Sponsored: bag competitive rates and fee-free savings with Raisin

Looking for an attractive return on your savings with minimum costs and hassle? Fee-free savings marketplace Raisin could help you secure competitive rates from banks across the UK and Europe.

If you’re keen to get a competitive return on your savings, it can be an uphill struggle in the current climate.

With rates constantly changing, you may need to spend hours trawling through best-buy tables to ensure you’ve found the right home for your hard-earned cash.

However, free savings marketplace Raisin could make all the difference.

With more than one million account holders worldwide, the UK platform connects savers with over 40 banks and building societies, offering competitive rates that are often not available through price comparison services.

Making it easier to move money

One of the biggest frustrations for today’s savers is the need to routinely shift funds between different providers to avoid being hit by so-called “bonus” or “welcome” rates.

Currently, several market-leading accounts offer rates for an introductory period, typically ranging from a few months to a year.

Once the bonus period expires, your interest rate can plummet.

To keep earning a decent return, you need to be ready to move your money to a new deal, which can be extremely frustrating for time-pressed savers.

How is Raisin different?

As a one-stop shop for a variety of savings products from different banks, Raisin makes it simple to switch your cash between accounts without the usual legwork.

Instead of hunting down deals yourself, the platform compiles a list of the most attractive deals available from its partners, offering you a wide range of providers to best suit your saving goals.

Top fixed-term deals

One of Raisin’s biggest attractions is its range of fixed-rate bonds.

These typically offer higher interest rates than easy-access savings because you agree to lock your money away for a set period – usually from six months to five years.

At the time of writing, the platform offers a rate of 4.3% AER on a six-month fixed-rate bond from QIB UK and a one-year fixed-rate account paying 4.33% from Kuwait Finance House PLC.

For those who prefer longer-term deals, there is a three-year bond paying 4.3% from Bank of Ceylon (UK), while UBL UK offers a slightly lower rate of 4.26% on its five-year bond.

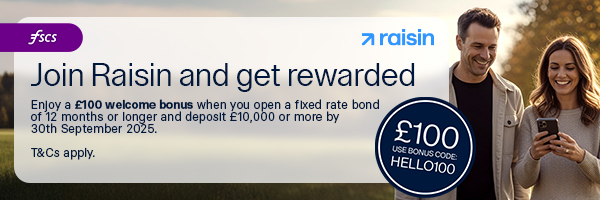

Earn a £100 boost for saving with Raisin

If the above rates aren't enough to tempt you, Raisin is also offering a £100 bonus to savers for a short time only.

To qualify, you just need to open a fixed-rate bond with a term of at least one year – being sure to use the code HELLO100 at signup – and deposit at least £10,000 before the end of September.

You can learn more about the £100 promotion here.

What else is available?

As well as fixed-rate deals, Raisin also offers a wide range of easy-access and notice accounts.

With easy-access savings, you can withdraw funds at any time without paying a penalty. At present, Shawbrook Bank is currently offering a rate of 4.26% AER on its access savings account, which comes with a minimum deposit of just £100.

Alternatively, a notice account requires you to let your provider know in advance if you plan to withdraw funds. Again, Vida Savings tops the tables here, paying a rate of 4.35% AER on its 45-day notice account.

Avoid sneaky fees

When you’re trying to build a nest egg, it’s important to be aware that fees aren’t your only consideration.

Although some current accounts may appear to offer market-leading returns on your deposits, these products often come with hefty monthly fees.

And if you’re considering investing your cash, you should also check for any management fees on trading platforms, as these can significantly eat into your funds.

In contrast, Raisin’s platform is completely free to use, without any hidden costs or management charges.

Who are Raisin’s partners?

Raisin partners with a wide range of banks, including well-known UK names and European institutions.

Some of the larger names include Investec, Kroo and Melton Building Society.

See the full list of Raisin’s partners

How do I manage my account?

Once you’ve signed up for a free account, you can browse savings accounts, compare interest rates, and check terms and conditions in one convenient place.

With a user-friendly interface, the platform provides clear information about how much you could earn and how long your money will be locked away.

When you find the right account, you apply online through Raisin – there’s no need to contact the bank separately. Once your account is up and running, you can keep track of your funds via Raisin’s dashboard.

If you’d prefer to spread your money across several banks, you can open multiple accounts via the platform and manage them all in one place.

Is my money protected?

All banks and building societies featured on Raisin are covered by the Financial Services Compensation Scheme (FSCS).

Under the terms of the FSCS, you’ll receive a Government-backed guarantee on deposits of up to £85,000 per financial institution.

If customer service is a priority, you may also be pleased to see that the platform has a rating of “great” on Trustpilot, with 57% of users awarding it the full five out of five stars.

Could Raisin work for me?

Whatever choice you make with your savings should depend on your goals for the future and how you prefer to manage your money.

That said, Raisin offers a simple, free way to move your money between some of the UK and Europe’s best savings accounts.

And, unlike many high-interest current accounts that charge a monthly fee, Raisin lets you keep all your interest, making it a smart choice for savers seeking flexibility and a competitive return.

This is a paid promotion on behalf of Raisin and does not necessarily reflect the views of loveMONEY.

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature