From selling Channel 4 to a tax on sugar: extraordinary ways the Government could destroy the deficit

The Chancellor is still nowhere near turning the deficit into a surplus. We look at some unconventional options which could raise some cash.

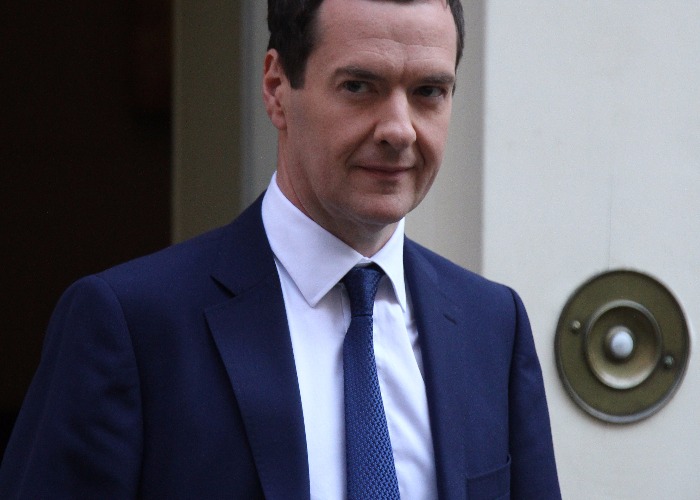

There are just a couple of weeks until George Osborne stands up and delivers the Government’s 2016 Budget. One thing that the Chancellor has talked a good game about, but so far failed to do, is balance the books.

In fact, the Office for Budget Responsibility reckons the deficit is now almost £70 billion – which he has pledged to transform into a surplus by the end of this parliament.

That gives him less than four years to turn it around. In fact, the Institute for Fiscal Studies has said that the Chancellor will have to either raise taxes or increase his spending cuts even further if he wants to achieve his self-imposed target and go into the next election on a financial high.

Not many of us are big fans of higher taxes, even if we’re opposed to the cuts, so could there be a third way? How much money could the UK make by selling off some of its… stuff?

Already flogged

It’s worth mentioning that quite a lot of decent stuff has already been sold off as Osborne battles to balance the country’s books. In last year’s Budget, he casually revealed that the sale of Government assets were the highest on record, beating the previous record from 1987.

The Government intended to raise £31 billion last year selling off various things, including the mortgage books it held from bailing out Northern Rock and Bradford & Bingley.

But there’s still plenty left that could be sold...

Urenco

The Government owns a one-third stake in the Urenco Group, a nuclear fuel company that operates plants in the UK, USA, Germany and the Netherlands. A possible sale of the UK’s stake has been mooted repeatedly, even during the last Labour government.

It’s still being discussed now, with analysts suggesting the UK’s share could be worth more than £10 billion. Now that really could make a hole in the deficit.

Money raised: £10 billion

Boost your own bank balance with a current account paying 5% interest!

Channel 4

Don’t let the ad breaks fool you, the nation owns Channel 4. Although it is mostly commercially self-funded, it’s owned and operated by the Channel Four Television Corporation – which is a public corporation belonging to the Department for Culture, Media and Sport.

There’s been huge political debate around Channel 4, though it doesn’t seem to get as much coverage as the potential future of the BBC. It’s been estimated that selling off the channel could raise as much as £1 billion. However it would then lose the public service remit that drives a lot of its focus on hard-to-reach audiences like minorities.

Money raised: £1 billion

The rest of Lloyds Banking Group

Sale of the last taxpayer-owned 10% of Lloyds was meant to happen this spring, but it was postponed due to the turbulent financial markets. That could mean it’s referred to in the forthcoming Budget speech.

The shares have fluctuated quite widely in value, with many analysts believing the Government won’t sell its stake until they reach 73.61p again (at the time of writing they are worth 72.42p). That would mean the stake is worth around £2 billion, although that obviously relies on the value climbing again.

Money raised: £2 billion

Social housing

When you thought of ‘right to buy’, you probably didn’t assume that meant investors too… However, at the end of 2015 it was reported that the Chancellor might be considering privatising the Government’s stake in housing associations, which would shift a lot of debt off the public books.

The Financial Times, which broke the story last year, estimated that ending the Government’s control of the sector could bring public debt down by £100 billion. Yep, £100 billion wiped off the nation’s debt – you can see why it’s tempting.

Having said that, it’s complicated to implement, hard to explain, and risks creating a vast amount of public anger. Watch this space.

Money raised: £100 billion

11 Downing Street

Maybe it’s not one of the biggest assets on the books, but we all know that London property is worth a fortune and George Osborne’s house is in prime central London and comes with half an acre of garden. It’s also got a fair amount of historic interest, even if it is in need of some upgrading. Of course, purchasers would have to be happy to hear Big Ben chiming not too far away but some might find the bongs soothing.

We asked several London estate agents what they would put it on the market for and the estimates varied between £12 million and £14 million, with some suggesting a bidding war could drive the price even higher if foreign investors took an interest.

Admittedly, that’s not going to make a huge difference to the deficit, but it would be quite satisfying for the rest of the country and prove that we are all in this together.

Money raised: £14 million

Boost your own bank balance with a current account paying 5% interest!

A sugar tax

Campaigners are desperate to impose a 20% sugar tax on sugary drinks, calling it an essential way of tackling childhood obesity. A 20p per litre duty would raise around £1 billion in taxation revenue, according to the UK’s Faculty of Public Health.

That money would most likely be ring-fenced to spend on obesity prevention, but it would be a substantial hike in the £638 million currently spent on that – and could potentially make a dent in the £5.1 billion that treating obesity costs the NHS each year.

Money raised: £1 billion

Bankers’ bonuses

Labour is always demanding another one-off tax on bankers’ bonuses. Last time Alistair Darling introduced the 50% bonus levy it raised £2.3 billion and ever since the party lost the election it has suggested a similar tax could fund an awful lot of projects, from the Youth Jobs Guarantee to reducing the deficit.

Sky News estimates that the amount paid out in bonuses this year will be around £5 billion – which is actually a drop on the previous year. Bankers themselves point out that they already pay tax on their incomes, but that hasn’t diminished the public appetite for them to pay more.

Money raised: £2.3 billion (maybe)

Robin Hood Tax

If you’ve seen campaigners wearing green eye masks, they aren’t cosplaying a new Teenage Mutant Ninja Turtle, they are fighting for a transaction tax that they claim would raise billions each year.

Such a tax – more commonly known as a Financial Transactions Tax – would mean that every transaction made with stocks, bonds, foreign currency and derivatives would be hit with a 0.05% tax, something that could raise £250 billion globally. That’s £250 billion a year, by the way.

In the UK (assuming it didn’t lead to everyone abandoning the City and tumbleweeds piling up around the Gherkin and Shard) it could raise £20 billion a year. That would definitely ease some deficit pain!

Money raised: £20 billion a year

What would you do if you were chancellor? Share your thoughts using the comments below.

Picture credit: Twocoms/Shutterstock.com

Boost your own bank balance with a current account paying 5% interest!

Be better off with loveMONEY:

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature