The major investment mistake too many people make

The recent falls in markets across the globe have highlighted the importance of having a longer-term outlook when it comes to your investments.

Stock market turbulence can be terrifying. Watching the value of your portfolio plummet in the wake of a dramatic sell-off is enough to spook even experienced investors.

The volatility endured at the beginning of February this year, which was triggered by the prospect of US interest rate hikes, is a prime example.

The fears were enough to wipe off a staggering 1,175 points from the Dow Jones industrial average – the largest one-day fall on record – while the UK’s FTSE 100 fell 3.5%.

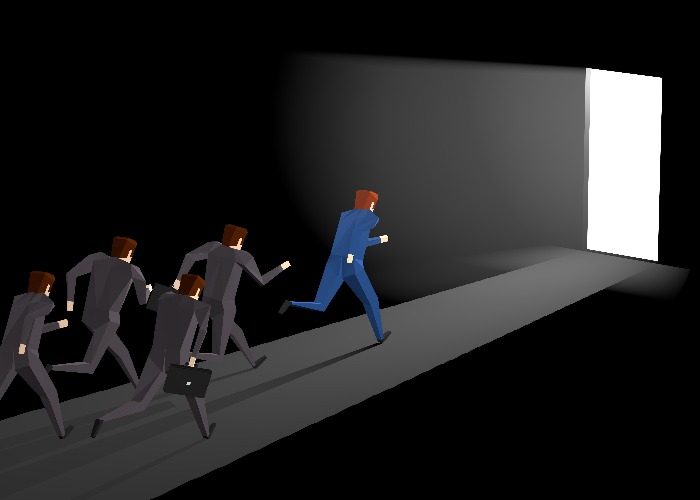

When global markets suffer such sharp corrections, it can be tempting to join the crowd heading for the exit rather than run the risk of further losses.

However, history has taught us the importance of keeping a cool head in such situations and not making knee-jerk reactions that may cost you dearly over time.

Let’s look at the main reasons why it could be a mistake to hit the panic button.

Stock markets recover

It may look horrendous and be financially painful for a while, but analysis of past data shows that stock markets generally recover over time.

Remember the global financial crisis that sent investors into a spin a decade ago? The FTSE 100 fell a whopping 31% during 2008 to close the year at 4,434.20 points.

However, it rose 22% over the next 12 months and followed that up with another 9% increase during 2010 as global markets started to settle down.

Five years later, by the end of December 2013, the market stood at 6,749.10 points, which represented a rise of 52% from the end of 2008.

Invest for the long-term

Any experienced investor will tell you that investing your money in the hope of making a short-term profit is not a wise course of action.

If you’re putting money in the stock market, then you need to consider it as a five-year investment at the very minimum. Ideally, it should be closer to 10.

Global stock markets fall for all sorts of reasons. Expected interest rate movements, global uncertainty and even comments from politicians can trigger a tsunami of concern.

However, this kind of volatility shouldn’t unsettle the longer-term investor.

They understand markets rise and fall so don’t get too excited about increases or too down when losses occur.

Don’t let short-termism distract you

You should have made your investment decisions based on a combination of your objectives and attitude to risk.

This strategy will have been built around your views on global markets, the broad long-term political backdrop, economic factors and which areas are likely to perform well over time.

If this plan made sense a couple of weeks ago is it really worth scrapping everything and starting from scratch, just because the market was all over the place for a few weeks?

That’s not to say changes are never required. However, it’s important that they’re being made for the right long-term reasons and not in response to events.

Other people might not be right

There is a real herd mentality when it comes to stock markets, but just because the consensus opinion is headed in one direction doesn’t mean it’s correct.

Take the dot.com boom back in the late 1990s as prime example.

Investors were buying into any technology company with a germ of an idea, which inflated their valuations to unsustainable levels.

Eager investors jumped on the bandwagon in the hope of making a small fortune overnight and the initial signs were encouraging.

However, when the bubble burst it wiped millions of pounds from stock markets around the world and caused widespread panic.

The only upside was it illustrated how investors should be cautious about following consensus as universally-favoured investments are not always fool-proof.

Alex Neilson, investment manager at Investec Click & Invest, suggests it’s human nature to indulge in ‘fear of missing out” occasionally, but buying into overvalued areas of the stock market can be an “expensive mistake”, just like in the late 1990s.

“We prefer active fund management, as experienced managers can exclude whole sectors from their portfolios if they believe them due a correction,” Alex said. “This compares directly to passive investments, which will blindly buy all areas of the market regardless of value.”

While the markets are moving, there are always real opportunities for anyone with the right expertise behind them.

Embrace pound-cost averaging

Regardless of where you want to put your money, investing regular monthly amounts enables you to embrace the benefits of Pound Cost Averaging.

This technique sees investors paying a set sum each month to buy units of a fund – at whatever price they are available.

For example, if you regularly invest £200 into the fund and have been buying units at £8 each, when they fall down to £6 you will get more units for your money.

It might seem weird to drip feed money into a falling stock market, but this is when great investments can be made as asset prices are lower.

Sell-offs create opportunities

Don’t forget that stock markets are made up of individual companies who may be in fantastic financial shape – regardless of what’s happening to the index itself.

Canny fund managers will take advantage of these anomalies and buy more of the stocks that have been unfairly hit by a sell-off and are now cheaper to buy.

The expectation is that when markets bounce back, these overlooked companies will perform particularly strongly and deliver a handsome return.

No-one has a crystal ball

The harsh reality with investing is that no-one knows with 100% certainty what will happen over the coming months and years.

What stock market sell-offs should teach you is the need to have a well-diversified, balanced portfolio that will enable you to smooth out the returns and limit short-term falls.

Exposure to unrelated asset classes – such equities, bonds and property – as well as different countries and sectors will help make the investment journey less fraught.

Can you cope with the volatility?

Stock markets are volatile. If you didn’t realise this before now, then living through the recent sell-off will have brought this home to you.

However, if you’ve found the falls impossible to bear then you might be in the wrong type of investment. In that case it’s time to revisit your goals and attitude to risk.

Maybe consider opting for more conservative funds that embrace a variety of asset classes and are less gung-ho in their approach than the pure equity portfolios.

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature