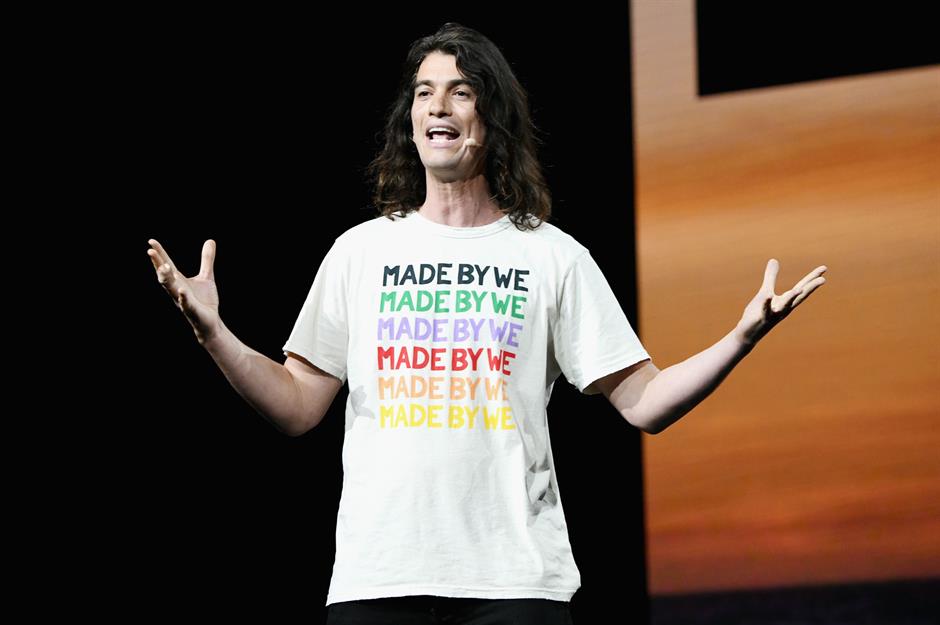

WeWork founder Adam Neumann's controversial career

The rollercoaster career of Adam Neumann

Super-eccentric, irresistibly charismatic, and downright lucky, Adam Neumann charmed his way to achieving a $47 billion (£38.9bn) valuation for his company WeWork while simultaneously almost running the business into the ground, as documented in recent Netflix series WeCrashed.

After walking away in 2019 with a juicy pay-off, Neumann is back with a brand new business – and has even persuaded one of Silicon Valley's leading venture capitalist firms to fund it. Read on as we look at his rollercoaster ride of a career. All dollar amounts in US dollars.

Nomadic lifestyle

Born in 1979 in Tel Aviv, Israel, Neumann spent much of his childhood on the move, and had lived in 13 different homes by the time he was 22.

His parents divorced when he was seven years old and the future entrepreneur relocated with his mother and sister to the US.

It was here he got his first job, delivering newspapers in the Indianapolis neighbourhood that his family called home.

Childhood challenges

Neumann struggled with severe dyslexia but the go-getting youngster persevered and eventually learned to read and write by the third grade.

In 1990, the family moved back to Israel and ended up on a kibbutz not far from the Gaza Strip.

Having led a largely nomadic life up to that point, Neumann quickly became enamoured with communal living and the new-found sense of belonging that came with it.

Sponsored Content

Key inspirations

The experience would go on to provide the chief inspiration for the WeWork concept, with Neumann even dubbing the coworking company "Kibbutz 2.0" – though his version would prove to be unabashedly capitalist.

Another key influence was Neumann's military service. After completing high school, he served in the Israeli Navy for five years, learning, he later revealed, "what it mean[t] to be part of something greater than yourself".

Cool kid

Popular among his peers during his time at school and while in the military, Neumann was the fun kid everyone wanted to hang out with. And all that moving around no doubt gave him a knack for making friends quickly.

His outgoing personality and cool aura would later work wonders when it came to getting investors to hand over their cash.

New York move

After his discharge from the Israeli Navy, Neumann made a beeline for New York in 2001 to, in his words, "have fun and make a lot of money".

The 22-year-old moved into an apartment in Tribeca with his sister Adi, a top model who has landed international Vogue and Elle covers.

Struck by how his neighbours kept themselves to themselves, Neumann devised a friend-making game with his sister. Within no time, the duo had racked up acquaintances on each floor of the building.

Sponsored Content

Hard partying

Blessed with runway-ready looks and a towering stature like Adi, Neumann toyed with the idea of modelling but decided instead to focus on improving his business skills through study.

That said, the aspiring tycoon was no bookish nerd, hitting up every club in the city and, as he put it, "hitting on every girl" in the process.

This propensity for hard partying wouldn't do him any favours later on in his career, as we shall discover...

College days

In 2002, Neumann enrolled in the Big Apple's Baruch College, where he majored in business at the Zicklin School of Business.

While attending the institution, Neumann came up with a communal living concept called WeLive, with his old friend-making game the major impetus for the idea. He entered it into a college competition but the concept failed to make it to the second round.

First business forays

In the meantime, Neumann was flexing his entrepreneurial chops.

Among his early ventures was a collapsible high heel shoe idea that failed miserably, while a babywear business called Krawlers that sold infant clothing with padded knees was decidedly more successful.

Buoyed on by Krawlers' apparent potential, Neumann dropped out of Baruch in 2006 to focus on the burgeoning business.

Sponsored Content

Brooklyn move

In 2006 Krawlers merged with Baby Egg, another baby apparel firm, and Neumann set up the HQ in Brooklyn's up-and-coming Dumbo neighbourhood.

He'd been tipped off about the availability of affordable commercial space in the district by an architect friend named Miguel McKelvey, who he'd met a year earlier at a roof party in Tribeca.

Coworking concept

Feeling frustrated that his babywear business wasn't taking off as fast as he'd hoped, Neumann would frequently bounce money-making ideas off McKelvey.

The son of one of his Baruch classmates was running a thriving enterprise renting out offices to startups lacking their own facilities. Neumann asked McKelvey if they should set up something similar in Dumbo.

Green Desk

The concept was also very much aligned with Neumann's communal kibbutz-inspired ethos.

The smooth-tongued entrepreneur sweet-talked the owner of the office space he was renting in Dumbo, and where McKelvey was also working, to let them take over a floor in a nearby block he owned.

In 2008, the pair formed the sustainability-focused Green Desk, which would be the precursor to WeWork.

Sponsored Content

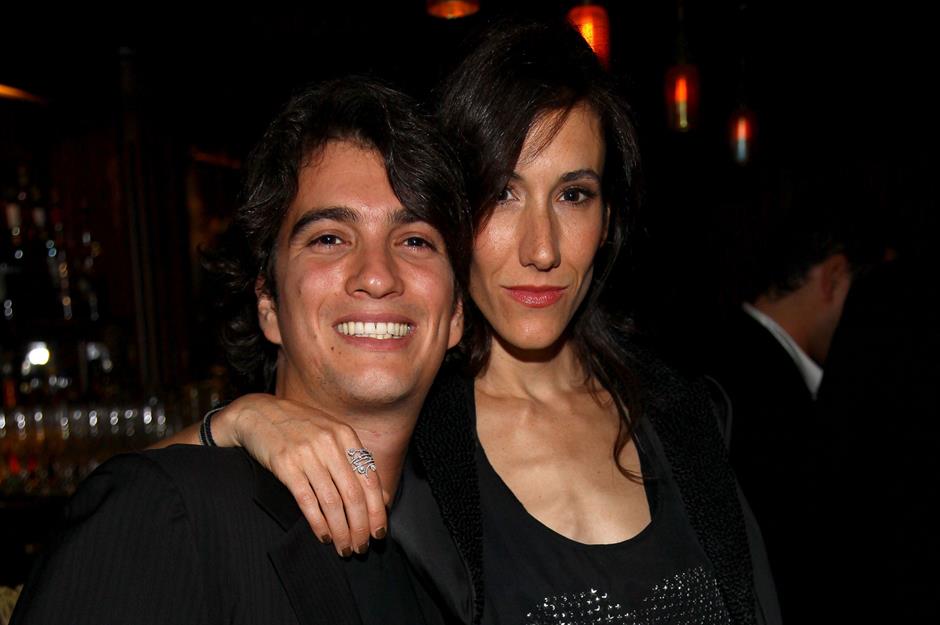

Rebekah Paltrow

Just as he was getting Green Desk off the ground, Neumann went on a blind date with budding actress Rebekah Paltrow, cousin of Gwyneth and friends with the likes of Ashton Kutcher, who she met via her interest in the Jewish mystic practice of Kabbalah.

Over dinner, Paltrow listened patiently to Neumann's many madcap ideas, then dismissed him. Yet the pair hit it off and a whirlwind romance ensued.

Power couple

Paltrow introduced Neumann to Kabbalah and her famous friends, who would prove helpful for financing and promoting the coworking business in its early days.

The pair got hitched in October 2008 and were famously gifted $1 million (£845k) by Rebekah's father, Bob Paltrow.

WeWork founding

Green Desk was going from strength to strength but Neumann and McKelvey were keen to shift the sustainability focus towards community and coworking.

Keen to break out on their own, the pair sold their stake in the company for $3 million (£2.5m) in 2010.

Neumann used his powers of persuasion to secure $15 million (£12.5m) from real estate investor Joel Schreiber and WeWork was born.

Sponsored Content

Lynchpin role

Neumann took on the CEO role, while McKelvey became the chief culture officer. The former was very much the frontman of the operation, while the latter was happy to stay in the background.

It wasn't long until the company opened its first coworking space in Manhattan's stylish SoHo neighbourhood.

Name idea

Interestingly, as revealed in Reeves Wiedeman's recent biography of Neumann, it was Lin-Manuel Miranda’s talent agent Andrew Finkelstein (pictured) who came up with the name "WeWork" while on a night out with Neumann and his wife.

Neumann simply couldn't think up a catchy name for the business, despite months of brainstorming.

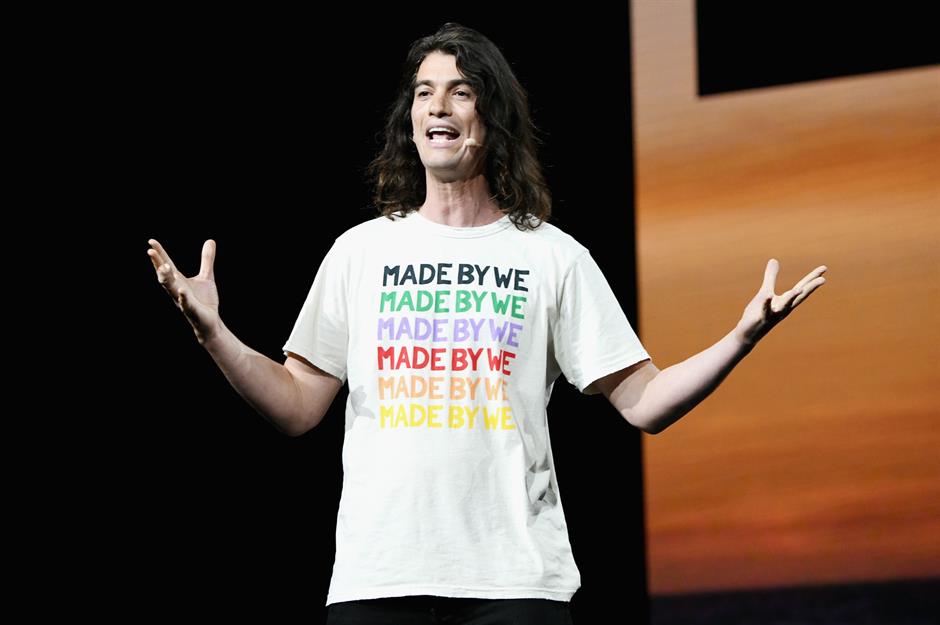

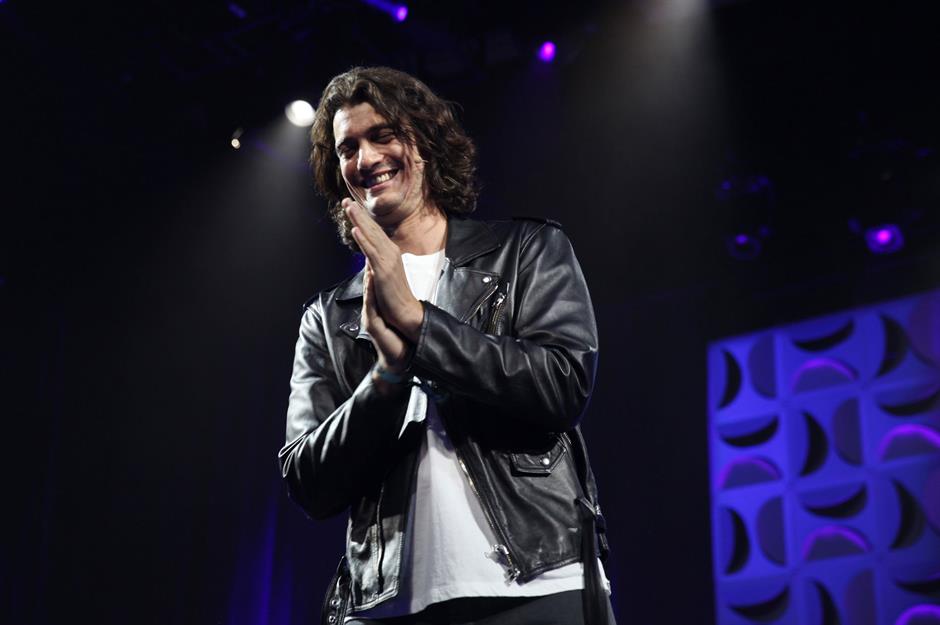

Magnetic personality

What he lacked in branding prowess, Neumann made up for in enthusiasm and charisma. He managed to create serious buzz for WeWork among investors and journalists alike, with people lapping up his lofty aspirations for the company.

Shrewdly, Neumann pitched WeWork as a paradigm-shifting tech game changer rather than the commercial real estate business that it really was.

Sponsored Content

Speedy growth

With famous friends on board courtesy of Mrs Neumann, investors lining up to get involved, and the media playing ball, WeWork was attracting money, publicity, and clients.

Within a couple of years, the company was worth almost $100 million (£83m) and had amassed six New York locations, as well as one in San Francisco and another in Los Angeles. It also had 3,000 members and a workforce of 75 people.

Investment bonanza

Investment cash was pouring in as Neumann wooed Wall Street with his vision of disrupting the commercial real estate industry and extending the "We" concept into other sectors.

In 2014, a slew of big names – including Goldman Sachs, J.P. Morgan, and Fidelity – ploughed $355 million (£294m) into the company, giving it a valuation of $4.6 billion (£3.8bn).

By the end of 2015, WeWork was boasting 54 locations in the US, UK, the Netherlands and Israel.

Branching out

WeWork started building its first ground-up projects and began acquiring other companies, beginning with the building information modelling firm Case.

The idea was to create synergies with the coworking business, as well as with the other industries that WeWork was looking to expand into, which included wellness and education.

Sponsored Content

SoftBank investment

In 2016, WeWork expanded into Asia. The following year, the company landed a bumper $4.4 billion (£3.7bn) investment from Japanese telecoms conglomerate SoftBank.

Bowled over by Neumann's increasingly messianic vision to change the world through the We brand, SoftBank founder Masayoshi Son was all in.

Spending spree

Flush with money, WeWork, which was valued at $20 billion (£16.6bn) after the SoftBank deal, went on an almighty spending spree.

Its acquisitions became increasingly eccentric. In November 2017, for instance, wannabe surfer Neumann splashed $13 million (£10.8m) of his company's cash on a wave machine business, and also went on to invest in a superfood brand founded by a pro-surfer friend.

WeGrow spin-off

Eyebrows were also raised in 2017 when WeWork launched WeGrow, its educational spin-off for kids.

The pet project of Rebekah, the Manhattan institution was described by The Daily Beast as "a yoga-obsessed, hippie school for the hyper-rich".

With its annual fees reaching as much as $42,000 (£35k), the school was shut down in 2019, but Mrs Neumann has reportedly since bought back the rights to the concept.

Sponsored Content

Lavish spending

Having landed on the Forbes' prestigious billionaire's list in 2016, Neumann was putting his new-found wealth to good use.

Together with his wife, the super-rich entrepreneur dropped almost $90 million (£75m) on six opulent homes in Manhattan, the Hamptons, San Francisco, and other locales during his time at the helm of WeWork.

Inflating ego

As WeWork continued to grow, Neumann's ego mushroomed accordingly.

According to The Wall Street Journal, he had modest aspirations to become the world's first trillionaire, as well as the prime minister of Israel and "president of the world".

He also wanted to achieve immortality and expand WeWork to Mars – Neumann even went as far as to set up a meeting with Elon Musk to discuss his plans for the Red Planet.

Mammoth valuation

Needless to say, investors were getting nervous. Still, WeWork garnered an additional investment from SoftBank in January 2019, which catapulted its valuation to a staggering $47 billion (£38.9bn).

The firm then rebranded to The We Company, to reflect its move into other fields. By this time, the business had 425 locations in 100 cities around the world.

Sponsored Content

IPO reveals some eye-opening info

The colossal valuation paved the way for the company's flotation on the stock market. And that's when the trouble started.

After filing for its IPO in August 2019, investors and the media were finally able to go through The We Company's finances with a fine-tooth comb. And the data didn't make for pleasant reading...

It transpired that the company was haemorrhaging money, with losses in 2018 amounting to a painful $1.9 billion (£1.6bn).

Serious doubts were cast over whether the business could ever be profitable, spooking investors. The IPO was delayed. Then, to make matters worse, the focus turned to Neumann and his managerial style, which was unconventional to say the least.

Reckless behaviour

According to insiders, the hard-partying CEO would down tequila shots at work, smoke copious quantities of weed, and host wild staff summer camps where he'd take psychedelic mushrooms and strut around with a water gun filled with vodka.

Rumours of Neumann missing a key investor meeting because he'd passed out after a particularly heavy night did nothing to quell stakeholders' fears.

The "personal" company plane

Neither did the fact that he bought a $60 million (£50m) Gulfstream G650 private jet with the company's money and effectively used it as his personal plane.

While awaiting the craft's delivery, Neumann is alleged to have borrowed another Gulfstream jet for a trip to Israel.

Following its arrival in the Holy Land, the crew discovered a cereal box full of marijuana, prompting the owner to recall the jet.

Sponsored Content

'Frat house atmosphere'

On another flight, Neumann and his entourage were using so much cannabis that the crew were forced to slap on oxygen masks to enable them to breathe through all the smoke.

More worryingly, Neumann was accused of mistreating employees and presiding over a frat house-style atmosphere that enabled sexual harassment. A number of conflict-of-interest issues also came to light, along with a string of other dubious behaviour claims.

Questionable conduct

It transpired that Neumann had leased properties he owned or part-owned to WeWork, making him millions in rent money.

Sensationally, the CEO was also discovered to have trademarked the word "We" before selling it to The We Company for a hefty $5.9 million (£4.9m).

Within a month of the filing, The We Company's value had plummeted from $47 billion (£38.9bn) to $10 billion (£8.4bn). With investor confidence evaporating, there was only one thing for it: Neumann had to go.

Forced resignation

Despite relinquishing the private jet and paying back the trademark cash, Neumann was forced to step down as CEO of The We Company, resigning from his position on 24 September 2019.

The following month, SoftBank assumed control of the ailing firm, which narrowly avoided bankruptcy.

Though Neumann lost the Japanese conglomerate a fortune, he still walked away with hundreds of millions. In fact, The Wall Street Journal reported that SoftBank gave Neumann a package worth around $1.7 billion (£1.4bn) when he left the company.

Sponsored Content

Unlikely comeback

After laying low and quietly buying up swathes of real estate, Neumann is now back in the spotlight, much to the fury of his critics.

His latest venture, Flow, is aiming to disrupt the residential property market by building on his WeLive concept, though the finer details of the concept are sketchy at present.

Jaw-dropping investment

A billionaire again after temporarily falling into the centimillionaire bracket, Neumann is said to have bought 3,000 apartment units in Miami, Fort Lauderdale, Atlanta, and Nashville for the project.

And he has secured a $350 million (£290m) investment for Flow from legendary Silicon Valley venture capital firm Andreessen Horowitz.

Second chance

The cash injection gives Flow a valuation north of a billion dollars. Neumann is also getting into the offsetting industry with a blockchain-enabled carbon credit trading platform called Flowcarbon.

We'll see if the out-there business maverick has learned from his mistakes and can transform his new ventures into major successes. Andreessen Horowitz certainly seems to think he can...

Now discover the meteoric rise and scandalous fall of Theranos founder Elizabeth Holmes.

Sponsored Content

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature