Average UK water bills for 2024 – and what to expect in the coming years

The average UK water bill for 2024 stands at £441, but households have been warned to prepare for hikes of up to £183 in the coming years.

No sooner have households adjusted to the average 2024/25 UK water bill hikes, but we've now been warned to prepare for a further 21% increase over the next five years.

And, remarkably, the water suppliers have responded to the news by calling for even bigger increases.

Here, we'll explain exactly what's going on with water bills, how much you should be paying and what increases to expect in pounds and pence over the coming years.

Average water bills 2024/25

We'll start by looking at what has happened to water bills recently.

In April, the average UK water bill jumped by £27.40 a year, an increase of 6.1%. However, there were huge variances depending on which company supplied your water.

For example, Hafren Dyfrdwy customers saw their bills rocket by £61 (16.4%), while households supplied by Dŵr Cymru Welsh Water actually saw bills fall slightly by £6 (1.2%).

Struggling to cover your water bills? Here's where you can get help with water bill debt.

How much will your bills rise in the coming years?

Fast forward to July and Ofwat, the water sector regulator, has outlined how much our bills should rise over the next five years.

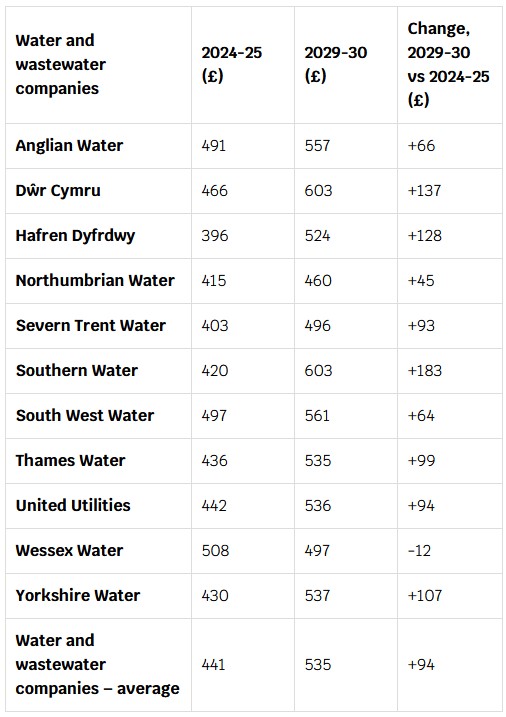

On average, it has proposed that costs increase by £94, or 21%, which would see the typical annual bill jump from £441 to £535 by 2029/30.

As before, there are some huge variances across the UK.

Southern Water customers are facing whopping hikes of £183, while those supplied by Dŵr Cymru (£137) and Hafren Dyfrdwy (£128) are also facing hefty increases.

By contrast, Wessex Water can actually expect to see their bills fall £12 over the next five years.

Actual hikes could be higher

Note that these are just the proposed hikes from Ofwat and they could be subject to change.

And that's because the water suppliers themselves are allowed to challenge them.

This seems likely given that water companies have already claimed that Ofwat had 'got this wrong', having called for increases that were a third higher than those set out by the regulator.

A final decision will be due at the end of the year.

Check the table below for proposed water bill hikes where you live.

Please note, we’ve only included suppliers that provide both water and sewerage services.

How is the average water bill calculated?

Your water usage may not actually have much correlation with your water bill.

That’s certainly the case if you don’t have a water meter. In this instance, your bill will be made up of a fixed charge (which covers things like admin) and a charge based on the ‘rateable value’ of your home.

This is the local authority’s assessment of the rental value of your property.

Unfortunately, these ratings took place between 1973 and 1990, so they're not exactly up to date.

You can’t appeal if you think the rateable value is too high either. Your bill is out of your hands and completely unrelated to your actual water use.

Good news if you use a lot of it, but not so good if you don’t.

In which case, you might want to switch to a metered bill. This means your bill will be made up of a fixed charge and a volumetric charge, covering your exact use.

Whether this means your bill goes down or up really is in your control.

To see if a water meter might save you some cash, try your provider's water meter calculator.

Switching to a water meter doesn’t have to be a permanent move either. You can switch back to unmetered bills within the first 12 months, so why not give it a try?

If your bills go up, just switch back!

Can I cut my water bill?

If you are on a water meter, then there are things you can do to reduce your bills.

Simple steps like taking a shower rather than a bath, turning off the tap when brushing your teeth and fixing leaky taps can all make a difference.

Most water companies offer widgets and gadgets to help you cut your water use. Many are free too so be sure to check out your provider’s site.

Even if you aren't on a water bill, it is still possible to make a saving by taking out a reward current account, which pays cashback on a range of household bills, including water bills.

Admittedly, your savings won't be massive, but when your options for cutting bills are limited then every saving helps.

Read the best current accounts for rewards and cashback for more options.

Want to save even more? Slashing your other monthly costs couldn't be easier. Have a look at our simple guides to cutting your grocery costs and saving on your petrol/diesel costs.

Want more stories like this? Visit loveMONEY homepage or sign up for our daily newsletter and let us send the news to you!

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature