Ponzi scheme scams have almost doubled

Significant jump in number of Ponzi schemes uncovered by authorities.

The number of Ponzi scheme scams identified by the authorities almost doubled last year.

According to figures compiled by Action Fraud, there were 633 cases of Ponzi scheme scams, up from 334 the year before.

What is a Ponzi scheme?

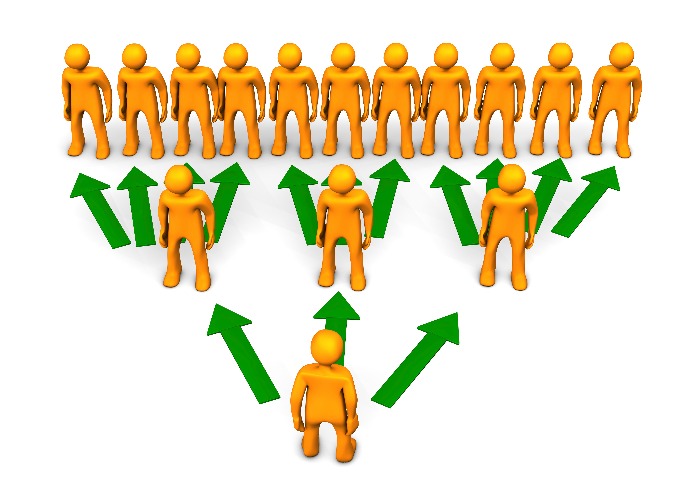

A Ponzi scheme, also known as a pyramid scheme, is a type of 'get-rich-quick' investment scam.

The fraudster advertises a multi-level investment scheme that offers massive profits for little or no risk.

The catch is that you’re required to pay a fee at the outset. Then you have to recruit friends or family to enter the scheme (hence the pyramid part). If you do, you’re paid out of the money they paid in. From there, the chain carries on.

For example, if each person who signs up recruits two others, there’ll be a million people by the 20th level of the pyramid.

However, your money isn’t actually invested in a product. It’s just passed through the chain of investors, meaning you’re unlikely to recover any lost investment. The fraudster collects the most profits while the latest person to join will get the least.

The scammer will use hard-sell techniques so that you make snap decisions under pressure, using technical jargon to make their business seem real.

Why people fall for Ponzi schemes

Put simply, it looks like easy money to the victim. What’s more, it’s getting easier to target people through different communication and social media outlets.

Pyramid promoters often target close-knit groups like social organisations and sports teams, which puts pressure on more people to participate. They also target those who are struggling for cash, of which there is no shortage at the moment.

With more people working remotely, there’s a greater risk of ‘working from home' scams, promising large sums for working from home and then recruiting a couple of other people to make more money.

What to do if you're targeted by a Ponzi scheme

Report the scheme and cease contact with the fraudsters immediately. Don’t give them any money; if you have already given them your bank details, alert your bank as soon as you can.

Keep any written communications from the scheme as evidence. Be careful of falling victim to other frauds. Fraudsters often share details about victims, changing their identity to commit further frauds.

And if you get a call claiming to be a lawyer or some kind of law enforcement, make sure it’s legitimate. It could be the scammer using your details to help recover your lost money, but request a fee.

Just remember that high returns come with high risk: if it’s too good to be true, it probably is.

Find out more about How to avoid scams and rip-offs.

What are you worth? Get a digital snapshot with Plans

More on scams, rights and politics:

Dodgy solicitors target ‘deafness’ compensation gravy train

Summer Budget 2015: what we know so far

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature