Tax expenditure breakdowns sent to millions

HMRC sending out tax summaries to over 24 million people.

From today [Monday 3rd November], more than 24 million people can expect to receive a breakdown of how their 2013/14 tax was spent by the State.

The statements are being sent out a month later than originally anticipated, but the Government hopes that they will aid in making taxation more transparent.

Your tax statement

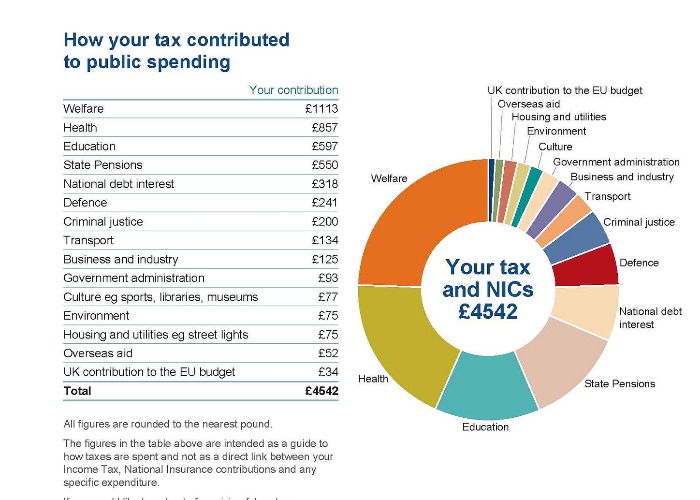

Examples of the new personal tax summaries are available to view here. Your statement, should you receive one, will show you your taxable income, tax free allowance, and a breakdown of how much of your tax was spent on welfare, health, education and so on.

There are almost 30 million taxpayers in the UK, so if you don’t receive a tax statement from HMRC, you can use the online calculator to estimate your tax bill and see how your money was used by the Government. There is also an app, which can be downloaded free of charge at the Apple app store or Google Play by searching ‘HMRC tax calculator’.

Chancellor George Osborne said that the statements “represent a huge boost for tax transparency, showing people very clearly how much tax they pay and giving them a better understanding of where their money is spent”.

Get a free life insurance quote with lovemoney.com

Breaking it down further

One major issue with the summaries is that they do not break down the category of ‘welfare’ into its component parts. This encompasses money spent on child benefit, jobseeker’s allowance and expenditure on sick and disabled people, among other costs.

The Conservatives are planning to make further cuts to the welfare system if they win next year’s election, and critics are saying that the way information is being presented in the tax summaries is not detailed enough because of the way it lumps all welfare payments together.

Dame Anne Begg, Chair of the Commons Work and Pensions Committee, was quoted in The Guardian as saying that her Committee had been “very critical of the way the Government, usually the DWP, presents its information about welfare, which gives people the impression the bulk of welfare goes to working-age unemployed people when in reality that is a very small proportion”.

Recent figures from the Treasury show that over £10 billion was spent on Employment and Support Allowance across Great Britain in the 2013/14 tax year. This is given to people who cannot work due to illness or disability. The cost of Disability Living Allowance totalled nearly £14 billion (this allowance is in the process of being replaced by Personal Independence Payments).

In comparison, the bill for jobseeker’s allowance was below £4.5 billion and housing benefits around £24 billion.

Will the new statements help make the tax system more transparent, or will the figures simply be new weapons for political point-scoring in the lead-up to the election? Let us know your thoughts in the Comments below.

Get a free life insurance quote with lovemoney.com

More from lovemoney.com

Why the State Pension is unsustainable

Illegally traded information hits record high

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature