The rich countries with the most debt in 2023

Find out which major nations are massively in the red

Wonder how indebted your country really is? The debt-to-GDP ratio compares a nation's external debt to its total output for a year and is a handy way to judge the overall state of a country's economy and ability to pay its dues.

A ratio of over 100% means a country isn't producing enough to cover what it owes, while a rising ratio can signal that a recession is on its way and a consistently high ratio is usually accompanied by poor economic growth.

With this in mind, read on to discover the debt-to-GDP ratios of 24 of the world's largest economies, from the lowest to the highest.

All dollar values in US dollars.

Russia, debt to GDP: 18.2%

Russia may have the lowest debt-to-GDP ratio in the industrialised world but its economy is in recession and its credit rating has been downgraded to junk status. While factors such as the nation's wealth of commodities and huge trade surplus have helped keep it in the black, Russia's lack of debt has a lot to do with the fact it's severely restricted from borrowing on the international markets due to sanctions imposed following Vladimir Putin's annexation of Crimea in 2014 and all-out invasion of Ukraine last year.

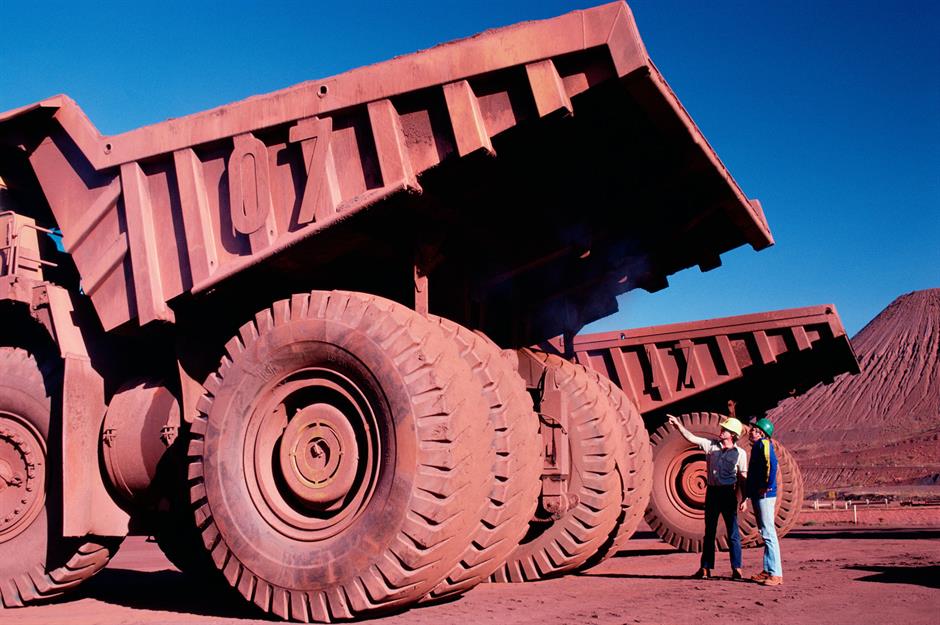

Australia, debt to GDP: 22.3%

Russia's debt-to-GDP ratio was recorded in December 2021 before the invasion of Ukraine and it's actually estimated to have to grown to 22%, more or less matching Australia's figure, which like most of the figures in this round-up was calculated at the end of last year. A resource-rich economy and fat trade surplus are key to keeping Australia's ratio low. However, the figure is somewhat deceptive as it doesn't include borrowing by states, while Australian household debt is among the highest in the developed world.

Sponsored Content

Saudi Arabia, debt to GDP: 30%

Saudi Arabia's debt-to-GDP ratio was last reported in December 2021, though its figure is predicted to have trended down since then. The surge in energy prices post-COVID has provided the natural gas and oil-rich country with an enormous windfall and its external finances are flourishing, enabling the government to pay off much of the debt it accumulated at the height of the pandemic when commodity prices tanked. Unsurprisingly, Fitch recently upgraded the nation's credit rating from A to A+.

Türkiye, debt to GDP: 31.7%

As we've mentioned, a low external debt-to-GDP ratio doesn't necessarily mean a country is prospering and Türkiye is a prime example of this. Mired in economic crisis, the nation is enduring everything from exceptionally high inflation to a plunging currency, largely brought about by President Erdoğan's unorthodox economic policies (though the recent interest rate hike indicates change is afoot). And while Türkiye's external liabilities are low, its internal debt is anything but.

New Zealand, debt to GDP: 35.9%

Long averse to racking up external debt, New Zealand, which recently fell into a recession, is seeing its debt-to-GDP ratio increase, with the slowing economy and other factors including the cost of natural disasters eating into government finances and forcing it to ramp up borrowing.

Thankfully New Zealand is more than capable of sustaining this debt, which is reflected in its excellent AA+ credit rating. By way of contrast, Türkiye is rated a much poorer B with a negative outlook.

Sponsored Content

Indonesia, debt to GDP: 40.9%

Mirroring its counterpart in New Zealand, the Indonesian state has a reputation for strict fiscal discipline and this is borne out by the country's low debt-to-GDP ratio of 40.9%. Bountiful export commodities and running a trade deficit are key too to keeping external debt levels down. This puts Indonesia in a better position than many other countries to navigate a global debt crisis.

Switzerland, debt to GDP: 41.4%

Likewise, successive Swiss governments have kept a tight rein on the country's finances and a 'debt brake' is even written into the nation's constitution. Spending surged during the height of the COVID pandemic, but debt levels have since come down.

Credit-wise, Switzerland is blessed with an AAA rating, the highest possible. Be that as it may, there's an argument to be made that Switzerland's aversion to borrowing actually holds back the economy in some respects.

South Korea, debt to GDP: 49.6%

The risk of default and other negative economic consequences start to mount when a country's debt-to-GDP ratio hits 50%, with South Korea almost at the threshold. In fact, the nation's ratio has been growing two-and-a-half times faster than the average for 35 advanced economies. Rising external debt is already having a detrimental effect, with South Korea ranked lower this year for global competitiveness as a direct result.

Sponsored Content

Mexico, debt to GDP: 49.6%

Mexico's debt-to-GDP ratio on the other hand is projected to remain more or less stable at just under 50%, with the government laser-focused on maintaining sustainable debt levels, and its BBB- credit rating. Public spending has been tightened this year as the Mexican government seeks to keep foreign debt below the agreed ceiling of $5.5 billion (£4.3bn).

Netherlands, debt to GDP: 51%

One of the least indebted EU countries and among the first to balance its books following the pandemic, the Netherlands has managed to keep its debt-to-GDP well below the 60% threshold enshrined in EU legislation. Together with Germany, the Netherlands is pushing the member countries that have exceeded it to drastically reduce their debt levels, which soared during COVID.

Germany, debt to GDP: 66.3%

Despite its efforts to encourage EU member states with excessive external liabilities to get their high debt-to-GDP ratios under the 60% threshold, Germany has a long way to go to meet the same criteria. With the economy flagging, Germany's finance ministry predicts a widening of the GDP deficit this year. Accordingly, the debt-to-GDP ratio is expected to increase to 66.8% and stay significantly above the threshold going into the latter half of the 2020s, though it is likely to remain the lowest among the G7.

Sponsored Content

South Africa, debt to GDP: 67.4%

South Africa's debt-to-GDP ratio, while on the high side, is lower than a lot of other developed countries, and has been described as one of few things the nation's economy has going for it. High inflation, OTT interest rates, and an unprecedented 'Loadshedding' energy crisis exacerbated by widespread corruption are hammering the country's finances and sapping growth. It's little wonder then that S&P recently downgraded South Africa's junk credit rating outlook to negative.

Brazil, debt to GDP: 72.9%

Brazil's debt-to-GDP ratio fell at the end of 2022 to its lowest level in more than five years. Though President Lula's government has been spending lavishly, the ratio is falling thanks to decent economic growth and other factors such as the appreciation of the real against the US dollar. This has helped the country score an outlook upgrade from S&P, though its credit rating remains in junk territory.

China, debt to GDP: 76.9%

China's debt-to-GDP ratio hit just under 77% at the end of last year. According to the World Bank, this is the danger threshold. If it's exceeded for a prolonged period, economic growth is stunted. And questions are being asked about whether China's debt, which is projected to increase considerably in the coming years, will be sustainable considering its current trajectory.

Sponsored Content

Argentina, debt to GDP: 85%

Argentina has defaulted on its sovereign debt multiple times and few countries have a poorer credit rating, making its debt expensive to pay back.

Already the International Monetary Fund's (IMF) biggest creditor, the country's government is in need of further bailouts as inflation skyrockets, the peso tanks against the US dollar, and foreign currency reserves run low. Needless to say, Argentina's debt-to-GDP ratio is projected to increase in the coming years.

India, debt to GDP: 89.3%

India's debt-to-GDP ratio stood at 89.3% at the end of 2021 due to the cost of the pandemic, but it has since declined to 83.1% and the IMF expect the future to remain around the 83% mark for the next few years. External debt is still above what it was before COVID struck, but the levels are comfortably within manageable limits according to Reserve Bank of India Governor Shaktikanta Das.

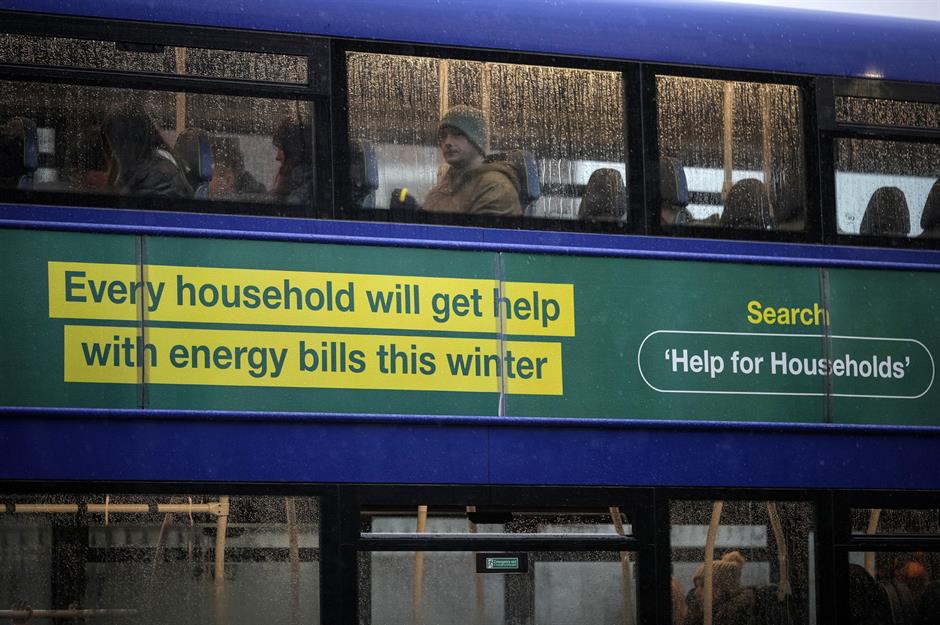

UK, debt to GDP: 101%

A debt-to-GDP ratio of over 100% means in a basic sense that a country isn't producing enough to pay off its debts. The UK recently exceeded the figure for the first time since 1961. Government borrowing has mushroomed to pay for the energy support scheme, rising benefits payments, and public sector pay hikes. Getting the ratio back down certainly won't be easy and presents a major challenge for Chancellor of the Exchequer Jeremy Hunt.

Sponsored Content

France, debt to GDP: 112%

France's debt in relation to GDP has risen sharply as the government has borrowed extensively to cushion the economy from the ravages of COVID, the conflict in Ukraine, and other major headwinds. The burning question is whether the government can get a grip on the debt mountain.

Reducing public spending is proving a nightmare for President Macron since any moves to cut costs are invariably met with massive opposition, as the reaction to his major pension reform, which raises the retirement age from 62 to 64, has shown.

Spain, debt to GDP: 113%

Spain's debt-to-GDP climbed a hefty 20% in 2020 and 2021, more than any other Eurozone country, as the pandemic hampered growth and led to enormous government spending. Spain does, however, appear to be having an easier time than France reducing its external debt as stronger growth, tighter fiscal policy, and larger-than-expected tax receipts shrink the ratio, though it will likely remain higher for some time yet.

Canada, debt to GDP: 113%

Chrystia Freeland, Canada's Minister of Finance, has made it her priority to reduce Canada's pandemic-hit debt-to-GDP ratio, which she says has to decline if the country's finances are to remain sustainable. Interestingly, Canada has been deemed the most indebted nation in the world by Global Finance magazine, based on several telling metrics such as household debt and credit card ownership.

Sponsored Content

USA, debt to GDP: 129%

The US has amassed external debts of over $30 trillion (£23.6tn), eclipsing every other country. And the ratio of the nation's debts to its GDP has continued to rise post-COVID. With America's national debt at its highest level since World War II, recent efforts by the Biden administration to raise the debt ceiling were almost stymied by Republican lawmakers, and future battles are likely to be just as difficult and protracted.

America's GDP to debt ratio is expected to stay high. There is however plenty of scope for it to come down, say if GDP grows faster than projected.

Italy, debt to GDP: 145%

Up to its eyeballs in IOUs, Italy has external debt amounting to more than $3 trillion (£2.4tn) and a bloated debt-to-GDP ratio of 145% to match. But it's not all doom and gloom. The Italian economy is showing remarkable resilience and the ratio has begun to drop, though the process is likely to be a lengthy one given the number of headwinds.

Singapore, debt to GDP: 160%

Singapore is something of an anomaly. Its debt-to-GDP ratio stands at an unenviable 160%, yet the compact island nation's credit rating is outstanding, as is its fiscal health. Basically, unlike other highly indebted countries, Singapore takes out loans to invest rather than spend and its assets considerably exceed the amount borrowed.

Sponsored Content

Japan, debt to GDP: 264%

Japan's external debt ballooned during the 'Lost Decade' of the 1990s and has since spiralled. Heavy borrowing to pay for a rapidly ageing population and to stimulate the perennially stagnant economy continues unabated, having risen to eye-popping levels during the pandemic.

Japan has long depended on ultra-low interest rates to sustain its sky-high debt levels, but with interest rates on the rise, the chickens could soon be coming home to roost.

Now discover how much money you need to be in different countries' richest 1%

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature