Roosterbank, PKTMNY: pocket money goes online

Two new services allow parents to dish out pocket money and manage their children's spending online. But are they as useful as they sound?

Getting children to learn about the value of money and how to manage it is one of the biggest challenges of being a parent. Two new online services, Roosterbank and PKTMNY, promise the ability to give your children their pocket money and manage their spending.

Roosterbank

Roosterbank works by a system of virtual credit, with both parent and child setting up an account. The parent can then gift the child pocket money, either as a set amount weekly on a specific day or in a lump sum whenever they want to.

The child’s account shows the amount of pocket money they have available to spend at any time. They can then choose to spend it in the Shop, leave it in their account or donate it to charity (charities include the Dogs Trust and Send A Cow).

The child can shop for products and then add them to a basket. Once the item is added to the basket, it is sent to the parent’s account where they can approve, decline it or leave it on hold.

The child can shop for products and then add them to a basket. Once the item is added to the basket, it is sent to the parent’s account where they can approve, decline it or leave it on hold.

If the parent approves the item, they are prompted to buy it using a checkout.

If they don't want to buy it there and then, it's added to a saver basket that shows how much money they need to be able to afford it.

The products are all sold via Amazon, so the parent is transacting with Amazon (with Roosterbank picking up some money via Amazon’s affiliate programme). This means that Roosterbank never holds any real money.

If a child doesn’t have enough money to pay for an item, they can request a ‘boost’, which is sent to the parent via email.

As well as the pocket money element, there’s also a farm simulation game (which bears more than a passing resemblance to hugely successful Facebook app Farmville). Here, children can play games to earn points to buy and keep animals.

If I was a cynical person, I would say this was designed to keep children on the site longer where they will doubtless look at more things to buy with their pocket money.

There will also be a community set up for older children later.

While it’s a nice idea in principle, the overtly commercial focus and the ability for children to request boosts means it could lead to a lot of nagging and harassment of parents. The fact that the shopping site is currently limited to Amazon also means that there’s no opportunity to shop around for the best price.

PKTMNY

PKTMNY works differently to Roosterbank in that children are issued with a physical prepaid Visa debit card, although you decide how much money the child has.

There is a one-off fee of £5 for joining PKTMNY and a monthly membership charge of £1 per child. You’ll also be charged fees if the child withdraws money from an ATM (50p in the UK, £2 abroad) and for adding money to the card via your credit card (1.21% of the amount you’re adding) or debit card (50p each time). There’s no charge for adding money via your bank account.

You can set up a regular Standing Order pocket money payment onto the card, which is also free of any fees.

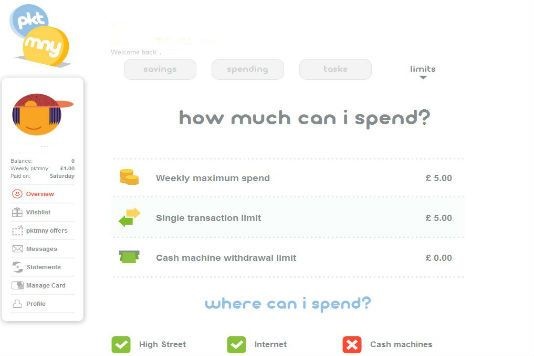

The parent activates the card and sets the limits before the child is able to use it. They can also dictate where the card can be used: via cash machines, on the high street and online. But it can't be used to purchase age-restricted products, such as fuel and alcohol.

The parent activates the card and sets the limits before the child is able to use it. They can also dictate where the card can be used: via cash machines, on the high street and online. But it can't be used to purchase age-restricted products, such as fuel and alcohol.

There is an option to set tasks, such as washing a car or helping with the cleaning, and set an amount that will be paid if the task is completed.

The child can also create a wishlist of items they want to buy and savings targets to show how far away they are from being able to afford them.

There are some definite plus points to PKTMNY, notably that issuing a card to older children (I would suggest 13 plus, although the minimum age to use it is eight) empowers them to manage their money in a real world way. But there's also the ability to limit money and where it can be spent can stop things if they get out of control.

The task functionality is also a nice way to illustrate how a child can be rewarded for work.

The downsides are the fees, which PKTMNY says are to cover the cost of the card and, as is common with any pre-paid card, the fact that the child doesn't earn interest on any savings. Which leads me to…

Alternatives

As a parent you can, of course, pay in pocket money to a child's bank or savings account via a regular Standing Order. Having said that, if your child has their own cash or debit card they can spend that money as they want. But one or two mistaken splurges could teach them a valuable money lesson they carry through into adulthood.

So using Roosterbank or PKTMNY instead of putting money in a savings or bank account misses out an important money-saving lesson. Namely that by saving and earning interest you’re making more money than you would if you keep your money in a piggy bank or savings jar or on a pre-paid card.

For example, Halifax’s Kids' Regular Saver account pays 6% interest for a year. You can deposit between £10-£100 a month.

To see all the latest best buy children's savings accounts, head to Top savings accounts for kids!

What do you think of these pocket money management sites? What's the best way to teach kids about managing their money? Let us know in the Comments box below.

More on children's money matters

Child Benefit changes: what you need to know

How to claim your Tax Credits

How your kids can start making money

The best Junior ISAs

The top Child Trust Funds

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature