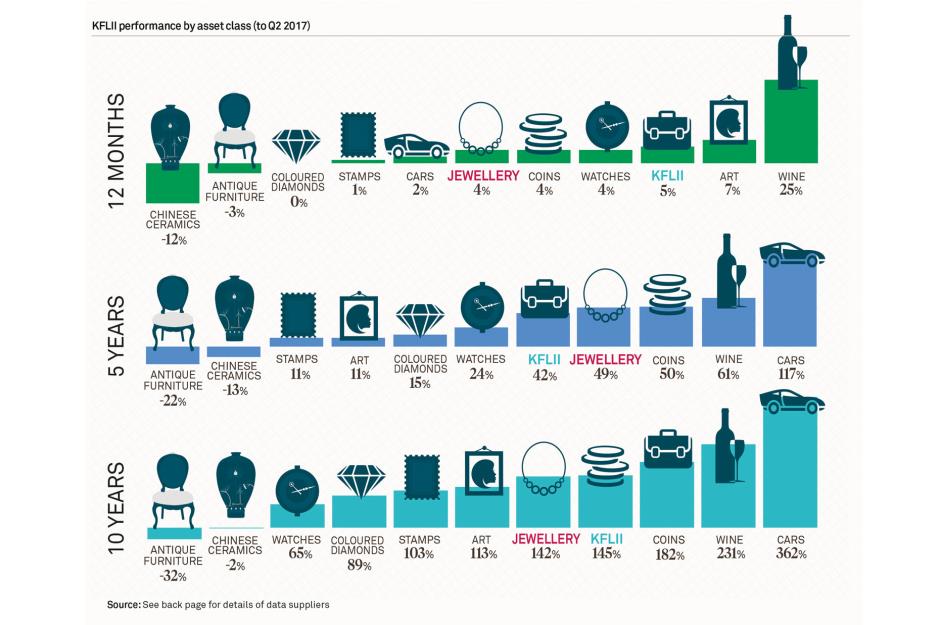

The best- and worst-performing alternative investments over the past year

The high-end collectables getting even more valuable

Looking to invest? You may want to skip the safe haven options such as residential property and gold, and opt instead for art or wine. Knight Frank's Luxury Investment Index has risen in value by 5% over the past year, outperforming many house price indices and the bullion market, with the most coveted objects of desire appreciating by 25%. But it's not all been plain sailing. Bucking the upward trend, certain luxe collectables have been plummeting in value. We take a look at the top 10 risers and fallers.

How the index works

Created in 2013, the Knight Frank Luxury Investment Index uses third party data to track the performance of a representative basket of high-end collectables, much like a consumer price index calculates inflation. A must for serious collectors, it analyses the performance of 10 key luxury investment sectors: cars, art, wine, coins, stamps, jewellery, coloured diamonds, Chinese ceramics, watches and antique furniture. Data sources include AMR, Stanley Gibbons, HAGI, Wine Owners and the Fancy Color Research Foundation.

How have safe haven assets performed?

Sponsored Content

10th. Chinese ceramics: -12%

10th. Chinese ceramics: standout sales

9th. Antique furniture: -3%

Sponsored Content

9th. Antique furniture: standout sales

8th. Coloured diamonds: 0%

8th. Coloured diamonds: standout sales

Sponsored Content

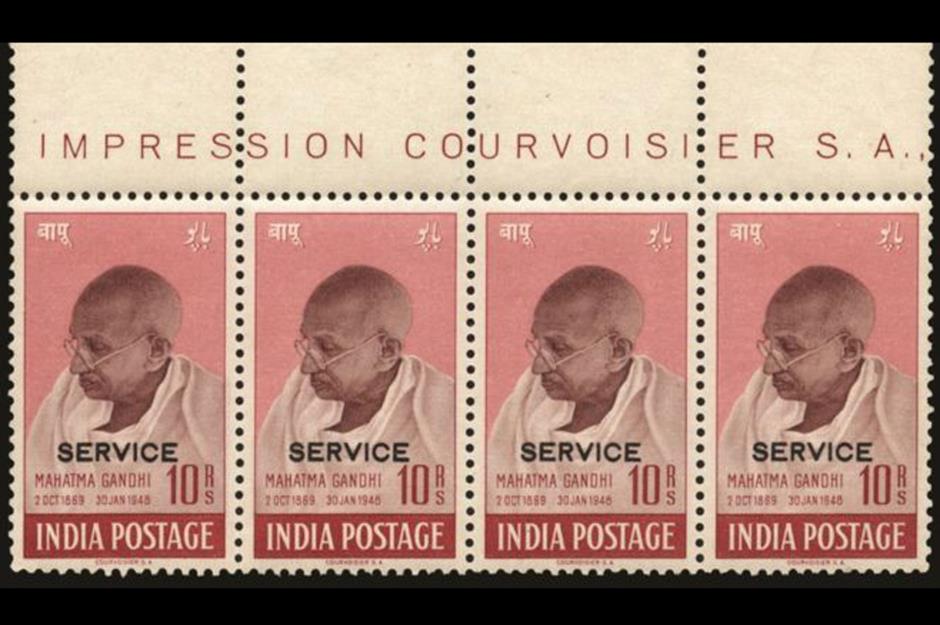

7th. Stamps: +1%

7th. Stamps: standout sales

6th. Classic cars: +2%

Sponsored Content

6th. Classic cars: standout sales

3rd (joint). Watches: +4%

3rd (joint). Watches: standout sales

Sponsored Content

3rd (joint). Jewellery: +4%

3rd (joint). Jewellery: standout sales

3rd (joint). Coins: +4%

Sponsored Content

3rd (joint). Coins: standout sales

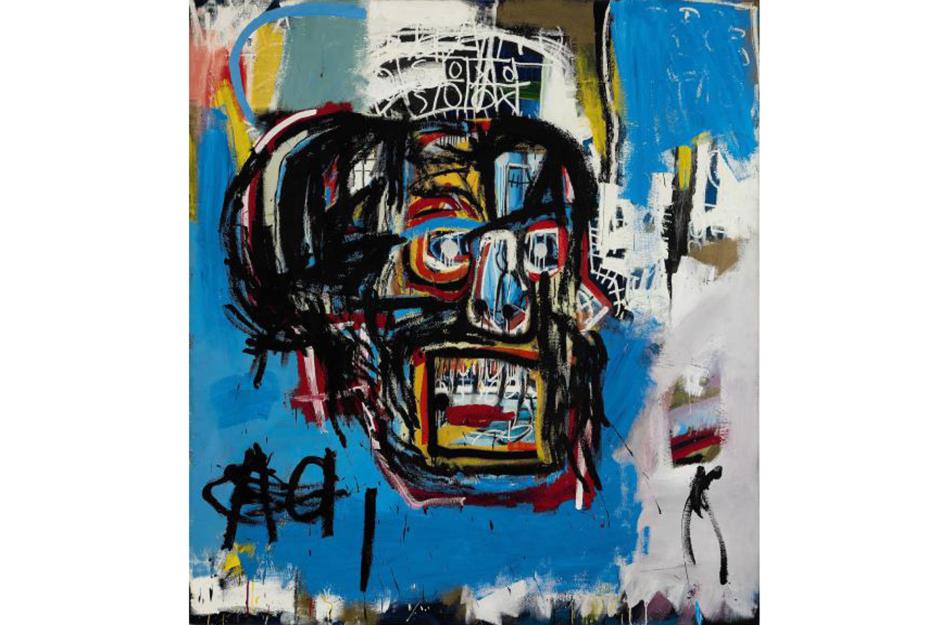

2nd. Art: +7%

2nd. Art: standout sales

Sponsored Content

1st. Wine: +25%

1st. Wine: standout sales

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature