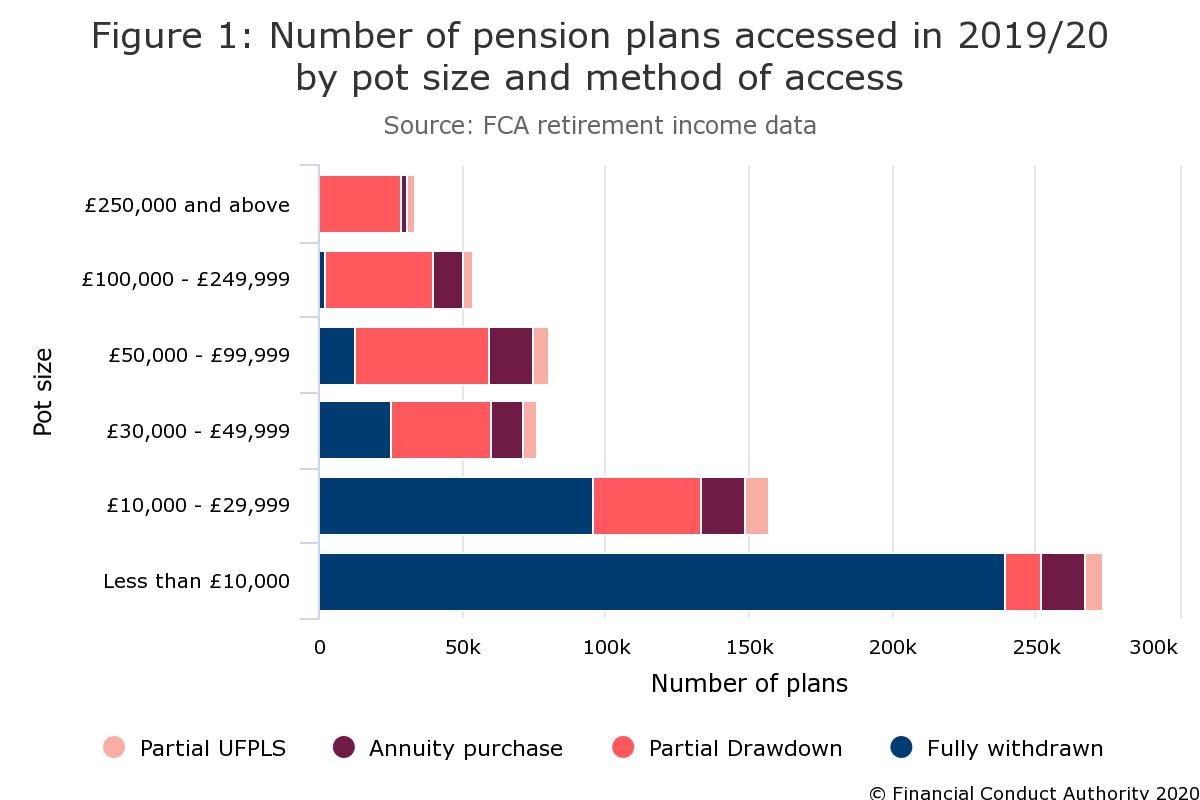

The table below from the FCA breaks down precisely how people have accessed their pension over the last couple of years.

As you can see, of the 674,000 pension plans accessed in some way in 2019/20, around 375,500 were fully withdrawn as cash. This is up by 5% from 2018/19, though it’s worth remembering that the vast majority of these were small pension pots of less than £30,000.

Not only is the number of savers using their pots to buy an annuity relatively small, at around 10%, but this has also been falling consistently in recent years.

By contrast, the best part of 200,000 plans entered into a drawdown arrangement, an option that has grown in popularity since the introduction of the pension freedoms.

Watch out for MPAA

It’s worth flagging the issues posed by the Money Purchase Annual Allowance (MPAA) before running through your different options when accessing your pension

MPAA can be triggered when you take your entire pension pot as a lump sum or withdraw chunks of money.

You can currently contribute up to £40,000 a year into your pension and get tax relief, but this falls to £4,000 once you’ve triggered MPAA.

You generally don’t trigger MPAA if you take a cash lump sum and buy a lifetime annuity or put it into a flexi-access drawdown scheme and don’t take income from it – or cash in pension pots worth less than £10,000.

Now we will outline the benefits and drawbacks of each way you can access your pension.

Withdrawing cash (partial/full): pros and cons

You can take a lump sum from your pension, with the first 25% of the withdrawal will be tax-free, while the rest is treated as income and taxed accordingly.

This is usually known as an uncrystallised funds pension lump sum (UFPLS) and basically lets you take a cash lump sum from your pension without buying a product.

If you withdraw £20,000 from a £100,000 pension, only £5,000 will be tax-free. The remaining £15,000 will be taxed as income.

A key benefit of this method is that you can get hold of your cash and have the flexibility to do what you want with it – but you could be hit with an emergency tax bill.

Alternatively, if you take your whole pension pot as cash, you’ll have to make sure it lasts throughout retirement and you can’t get a guaranteed income for your spouse after you die.

By withdrawing your whole pot, you’ll also probably be pushed into a higher tax bracket, so you may end up with a huge bill.

Pension freedoms: 5 things to consider before dipping into your funds

How pension withdrawals can dramatically fall in value

You could miss out on further growth in your pension by dumping cash into a current account, instead of leaving it in your pension.

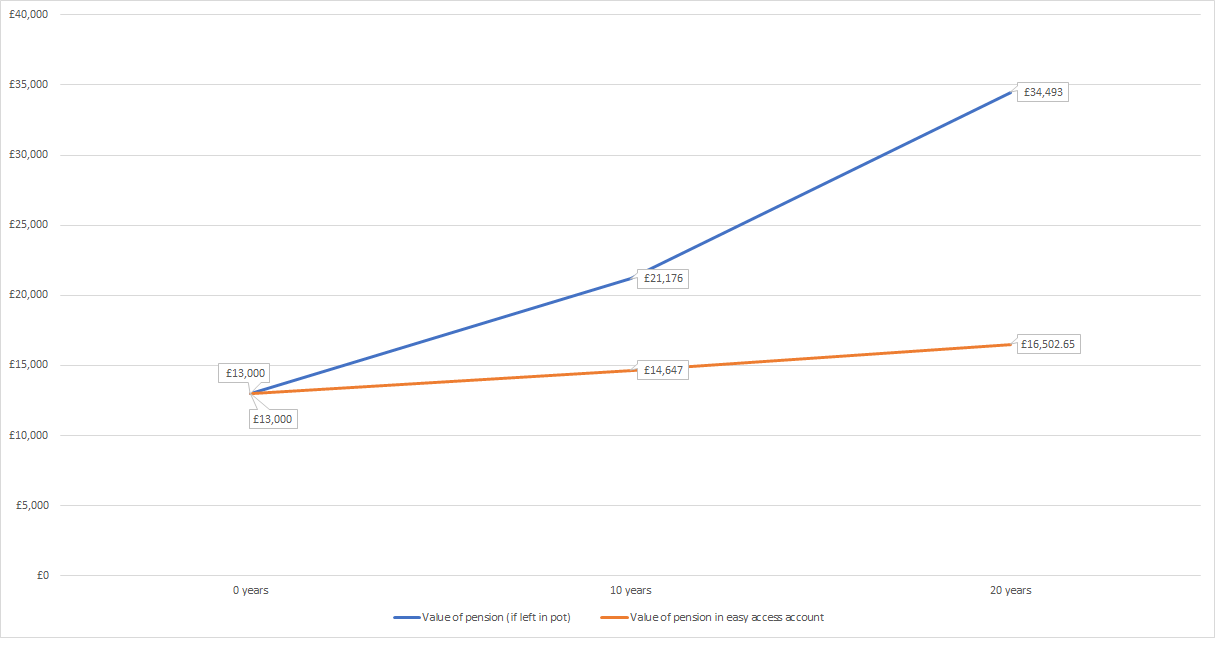

The average value of a pension pot fully withdrawn at first access in 2018/19 was £13,000, so we’ll work with this figure to illustrate how the value of your pension can fall in value.

If you leave £13,000 in your pension that achieves 5% growth per year after charges, it’ll be worth £21,176 after 10 years and £34,493 after 20 years.

If you withdraw £13,000 and your pension is your only income, you’ll pay £100 in tax as you’ll exceed the Personal Allowance of £12,500.

As current accounts tend to offer little in interest, this amount is unlikely to grow.

Even if you put your money in a competitive instant access account (paying 1.20%) after 10 years it would be worth £14,647 and after 20 years it would be worth £16,502.

You’ve possibly lost half the value of your pension in this scenario (click on the below image for larger size).

But what if you already earn an income and are a basic rate taxpayer? In this scenario, you would pay £2,600 in tax on your £13,000 withdrawal, leaving you with £10,400 in the bank.

If you put it in an easy access account, after 10 years it would be worth £11,982 and after 20 years it would be worth £13,599.

Even if you put the money into a notice account paying 2% interest, it would be worth only £12,678 after 10 years and £15,454 after 20 years.

"One of the biggest mistakes people can make when it comes to accessing their pension is making large withdrawals, taking an unnecessary tax hit and then doubling down by shoving the money in a low or even 0% interest bank account,” warns Tom Selby, senior analyst at AJ Bell.

“This leaves the fund vulnerable to the ravages of inflation, particularly over the long-term, while the pot has no chance of achieving positive real growth (assuming the interest rate is set below inflation).

“Often decisions to strip money out of retirement pots are taken out of fear and mistrust, with savers citing past scandals, endowment policies that have delivered large losses and constantly changing Government rules.

“While this aversion to pensions is perhaps understandable for those scarred by previous scandals, making large withdrawals could seriously damage your financial health.”

Annuities: pros and cons

You can withdraw 25% of your pot as tax-free cash and buy an annuity with the other 75% although you pay tax on the annuity income. You may also need to pay administration fees.

A lifetime annuity can be handy if you want a guaranteed income for retirement or want to provide an income for someone else after you die.

If you have a pension pot worth £147,500 and you want to use it to buy an annuity at the age of 65, you could get £36,875 tax-free and £5,600 annual taxable income for the rest of your life.

If you want to find out how much you can get, check out this calculator.

Bear in mind, this amount isn’t guaranteed and could be impacted by certain factors.

So, if you’re in poor health, you could get more money as your life expectancy is shorter. This is sometimes known as an enhanced annuity.

Smoking, drinking and health problems: what to disclose when buying an annuity

Of course, a lifetime annuity may not be suitable if you want access to your pension pot before you die or more flexibility over your income.

Of course, a lifetime annuity may not be suitable if you want access to your pension pot before you die or more flexibility over your income.

A fixed term annuity offers a guaranteed income for a certain amount of time and is useful if you don’t want to be locked into a lifetime annuity.

But again, it’s not ideal if you want to draw cash from your pension whenever you want, and you could also trigger MPAA if you get an investment-linked or flexible annuity where your income could decline.

If you’re interested in an annuity, make sure you shop around for the best deal – you don’t have to buy one from your pension provider.

According to the FCA, eight out of 10 people lose out by not switching annuity providers.

Annuity rates are also an issue as the average annual annuity income has fallen by more than £1,000 over the last decade. In fact annuity rates have hit their lowest ever levels in 2020.

It’s vital you get the best rate you can. Once you buy a lifetime annuity, you can’t change your mind. It’s always a good idea to get financial advice before signing on the dotted line.

Drawdown: pros and cons

You can move 75% of your pension pot into one or more funds within a flexible income product. If you take your tax-free lump sum, you can choose when to take income via drawdown.

You can also move your pension pot gradually into income drawdown instead of in one go.

Before April 2015, capped drawdown was available, which capped the amount you could withdraw as income. As it’s no longer available, this guide will focus on flexi-access drawdown.

Flexi-access drawdown lets you access your pension savings whenever you want, while your remaining funds are invested to help generate a regular income.

You can nominate someone to receive money on your behalf after you pass away and if you only take your tax-free cash and not enter drawdown, you won’t trigger MPAA.

By not triggering MPAA, you can still contribute up to £40,000 per year into your pension.

But unlike an annuity, you won’t get a guaranteed income and you’ll need to decide how much you withdraw and when via drawdown.

But unlike an annuity, you won’t get a guaranteed income and you’ll need to decide how much you withdraw and when via drawdown.

If you withdraw too much, your retirement fund could run out sooner than expected, which could be a big issue if you live longer than anticipated.

You should also be aware that the value of your investments could rise and fall, so you can’t predict how your investments will perform.

As drawdown can be complex, you should get advice from a regulated financial adviser and regularly review your investments to ensure your portfolio keeps delivering the expected returns.

You should also research all your options including what’s on offer from other drawdown providers as the choice of funds and flexibility can vary.

Pension strategies: is guided drawdown a good way to stretch cash?

What’s the best strategy for me?

There’s ‘no one size fits all’ approach when it comes to pensions.

“The size of the pension is somewhat irrelevant, it’s what sort of income you intend to draw from the pension that is important,” says Long.

“For those who’ve taken their tax-free lump sum but don’t want income, the investments held in the run up to accessing the pension may continue to be fine.”

If you need your income to last a lifetime, Long recommends investing in a portfolio of income generating investment and taking the income that is naturally produced.

Of course, your income may fluctuate.

“For those looking to take a higher level of income by selling down investments regularly, investing in a well-diversified portfolio, including some absolute return funds, may be a better approach,” advises Long.

“Here you want to make sure you’re not a forced seller of your pension investments in a falling market, so holding some money as cash to draw on in times of a falling market is sensible.

He recommends having three to six months of living expenses set aside and an extra two to three years of income if you plan to sell investments to fund your retirement.

How you can (legally) avoid paying Income Tax

Selby says retirees can use ad-hoc lump sums (UFPLS) from their fund to potentially avoid paying Income Tax.

“You could take a £16,650 UFPLS, of which 25% (£4,162.50) would be tax-free,” comments Selby.

“That would leave you with £12,487.50 of taxable income, but that’s within your Personal Allowance (assuming you have no other taxable income) so your tax bill will be zero.”

He stresses this wouldn’t work for everyone, but it highlights how withdrawals can be managed to avoid paying tax.

Pension withdrawals: four tax-free ways to access your retirement savings

What are the biggest mistakes retirees are making?

Unfortunately, there are many mistakes that retirees make with their pension.

"The biggest mistake is not thinking holistically when it comes to retirement, but this is not helped by the system, which leaves people with pensions scattered all over the place,” says Long.

He believes consolidating your pensions is a good idea as it gives you a good idea of how much money you have to work with throughout retirement.

Selby agrees, flagging that consolidating pensions can make everything easier to manage, and you can also potentially cut down on charges.

Consolidating pensions: costs, benefits and risks

“The other mistake that’s easy to make is to think that retirement decisions are all or nothing,” warns Long.

“You don’t have to opt for an annuity or drawdown, you can do a bit of both which helps give you the best of both worlds.”

Another key mistake made by retirees is overlooking the impact of fees on their pension, as it can eat into their retirement over a long period of time.

Another key mistake made by retirees is overlooking the impact of fees on their pension, as it can eat into their retirement over a long period of time.

Even a small difference in providers’ fees can make a big difference during your retirement.

Having a retirement plan is important, particularly if you want to still contribute to your pension (if you’re still working) and don’t want to trigger MPAA.

You also don’t have to take your tax-free cash lump straight away.

Yet the biggest issue people face is figuring out how much they need during retirement.

Many people may enjoy retirement for 30 years, so it’s vital to note down daily expenditure and account for other costs, including holidays and the cost of caring for a relative.

Check out this article to figure out how much income you really need in retirement.

The information included in this article does not constitute regulated financial advice. You should seek out independent, professional financial advice before making any decisions.

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature