Premium Bonds: alternative savings accounts which offer higher returns

Premium Bonds may be the most popular savings account around, but it’s not difficult for savers to find a much better return.

Sections

The nation's favourite savings account

Premium Bonds are the nation’s favourite savings account, with an incredible £68 billion held in bonds across the UK in total, a staggering amount really.

In recent years, that number has jumped sharply as the maximum amount that could be held in bonds has increased, initially to £40,000 in June 2014 and then up to £50,000 the following year.

There are a few obvious attractions to putting your money into a Premium Bond. For starters, there’s the fact that your cash is completely protected by the Government.

Premium Bonds are run by the Government-backed National Savings & Investments, and so every pound you put into them is entirely safe.

That’s not the case with high street banks and building societies, which are generally members of the Financial Services Compensation Scheme (FSCS), which only protects the first £85,000 you deposit with each institution.

Then there’s the fact that Premium Bonds have the potential to deliver big. While you don’t earn interest, each bond you own is entered into a monthly prize draw, with prizes going all the way from £25 up to two lucky winners each month bagging a cool £1 million each.

Will you ever bag a payout?

While there is no formal interest rate, NS&I does publish an annual prize rate which currently stands at 1.15%, which is essentially a rough guide towards what the average payout for bondholders is.

It’s very much just a guide though – you can easily go years without winning anything. Some bondholders claim they have NEVER won.

Even in the current low interest rate environment, a 1.15% return is nothing to get excited about.

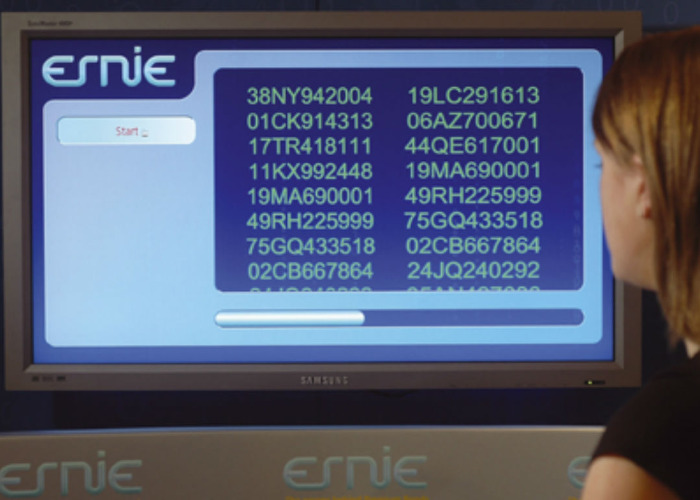

Image credit: NS&I

Get a guaranteed return instead

So, what are savers’ options if they are looking for a guaranteed return that’s better than that? We’ve broken it down based on different saving amounts.

As always, the best interest rates are reserved for deals where the money is locked away for a longer period.

It's worth noting that Premium Bonds are usually held for years – or even decades – at a time, so it’s not an unfair comparison, even though it’s obviously easier to get your hands on money held in a Premium Bond if you need it than money that’s locked away in a five-year bond.

Before we jump in, one final point: if the only reason you hold Premim Bonds is the thrill of knowing you could win big one day, you can always use the additional interest you earn on the top-paying accounts below to purchase lottery tickets.

How to cash in your Premium Bonds

Beating Premium Bonds at £100-£500

If you have £500 to put aside and want to keep the money within relatively easy reach, then your best bet is an ISA from Al Rayan Bank, which can be opened with £250.

While this isn’t a particularly familiar name to many, it is a member of the Financial Services Compensation Scheme, so your money enjoys the same protection as if you save it with a high street bank or building society.

There are a few caveats to note here. While the advertised rate of return is 1.21% AER, it’s important to note that this is an ‘expected profit rate’ rather than an actual rate of interest, as the account is sharia-compliant.

The other is the fact that this account doesn’t offer instant access – you’ll need to give 120 days’ notice before you can take your cash out.

Another option, and one that really does provide true immediate access, is a current account.

There are now a handful of accounts paying better returns than savings accounts. For example, the Nationwide FlexDirect account pays 5% for a 12-month period on balances of up to £2,500, while TSB pays 3% on balances up to £1,500 and Tesco Bank pays the same rate on balances of up to £3,000. All of these accounts can be opened with just £1.

If you are happy to lock your money up for a longer period in order to secure a better deal, then your best bet is to take a look at the new online challenger, Atom Bank. Its fixed savers have the best rate on offer over a year (1.8%), two years (2%), three years (2.2%) and five years (2.4%). Atom is also a member of the FSCS. All of these accounts can be opened with just £50.

Beating Premium Bonds at £1,000

If you have £1,000 to save, then the best choice on an easy access basis is still Al Rayan Bank.

Al Rayan Bank is also the market leader for short-term bonds, with the top rate over a year (2.02%), 18 months (2.06%), two years (2.11%) and three years (2.16%).

All of these bonds can be opened with a balance of £1,000. Remember, these accounts are sharia-compliant so the return is an expected profit rate rather than actual interest.

If you are happy to lock your money away for longer, Atom Bank’s five-year bond remains your best bet.

Beating Premium Bonds at £2,500-£10,000

At these savings points, the leading accounts are still those mentioned above.

Beating Premium Bonds at £25,000

With the ISA limit set at £20,000 for this financial year, you’ll (finally) have to look elsewhere if you want to keep all of your cash within easy reach. The next best account comes from Kent Reliance, which pays 1.15% – the same return as Premium Bonds – on balances above £1,000.

Al Rayan remains the market leader over one and two-year bonds, but if you are happy to lock your cash away for longer then the Bank of London and the Middle East (BLME) is a better option. It pays 2.25% over three years, 2.4% over four years, 2.5% over five years and 2.55% over a seven-year term.

Bear in mind that this is another sharia-compliant account, so those rates of return are expected profit rates rather than rates of interest. BLME deposits are protected by the FSCS.

Beating Premium Bonds at £50,000

The top accounts at this savings level are the same as those at the £25,000 mark.

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature