Which major firms are hoarding the most cash?

The public companies sitting on massive war chests

Global corporate cash reserves now exceed an eye-watering $8 trillion (£5.9tn), roughly equivalent to the GDPs of Japan and India combined.

Unsurprisingly, the global top 100 is dominated by banks, insurers, asset managers, and other financial companies, which makes sense because holding cash is at the core of their businesses. But plenty of non-financial heavyweights have amassed enormous cash piles, from Big Tech to leading carmakers. Read on to discover 20 of the firms that are hoarding the most money, and why. All dollar amounts in US dollars.

Why do companies hoard cash?

Banks, insurers, and other financial firms need vast cash reserves to meet regulatory rules, cover withdrawals, claims and settlements, absorb unexpected shocks, and reassure customers that their money is safe.

For non-financial companies, a huge cash pile can provide a cushion against downturns, fund acquisitions, and bankroll long-term bets like AI without the need for expensive borrowing. It can also minimise tax liabilities, as well as fund shareholder dividends and buybacks. In essence, enormous cash reserves offer these businesses the freedom to act quickly when opportunities or crises arise.

What are the potential downsides of hoarding cash?

A supersized cash pile earns relatively meagre returns, meaning firms potentially miss out on bigger profits that could come from lucrative new projects or acquisitions.

It can also blunt financial discipline, tempting managers into wasteful spending. And far from being a shield, excess cash can paint a target on a company’s back, attracting angry activist investors demanding better returns or even rivals eyeing a takeover.

Sponsored Content

Which financial firms are holding the most cash?

Financial companies make up 90 of the global top 100 firms by cash reserves. Japan's Mitsubishi UFJ Financial Group is number one, with $797 billion (£588bn) cash on hand, equivalent to the GDP of Taiwan.

Hot on its heels is Germany's Allianz, the world's largest insurance firm. It's currently sitting on $696 billion (£513bn). Other major financial corporations holding more than half a trillion dollars include the Big Four Chinese banks, France's Crédit Agricole and BNP Paribas, and America's JPMorgan Chase. Now, let's take a look at the 20 non-financial public companies with the biggest cash piles.

20. Stellantis: $38.58 billion (£28.46bn)

Legacy carmakers need hefty cash reserves to fund the costly shift to electric vehicles (EVs). Stellantis, the multinational behind Fiat, Chrysler, Peugeot, and other top marques, is no exception. Because EV development, battery plants, and software upgrades are super-expensive, a bulging war chest is essential. Like many of its rivals, Stellantis also has a financial services arm that lends to customers, and its cash is vital for managing this business.

That said, the company has burned through more than $10 billion (£7.4bn) in the past year due to factors including weaker North American sales and the Trump administration's tariffs, which shows just how quickly reserves can shrink.

19. PetroChina: $40.97 billion (£30.22bn)

High commodity prices in the immediate wake of the COVID-19 pandemic enabled oil companies including PetroChina to rack up sizeable cash piles. The oil business is hugely capital-intensive; new exploration and production projects require billions of dollars in upfront spending, and can take years to deliver returns.

A deep cash cushion also protects against swings in crude prices and helps fund these companies' slow but necessary pivot toward renewables.

Sponsored Content

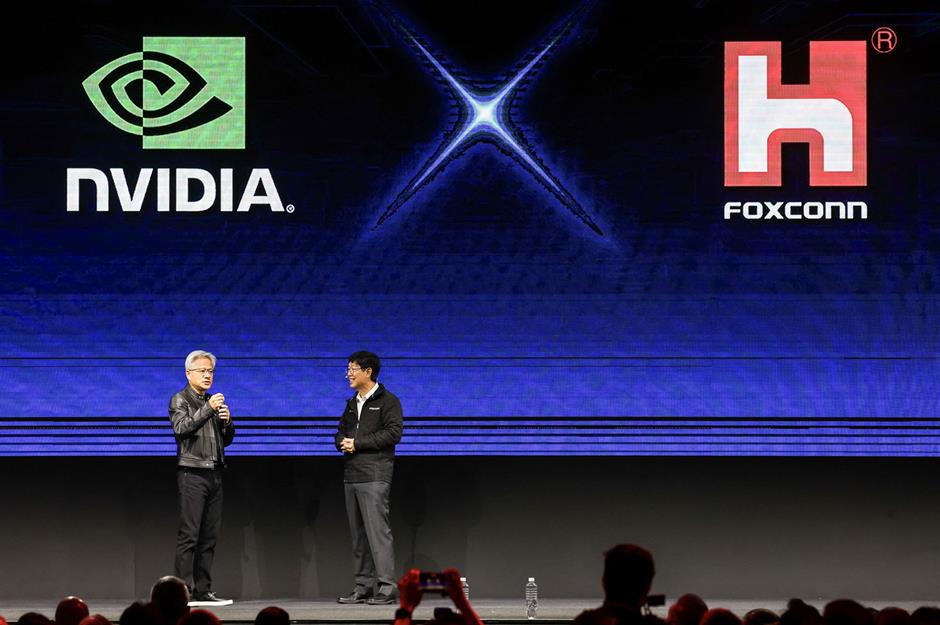

18. Foxconn: $41.14 billion (£30.35bn)

The world’s largest contract electronics maker, Foxconn is incredibly cash-rich. While its fame comes from being a major Apple supplier, the Taiwanese firm is now raking it in from the AI revolution, with its AI server and cloud contracts with tech giants like Nvidia and Dell proving even more lucrative than the smartphone business.

This extra-large cash stockpile is now fuelling the company's transformation, allowing it to expand its AI server and cloud business, increase its manufacturing presence in new regions, and move into the burgeoning EV market.

17. Meta: $47.07 billion (£34.72bn)

Meta, the parent company of Facebook, Instagram, and WhatsApp, is splurging big in a bid to catch up in the AI arms race. After sinking tens of billions of dollars into the ill-fated Metaverse, Mark Zuckerberg has shifted focus, recently unveiling a $15 billion (£11bn) 'superintelligence' team and a blockbuster investment in Scale AI.

While rivals like OpenAI and Microsoft are well ahead, Meta’s enormous cash pile gives it the firepower to become a serious rival.

16. CATL: $52.07 billion (£38.41bn)

China's CATL, the world’s largest EV battery maker, has amassed a prodigious cash pile in recent years. That liquidity is crucial in an industry where competitors like BYD drive a very hard bargain.

CATL needs the funds to bankroll overseas expansion, research and development, and potentially transformative deals, including a rumoured bid for Nio’s battery division. With its coffers full, CATL has the means to secure an edge in the EV battery arms race.

Sponsored Content

15. CSCEC: $53.07 billion (£39.15bn)

China State Construction Engineering Corporation (CSCEC) is the world’s richest contractor, pulling in over $300 billion (£221bn) annually and employing nearly 400,000 people. Backed by Beijing, it wins the monster projects that others can’t touch: entire city districts, airports, and megaprojects throughout China, as well as across Africa, the Middle East, and other global regions.

That scale demands deep reserves. Its $53.07 billion (£39.15bn) cash pile helps finance colossal builds that take years to complete, while cushioning against real estate slowdowns at home and volatile payment schedules abroad.

14. Tencent: $53.1 billion (£39.17bn)

Tencent, the Chinese tech giant behind WeChat, QQ and a sprawling gaming empire, is sitting on more than $53 billion (£39.09bn) in ready cash. In 2025 it's been putting that money to work, launching a massive buyback program that signals confidence in its long-term prospects even as tech valuations wobble.

The company has already repurchased billions of dollars' worth of stock, using its cash cushion both to reward shareholders and counter pessimism in China’s internet sector. The war chest is also financing Tencent's bets in AI and cloud computing.

13. Saudi Aramco: $53.95 billion (£39.79bn)

The world's most profitable business in terms of raw numbers, Aramco is the Saudi state's primary cash cow. Its gigantic money pile is a result of having the oil industry's lowest extraction costs, which allows it to rake in mammoth profits even when crude prices are low.

However, Aramco's cash reserves have more than halved since 2022 due to heavy dividend obligations. The company has also been funding capital spending on infrastructure and diversification megaprojects as part of the country’s exceedingly ambitious Vision 2030 plan.

Sponsored Content

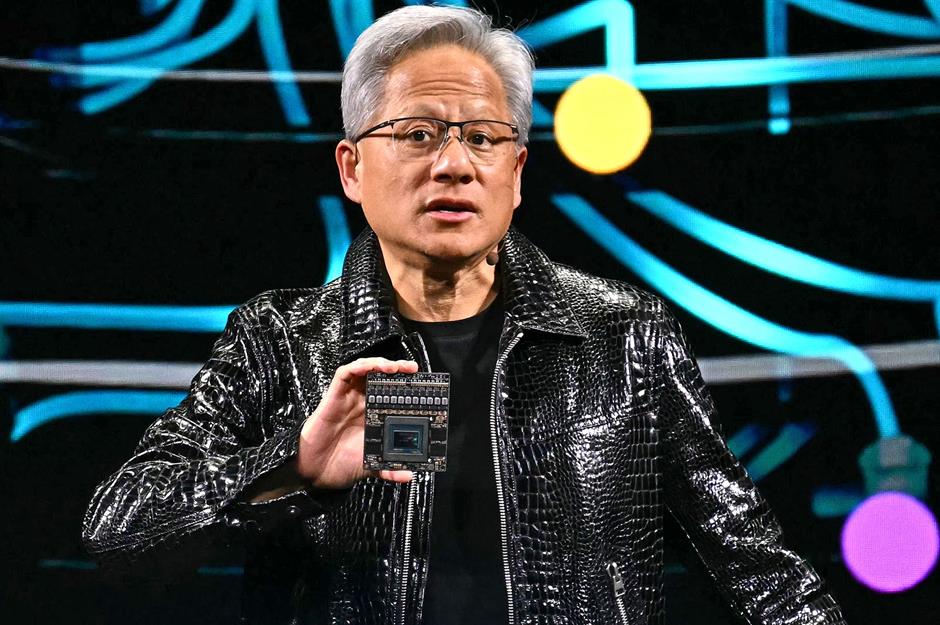

12. Nvidia: $53.99 billion (£39.82bn)

Nvidia has piled up nearly $54 billion (£39.83bn) in cash thanks to its dominance in AI chips and stellar profit margins. In August, the Silicon Valley success story stunned Wall Street by approving an extra $60 billion (£44.26bn) in stock buybacks, on top of $24 billion (£17.7bn) already repurchased this year.

The move has split opinion. Some see it as a signal that the stock remains undervalued, while others argue the money would be better spent on research and development to stay ahead in the AI arms race.

11. PDD Holdings: $54.04 billion (£39.86bn)

The company behind global e-commerce sensation Temu and Chinese platform Pinduoduo, PDD Holdings has seen its revenues soar in recent years. At the same time, its cash on hand has surged, up from a mere $230 million (£170m) in 2016 to over $54 billion (£39.83bn) at the last count.

Even more impressive is the fact that PDD Holdings doesn't use its excess cash to pay dividends and finance buybacks; the money acts as a safety net against downturns in its business, as well as providing a war chest to fund acquisitions, invest in new tech, and finance expansion plans.

10. China Mobile: $55.36 billion (£40.83bn)

For years, China Mobile struggled to deploy its mega cash pile. Overseas deals proved tricky and buybacks were constrained by state ownership. But times have changed.

The firm says it invested over $10 billion (£7.38bn) in AI last year and will end up spending even more this year, building huge data-centre capacity and cloud services that are already generating stunning revenues. This capital now bankrolls this AI pivot while still cushioning China Mobile's domestic billion-customer network.

Sponsored Content

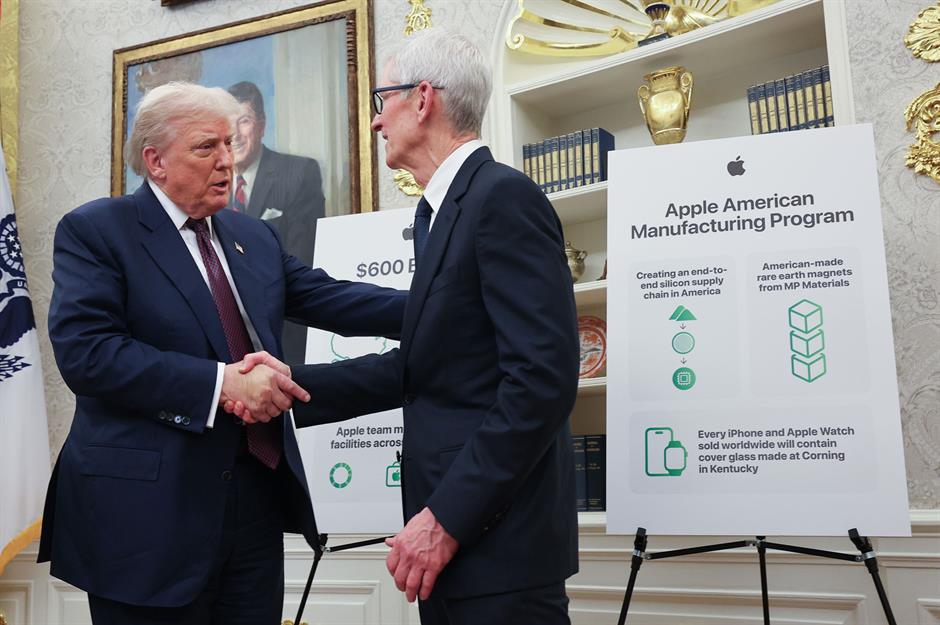

9. Apple: $55.37 billion (£40.84bn)

Apple’s famously titanic cash pile has almost halved since 2019, largely because it’s funnelled money into record share buybacks and steady dividends. Activist shareholder Carl Icahn helped kick-start that push a decade ago by publicly pressing Apple to return more cash.

Even so, Apple keeps a sizeable buffer to prepay suppliers and lock in production, smooth payouts through slow quarters, and fund research and development, particularly in the field of AI. Apple's immense cash reserves also serve to finance strategic long-term projects, including a $600 billion (£441bn) commitment over the next four years to boost its US manufacturing and supply chain.

8. Alibaba: $58.12 billion (£42.87bn)

Alibaba remains the most cash-rich non-financial Chinese company. Nonetheless, the e-commerce and tech behemoth has been working hard to reduce its holdings in recent years.

In 2021, it pledged $15.5 billion (£11.41bn), a third of its then balance, to 'common prosperity' social and economic programmes in China. More recently, the firm has been returning cash via buybacks and is investing big in AI and cloud computing.

7. Samsung: $71.42 billion (£52.68bn)

Built up over a number of years, Samsung’s immense cash pile is proving a godsend as its chip profits sag.

The South Korean tech titan is using it to fund major AI bets and keep investment steady. And while some worry the pot could dwindle if the downturn drags on, the buffer is a testament to the power of holding considerable capital: it buys time, keeps projects on track, and allows a firm to make a triumphant comeback when the cycle turns in its favour.

Sponsored Content

6. Volkswagen: $74.15 billion (£54.69bn)

Volkswagen's cash pile might seem baffling given its larger debt of over $220 billion (£162bn), but the vast majority of these liabilities is used to fund its extensive financial services division, which provides loans and leases to customers.

This dual business model allows the company to maintain a cash buffer for its costly shift to EVs. Its reserves are crucial for addressing its current strategic challenges, including software problems and intense competition in the EV market, especially from Chinese carmakers.

5. TSMC: $90.19 billion (£66.53bn)

Taiwan Semiconductor Manufacturing Company (TSMC) is the world's largest contract chipmaker and an indispensable part of the global tech economy. Its business is incredibly capital-intensive, with a single new fabrication plant costing tens of billions of dollars.

TSMC’s massive cash pile funds its aggressive expansion, research and development, and the construction of new foundries across the globe, including in the US, Japan, and Germany. This stash is essential to stay ahead in the race to produce the most advanced chips for top-tier clients like Nvidia and Apple.

4. Amazon: $93.18 billion (£68.73bn)

Amazon's cash pile is a necessary side effect of its debt-driven expansion. The US e-commerce and cloud giant has taken on enormous debt, primarily to fund its capital expenditures on warehouses, data centres for its lucrative Amazon Web Services (AWS) business, and its global logistics network.

The cash it holds is the required liquidity to manage these enormous operations and fund long-term strategic bets, such as its push into AI, satellites, and a $54 billion (£39.69bn) commitment to UK infrastructure over the next three years.

Sponsored Content

3. Microsoft: $94.55 billion (£69.74bn)

Microsoft's almighty cash position comes down to its astonishingly profitable software and cloud businesses. The company generates bewildering sums of cash from its subscription-based services like Microsoft 365 and its dominant cloud platform Azure.

Unlike carmakers and firms like Amazon, Microsoft's business model doesn't require a large amount of debt to fund its operations, which means its cash is less about liquidity for lending and more about strategic flexibility. Its cash pile is predominantly used for strategic acquisitions such as its purchase of Activision Blizzard and recent major AI investments, as well as share buybacks and generous dividends for shareholders.

2. Alphabet: $95.14 billion (£70.18bn)

Google parent Alphabet generates a gargantuan amount of cash from its core advertising and search businesses. While the company's cash pile has declined from its 2020 peak, it remains the second-largest globally for a non-financial firm.

This financial might is now being deployed in the fierce AI arms race; the company has committed to spending around $75 billion (£55.12bn) this year, primarily to build data centres and AI infrastructure.

1. Toyota: $111 billion (£81.91bn)

Toyota's cash on hand has reached a record $111 billion (£81.91bn), but the company also carries an astronomical $267 billion (£196bn) in debt. The explanation for this seemingly contradictory balance sheet is that Toyota, like its rivals, is both a carmaker and a formidable financial services provider.

Much of its debt is used to fund its global lending and leasing business. This dual business model allows the company to maintain a gigantic cash buffer to manage daily operations and fund its costly long-term transition to EVs and other new technologies.

And a special mention goes to...

Sponsored Content

Special mention: Berkshire Hathaway: $344 billion (£253bn)

Berkshire Hathaway's cash pile is unique. A significant portion of it comes from the conglomerate's insurance companies, which collect premiums that must be held to pay future claims. This is a crucial part of the business.

Yet the cash hoard has grown far beyond what's needed. This is a deliberate strategy by outgoing CEO Warren Buffett, who has been raising cash by selling stocks. He believes the market is overvalued and is waiting for a major downturn to buy a large, quality company at a good price. In short, the company is holding financial ammo for a future acquisition.

Now discover the richest Hollywood dynasties in 2025, ranked

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature