The biggest economic bubbles of all time

The most damaging and wide-ranging speculative frenzies in history

History is littered with examples of economic bubbles in which assets like commodities, land, or stocks rapidly inflate in price well above their intrinsic value. These bubbles are invariably followed by a crash when investors, who are no longer willing to pay through the nose, panic and sell en masse, resulting in a sudden collapse in prices and tears all round.

Amid fears that the ever-inflating AI bubble may soon burst, we reveal the biggest and most notorious speculative frenzies of all time. All dollar amounts in US dollars.

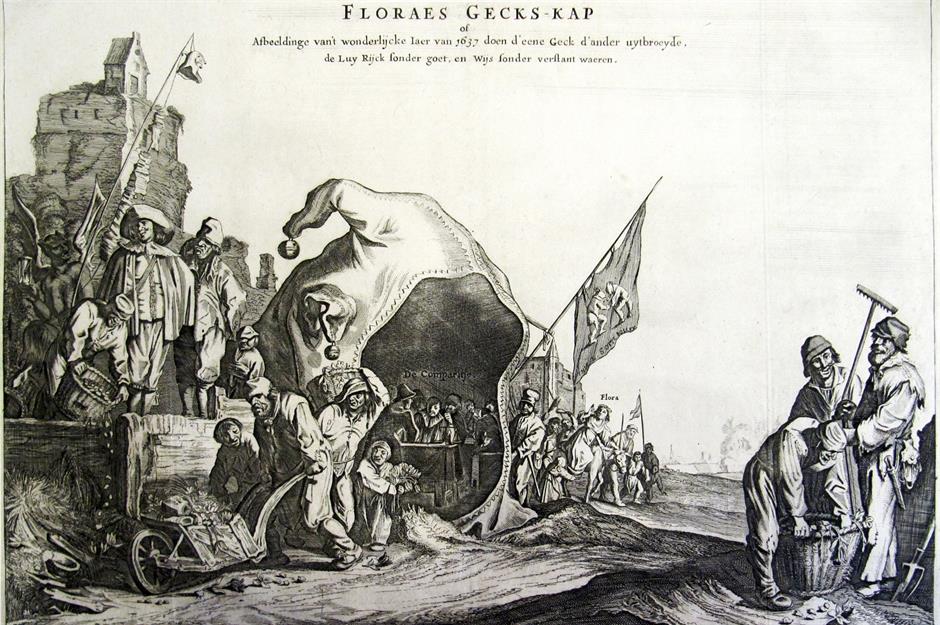

Tulip mania

Widely considered to be the world's first true asset bubble, so-called 'tulip mania' kicked off in the Dutch Republic in 1634 as speculators began frantically buying up tulip bulbs, which were highly prized status symbols at the time. The value of the most desirable specimens, the ones that would go on to produce striped, multicoloured flowers, soared to ridiculously high levels.

Tulip mania

In fact, at the height of the craze, the most sought-after bulbs each cost more than the yearly pay of a skilled worker or the price of a fine townhouse in Amsterdam. The mania came to a head in February 1637 when even the cheapest bulbs reached absurd prices. Soon, demand collapsed, bursting the bubble, and prices nosedived. Many investors were left seriously out of pocket.

Sponsored Content

South Sea Company bubble

A British joint-stock firm, the South Sea Company was formed in 1711 and granted a monopoly over all trade in the South Seas (which we now know as South America and its neighbouring islands). Investors rushed to put their money into the enterprise, which, “fuelled by extravagant rumours”, was poised to offer sensational returns. The company share price skyrocketed.

South Sea Company bubble

By mid-1720, the price per share had climbed to a thousand pounds, up from a hundred earlier in the year, giving the company a market value equivalent to over $4.5 trillion (£3.4tn) today. But then the whole shebang came crashing down. The prospect of trade was wishful thinking and the bubble popped catastrophically, bankrupting many of the shareholders.

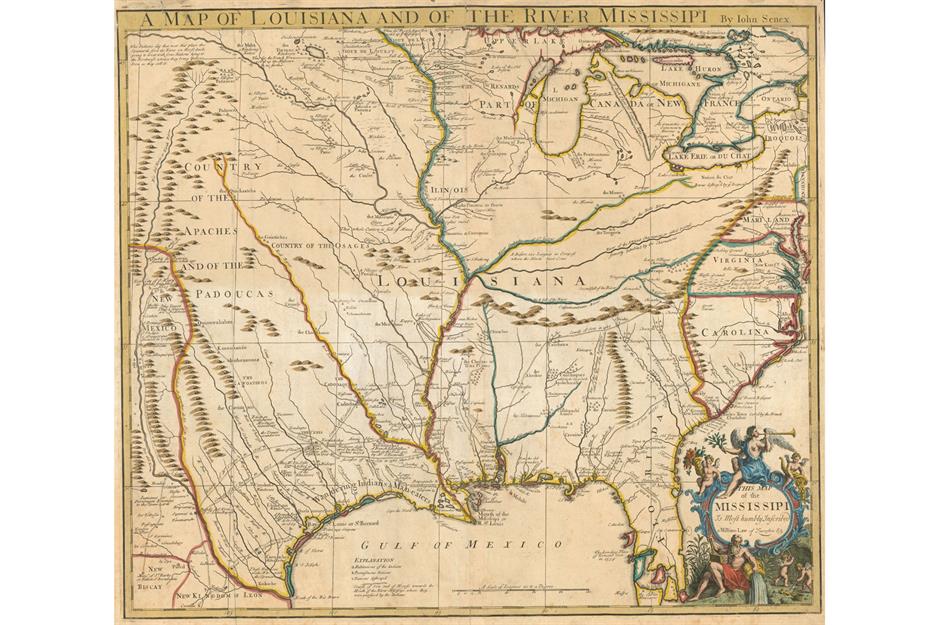

Mississippi Company/Company of the Indies bubble

Originally called the Mississippi Company, the Company of the Indies sparked a bubble around the same time. Founded in 1684, the French firm held a monopoly over trade in North America and the West Indies. Enticed by exaggerated claims of wealth in Louisiana, which was meant to be abundant with precious metals and animal skins, as told by Scottish economist John Law, speculators poured crazy sums of money into the company in 1719.

Sponsored Content

Mississippi Company/Company of the Indies bubble

Within the space of a year, the share price rose 1,900% and the value of the enterprise increased to $8.5 trillion (£6.4tn) in today's money. But when investors learned of the failure of the South Sea Company, they went in their droves to convert their share certificates to coins, and the bubble ended up rupturing in late 1720.

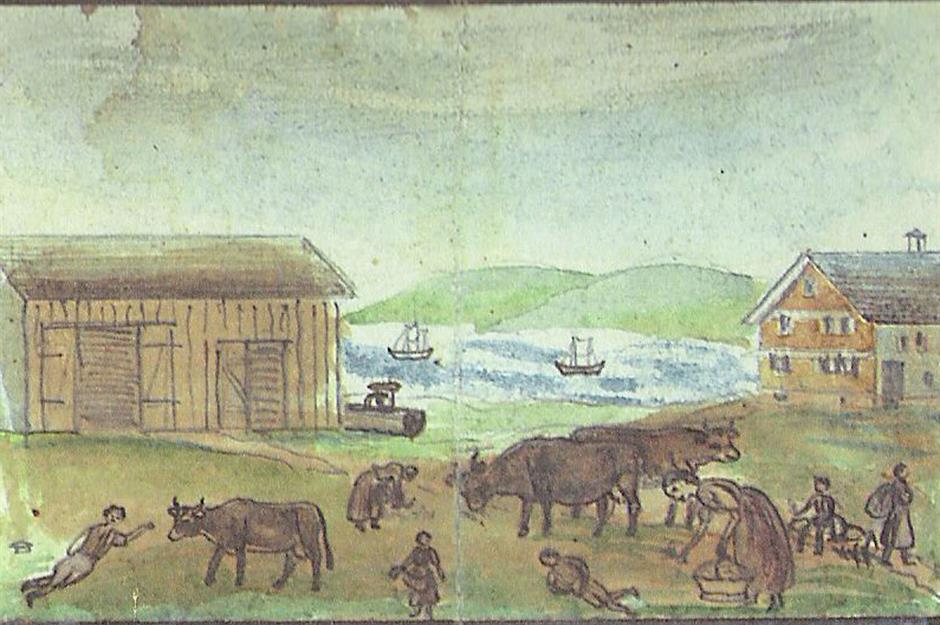

Panic of 1819 bubble

America's first real estate bubble led to the Panic of 1819, the first peacetime financial crisis in US history. European demand for American agricultural goods such as cotton, tobacco, and flour reached fever pitch in 1815 following the end of the Napoleonic Wars and grew further in 1816, the so-called Year Without a Summer, which devastated harvests on the old continent.

Panic of 1819 bubble

Speculators scrambled to secure loans to purchase farmland in the Southern and frontier states, and the largely unregulated banks were only too willing to oblige. As a result, land prices soared. By 1818, however, European agriculture had recovered and demand for US goods plummeted. Real estate prices fell by half and when the banks called in the loans, many investors were unable to pay up, catapulting the US economy into crisis.

Sponsored Content

Panic of 1837 bubble

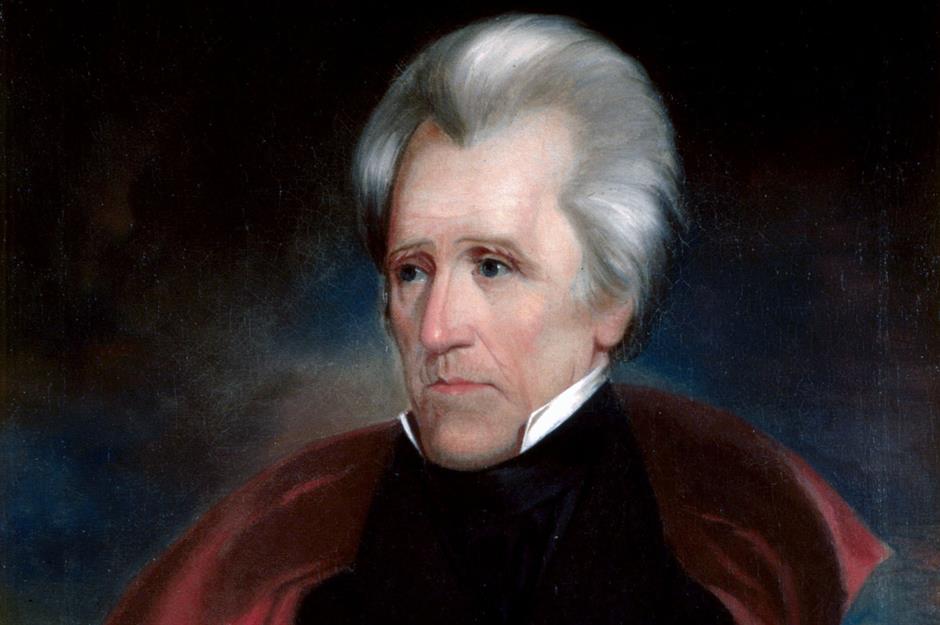

History repeated itself in the US during the 1830s. America's banks were dishing out paper money loans like candy to all and sundry and this easily available credit fuelled a number of bubbles, including land, cotton and even – horrifyingly – enslaved people. In 1836, President Andrew Jackson (pictured) issued an executive order demanding that public land be paid in gold and silver rather than paper money.

Panic of 1837 bubble

The executive order restricted credit and led to falling land sales and prices, which burst the various bubbles and culminated the following year in a biting depression. The nationwide economy shrunk by over 40% from 1837 to 1843, which makes the downturn following the Panic of 1837 the worst in US history, more damaging in a relative sense than the Great Depression of the 1930s (more on that soon).

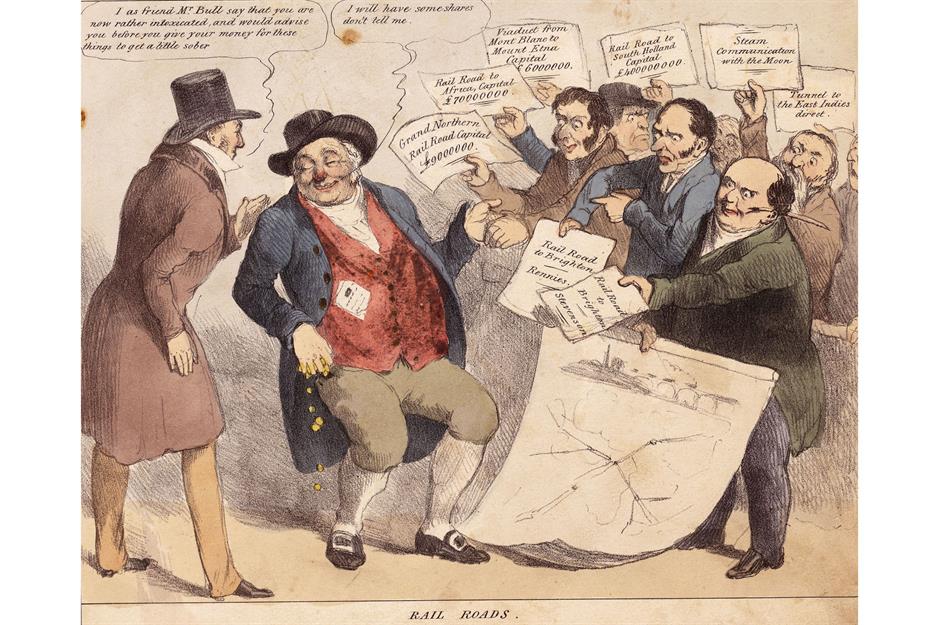

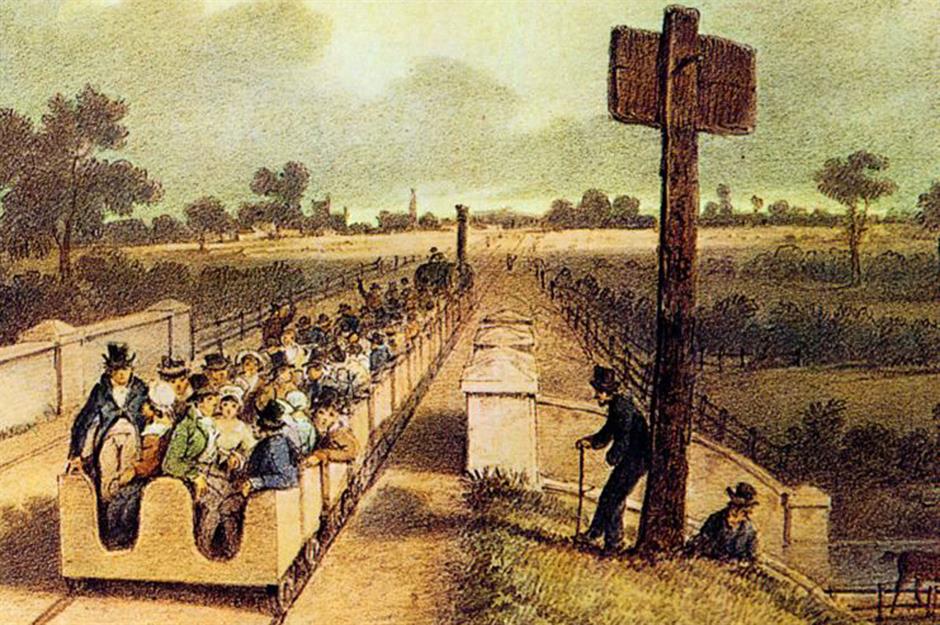

Railway mania

Across the Atlantic, a speculative frenzy developed in the UK during the massive expansion of the railway network in the 1840s. The bubble bore similarities to the canal mania of the late 18th and early 19th century, an era of intensive waterway building in the country that hit investors hard when the craze waned.

Sponsored Content

Railway mania

Aided and abetted by the British government, which cut interest rates and passed several hundred Acts of Parliament setting up a multitude of railway companies, the bubble reached a peak in the early 1840s when stocks in these firms hit silly prices. It burst in a big way in 1845 after an interest rate hike. In the end, only a third of the proposed railways were built and many investors lost out.

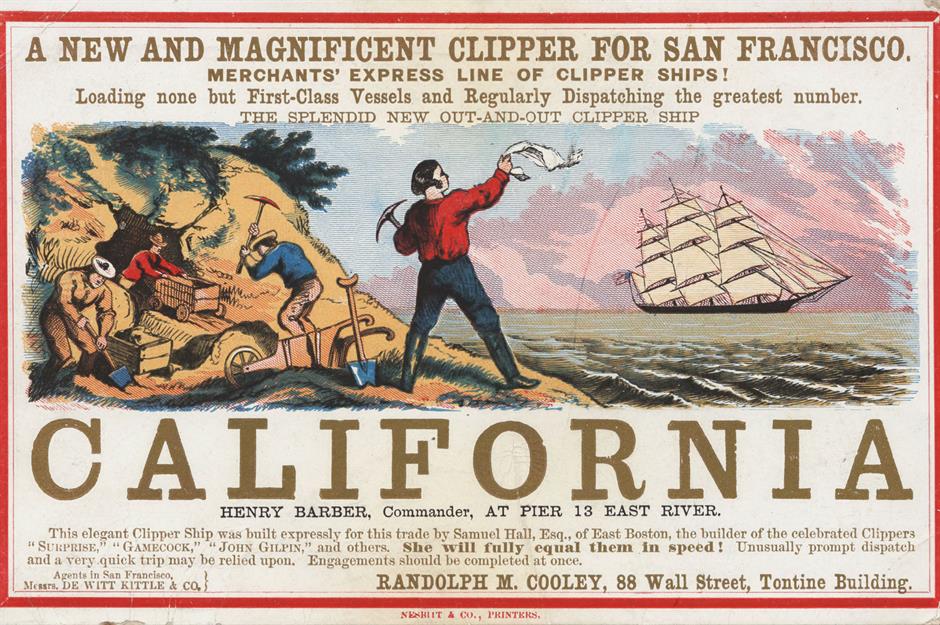

Panic of 1857 bubble

Spurred on by the Californian Gold Rush of 1849, which flooded the US economy with money, a railway, land, and stock market bubble inflated in the US during the 1850s. Banks readily lent investors enormous loans and the stock market surged, but when the amount of gold being mined started to decline in the mid-1850s, financial institutions and investors alike lost confidence.

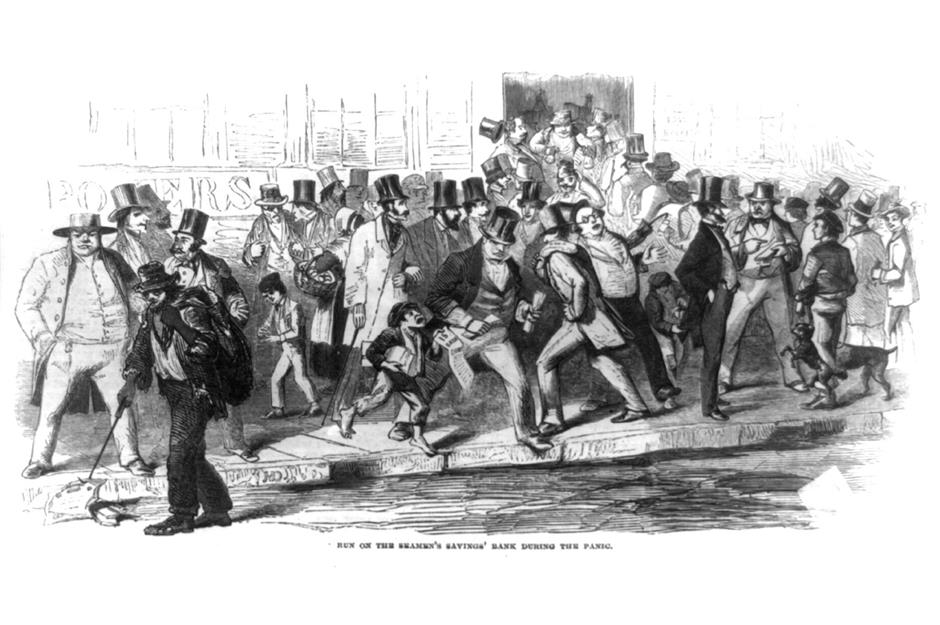

Panic of 1857 bubble

The failure of a major New York commodities firm and Ohio bank in 1857 triggered a large-scale sell-off and run on the banks, bursting the bubble. The sinking of the SS Central America, which was carrying vast quantities of gold to help offset the panic, intensified the crisis and credit dried up. The downturn that followed was felt worldwide, making the Panic of 1857 the first real global economic crisis.

Sponsored Content

Florida real estate bubble

A toxic combo of external speculation, easy credit, and soaring property values set off a major real estate bubble in Florida during the early 1920s. Holidaying in warmer climes had become fashionable and as the Sunshine State was largely undeveloped at the time, speculators rushed in to buy up land to construct vacation homes and hotels. In fact, the real estate market was so popular that the Miami Herald became the heaviest newspaper in the world in 1922 because of the sheer number of property adverts inside it.

Florida real estate bubble

Land prices skyrocketed and money flowed in from investors across America. But in 1925, a series of negative press reports along with a railway embargo and investigation by the IRS spooked investors and land prices went south, rupturing the bubble. Developments such as Aladdin City and Fulford-by-the-Sea were left unfinished and the state's economy floundered.

Roaring Twenties bubble

Financial speculation was rife throughout America during the 1920s. Exciting new technologies from automobiles and aeroplanes to radio and cinema, a construction boom, and developments such as mass production worked wonders on the US economy and more people than ever were investing in stocks and shares, many of which were purchased on credit, so-called buying 'on margin'.

Sponsored Content

Roaring Twenties bubble

Needless to say, the stock market exploded. The Dow Jones Industrial Average (known as The Dow) increased six-fold over the decade and share prices hit record levels. However, this unprecedented bull market was thoroughly unsustainable, and when confidence vanished in late October 1929, it collapsed spectacularly. The crash resulted in the Great Depression as the GDP of the US contracted by 33% and unemployment hit 25%.

Souk al-Manakh stock market bubble

Regarded by many analysts as the most frenzied stock market bubble of all time, the Souk al-Manakh stock market bubble was a speculative boom in Kuwait's unofficial stock market that transpired during the early 1980s.

Souk al-Manakh stock market bubble

Flush with oil money, investors pumped obscene amounts of capital into a plethora of dubious local companies but instead of paying in hard cash, they used post-dated cheques. When one of these cheques bounced in August 1982, the bubble popped and the entire Gulf region entered into recession as a consequence.

Sponsored Content

Global stock market bubble, or Black Monday

Fed by a succession of corporate mega-mergers and other factors including favourable interest rates and deregulation, stock markets around the world rallied big-time in the mid-1980s. The Dow, for instance, doubled in value from 1986 to 1987. By the latter half of 1987 however, investors became increasingly concerned that global stock markets were overvalued.

Global stock market bubble, or Black Monday

To anticipate a slowdown and limit their losses, investors turned to new trading tools such as portfolio insurance and index arbitrage, but instead of protecting their investments, these strategies helped trigger a mass sell-off on Black Monday, 19 October 1987. This reverberated around the planet, bursting the bubble and crashing stock markets globally.

Japanese asset price bubble

The Japanese yen soared in value during the early 1980s, setting off the endaka recession of 1985 and 1986. In a misguided attempt to counteract the downturn, the Japanese government embarked on an aggressive programme of fiscal stimulus, the unforeseen consequence of which was a crazy stock and real estate bubble.

Sponsored Content

Japanese asset price bubble

Stock and land prices mushroomed from 1986 to 1989. At the zenith of the bubble, the Imperial Palace grounds in Tokyo, which cover just 0.4 square miles, were worth more than all of the real estate in California. The bubble eventually burst in 1990. Japan entered its Lost Decade and the effects of the bubble and ensuing downturn are still being felt in the country today.

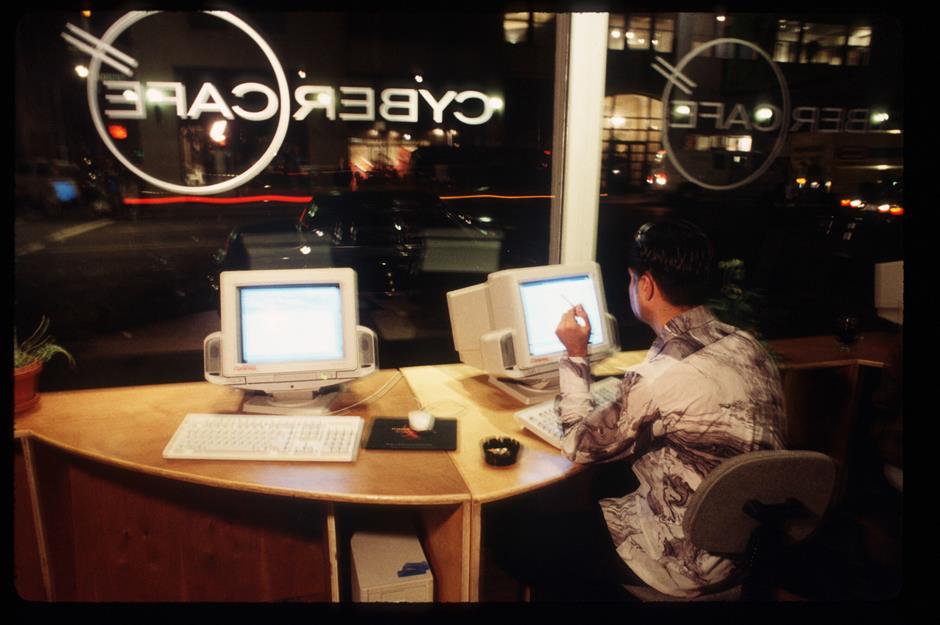

Dot-com bubble

During the 1990s, a sort of mass hysteria gripped investors (particularly in the US) as the internet began to become widely adopted. Overly eager to invest in just about any company in the burgeoning online sector, investors, who were egged on wholeheartedly by the banks, threw insane amounts of money at internet startups.

Dot-com bubble

Many of the newfangled companies were listed on the Nasdaq, which saw its index surge by 400% from 1995 to 2000. But a large number of these firms were seriously overvalued. Investors became increasingly resistant to the hype, and the house of cards came crashing down in 2000. Notable casualties of the crash include Pets.com and Worldcom.

Sponsored Content

US housing bubble

Starting in 2001, a tremendous real estate bubble blew up in the US. It peaked in 2006. A multitude of reasons have been posited by experts as to how the bubble developed, from historically low interest rates and deregulation, to an obsession among Americans for home ownership and risky lending practices by the likes of Fannie Mae (officially the Federal National Mortgage Association) and Freddie Mac (Federal Home Loan Mortgage Corp).

US housing bubble

After house prices reached their zenith in 2006, prices dropped precipitously triggering the subprime mortgage crisis, which left many homeowners in negative equity and led to a record number of foreclosures. The crisis in turn was a major factor in the credit crunch and Great Recession, which lasted from 2007 to 2009 and spread around the world.

Cryptocurrency bubble

The cryptocurrency bubble developed in 2017 as intense speculation surrounding Bitcoin prompted investors the world over to put their money into the digital financial asset. The price per Bitcoin rose from $843.52 (£639) in early January 2017 to a jaw-dropping all-time high of $20,089 (£16.5k) on 18 December 2017, an almost unbelievable increase of just under 2,282% in less than a year.

Sponsored Content

Cryptocurrency bubble

Not long after, cryptocurrency tanked and a rash of bad news and high-profile hacks eroded its value considerably during 2018. By early December 2018 the price per Bitcoin had bottomed out at $3,295.27 (£2.7k). Since then, the price of crypto has gone through various peaks and troughs – but 1 BTC is currently trading at over $110,000 (£82.5k), leading some experts to believe another bubble is inflating...

Now discover the real story of the Guinness family fortune

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature