UK Spring Statement 2022: changes to National Insurance, Income Tax, Fuel Duty & more explained

The Chancellor has announced a raft of tax cuts to help ease the cost of living crisis, but the outlook for many households remains bleak. Here's what the Spring Statement means for your money.

The rising cost of everything

Rishi Sunak, the Chancellor of the Exchequer, has delivered his Spring Statement ‒ what was in effect a mini-Budget.

It’s a particularly noteworthy time for the Chancellor, since it’s impossible not to have noticed the impact of inflation at the moment, with the cost of most things we pay rising. Indeed, inflation has hit its highest level in three decades.

The Chancellor warned that this is something we are going to have to get used to, with forecasts from the Office for Budget Responsibility (OBR) suggesting that inflation will average 7.5% this year.

In other words, no matter how much your finances might be creaking right now, there will be further issues to come.

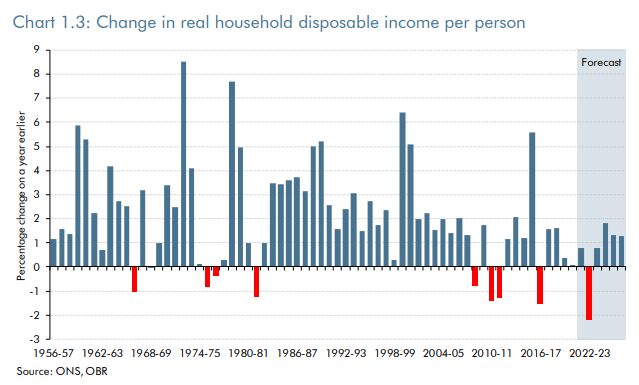

This fact was hammered home by the OBR, which made the staggering prediction that UK households will this year face the biggest fall in real income since Office for National Statistics records began (see graph below).

We wanted to mention this upfront before getting into Sunak's headline giveaways as this broader context is important: as welcome as the tax cuts outlined below are, there's no escaping the fact most households will still be worse off by year end.

National Insurance

Last year the Government announced a 1.25% increase to National Insurance for this year, in order to raise funds for the NHS and social care.

It’s a rise that has been controversial from the outset ‒ as we highlighted at the time, it’s rightly viewed as a tax on jobs, which punishes the young.

The increase applies to businesses too, with some business groups warning that the added expense would push them close to the edge.

With the cost of living on the rise, the Chancellor had come under pressure from all sides to scrap the increase, but he opted against doing so.

Instead, Sunak hiked the threshold at which people start paying National Insurance on their earnings, by a whopping £3,000, to bring it in line with the Personal Allowance, which covers when people start paying Income Tax.

It means that from July, the National Insurance threshold will sit at £12,570, the same level as the personal allowance.

The Chancellor argued that around 70% of workers will see their tax bill drop, despite the hike in the actual rate we pay, as a result of that higher threshold.

Income Tax

On the subject of Income Tax, the Chancellor also announced a cut, just one that won’t be taking place yet.

The basic rate of Income Tax stands at 20% currently, meaning that 20p in every pound you earn goes to the taxman.

Sunak has promised that before the end of this Parliament in 2024, it will be dropped to 19%.

Of course, this is based on an awful lot of assumptions ‒ including the fact that the OBR reckons inflation will be under control by then ‒ and as we have seen over the last couple of years with Covid and the Ukraine war, unexpected events can throw plans off course.

Only time will tell if it actually goes ahead.

Fuel Duty

The scrapping of planned increases to Fuel Duty has become a regular fixture at these House of Common statements in recent years, giving the Chancellor the opportunity to trumpet abandoning a tax rise in order to support working people.

Fuel Duty makes up a massive proportion of what we pay at the pump. 57.5p of what we pay for every litre we put into our vehicles goes to the Government in fuel duty, and then we pay a further 20% in VAT on top, so it’s a big moneyspinner.

And with the cost of fuel having rocketing to record highs of late, the Treasury has enjoyed a significant financial boost.

Sunak had been under pressure to actually cut Fuel Duty, with a host of Tory MPs lobbying for a reduction, and even the Labour Party saying they would support such a move.

It was effective too, with the Chancellor dropping Duel Duty by 5p per litre until next March. The cut takes effect from 6pm tonight.

Energy efficient improvements

Given rocketing energy bills, it’s unsurprising that many of us are considering how we can improve the efficiency of our homes.

After all, if our homes are energy efficient then they don’t lose the heat generated by our radiators and the like. As a result, keeping the property warm is easier and costs less overall.

The trouble is that these improvements can not only be expensive, but the cost is bumped up by 5% in VAT.

At the Spring Statement, Sunak announced that this tax is being ditched on energy-efficient home improvements like having heat pumps installed, solar panels and home insulation.

This tax break will be in place for five years.

More support for the vulnerable

The Household Support Fund is a pot of cash devoted to helping those who most need financial support.

It’s distributed by individual councils, and can be used for things like help with paying bills, or covering food costs for children for families that receive free school meals.

The fund was worth £500m, but the Chancellor announced it would be doubled to £1bn. Councils will then be tasked with ensuring that the money ends up in the hands of the households that most need it.

There’s MUCH more pain on the way

At the risk of really piling on the doom and gloom, it’s important to bear in mind that we really are just at the start of a painful financial period.

The cost of EVERYTHING is already going up, irrespective of what the Government plans to do - the consumer prices index (CPI) measure of inflation hitting 6.2% this month, a 30-year high - and there are still many more bill hikes to come.

Mortgages will get more expensive following Base Rate hikes, Council Tax will increase for many next month, and energy bills are going to hit levels we have never seen before.

While the Government announced a few small giveaways yesterday, they won't even begin to counter the above problems.

That's why the OBR has issued such a stark warning about the dramatic decline of real household incomes this year.

That means millions of us will need to make significant cutbacks to our monthly spend just to get by. To that end, we've compiled these guides which could significantly boost your budget:

- How to save money on absolutely everything

- Simple ways to make more money

- How to legally cut your tax bill

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature