Budget comment: bruising tax hikes won’t make a dent in debt levels

Our tax burden will soon hit a historic high, yet debt levels keep on rising.

Yesterday’s Budget came with no shortage of bad news for the public.

From extending the painful freeze on personal tax thresholds to new levies on electric and hybrid vehicles, millions of Brits will be worse off as a result of yesterday’s big speech.

Depending on which report you read, the myriad of tax hikes is expected to raise anywhere between £25 and £30 billion for the public purse.

Following on from last year’s £40 billion Budget hikes, give or take some change, we are rapidly seeing tax levels near uncharted waters.

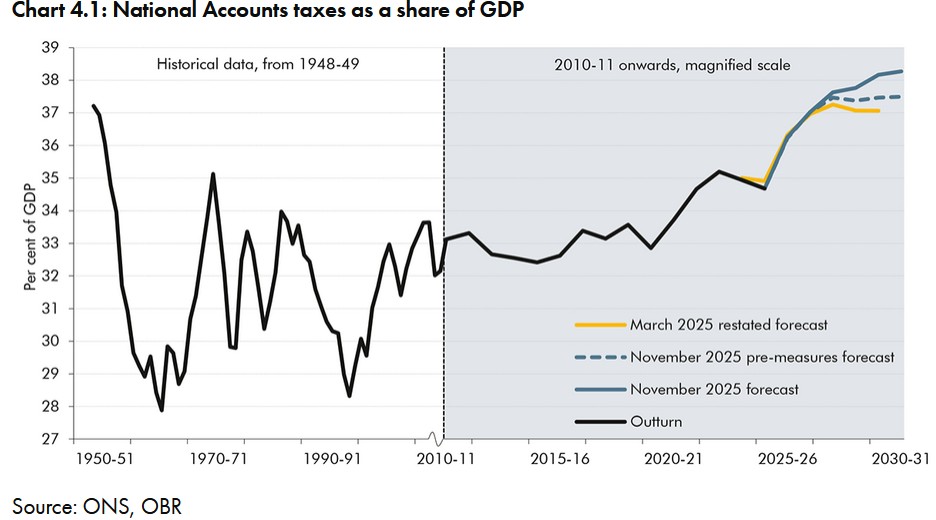

Figures from the Office for Budget Responsibility (OBR) show that tax receipts will hit an all-time high by 2030.

Graph: tax as a share of GDP

“Taxes as a share of GDP are forecast to increase from 34.7% in 2024/25 to a peak of 38.3% by the end of the forecast period,” it noted yesterday.

“The 2030/31 peak would be a historic high and a 5.4% increase on the pre-pandemic level of 32.9% of GDP in 2019/20."

Rising taxes are obviously never welcome, but they are especially hard to take when all other costs are rising so rapidly as well.

Various members of the Government have been at pains to stress these hikes are necessary to fill a “black hole” in the public finances.

While we have no doubt that the black hole exists, there are question marks over whether this Government – or indeed any in the last 20-plus years – has actually succeeded in filling it.

For debt levels are only going one way.

The rising debt mountain

National debt currently stands at £2.8 trillion, but the OBR forecasts this will hit the £3 trillion mark in 2027 and reach a mind-boggling £3.5 trillion by 2031.

This is because, despite taxes reaching record levels, our national spending is far higher, meaning more borrowing is required.

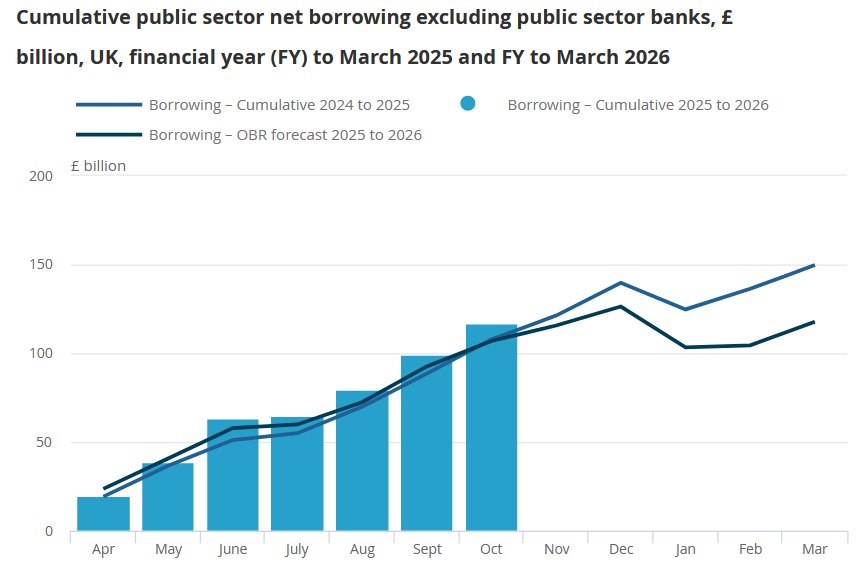

As the Office for National Statistics (ONS) graph below shows, total borrowing since April has already blown past £100 billion.

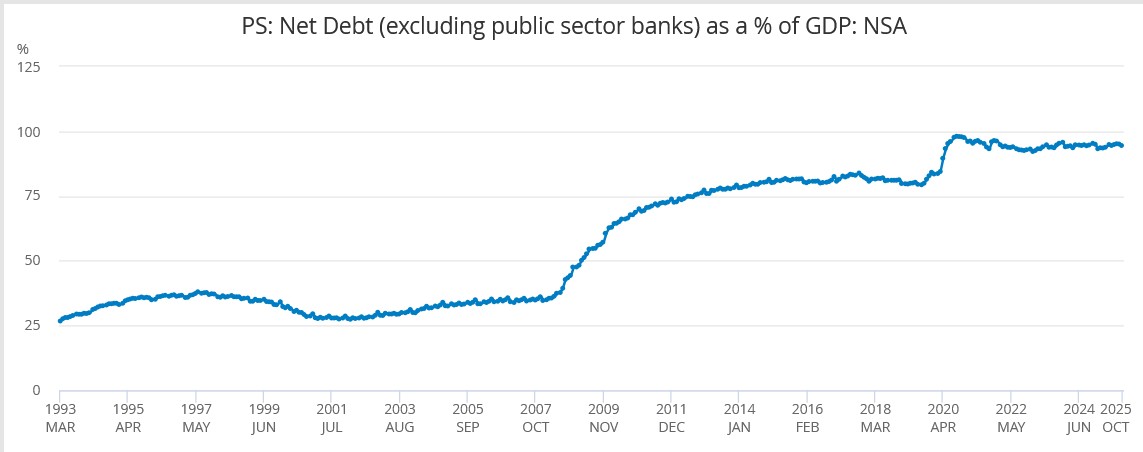

All this borrowing means our total debt is nearing the equivalent of what we as a nation can generate in a year.

As the OBR notes: “Debt rises as a share of GDP from 95% of GDP this year and ends the decade at 96% of GDP, which is 2% higher than projected in March and twice the debt level of the average advanced economy.”

To avoid being overly alarmist, we should point out that the amount we have to borrow each year as a percentage of GDP is forecast to fall in the coming years, from 4.5% now to 1.9% in 2030/31.

This is an improvement, but it doesn’t detract from the fact that spending more than we earn as a nation has become the norm.

As the ONS graph below shows, debt as a percentage of GDP has been rising for the last two decades.

Indeed, the last time the UK boasted an annual surplus – where earnings exceed outgoings – was back in 2000/01, a full 25 years ago.

Tax hikes won’t fill the void

All of which brings us back to yesterday’s Budget.

Despite all the talk of filling black holes and all the anger about rising taxes, the reality is we’re still falling deeper into debt.

There is obviously time to improve things, and achieving a healthy, growing economy will certainly help the figures look a lot rosier.

But let’s be honest about the situation we find ourselves in and the scale of the challenge that lies ahead.

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature