20 things that were much cheaper 10 years ago

You won't believe how expensive they've become

What a difference a decade makes. Over the past 10 years, prices have soared for a wide range of items, from everyday essentials to high-end treats, while the value of many in-demand assets has skyrocketed.

Costs have been reshaped across the board, fuelled by everything from post-pandemic inflation to climate shocks, shifting supply chains, and booming demand coupled with acute scarcity. Read on to discover 20 items that were considerably cheaper in 2015 (and why) – whether you’re groaning at today’s receipts or kicking yourself for not buying Bitcoin and Nvidia stock. All dollar amounts in US dollars

Coffee

Wondering why your favourite roast in the supermarket and latte at the coffee shop have got so expensive? Global wholesale coffee prices have more than doubled since 2015, with poor weather conditions and rising demand the chief culprits.

Climate change-driven droughts and other adverse weather events in major growing areas have led to disappointing harvests as demand from countries like China soars. Meanwhile, higher production costs and speculative trading have only added to the squeeze.

Chocolate

Cocoa is now more than twice as expensive as it was a decade ago. Costs have exploded in the past few years as plant diseases and extreme weather, exacerbated by climate change, ravage crops in West Africa, which supplies over 70% of the world’s cocoa. Add spiralling sugar and milk prices into the mix, and it’s no surprise your favourite chocolate bar now feels like a luxury purchase.

As well as cranking up prices beyond general inflation, big names like Cadbury, Hershey, Mars, and Ferrero have been 'shrinkflating' (reducing the size of their products without reducing the price), leaving chocoholics paying more for less.

Sponsored Content

McDonald's menu

No longer the super-cheap bite it once was, fast food has leapt in price over the past decade. A study by finance site FinanceBuzz of major American chains shows McDonald's is leading the way. Its menu prices in the country doubled between 2014 and 2024, and have continued to rise markedly. Prices have also jumped in other markets such as the UK, with the cost of some items rising by as much as 15% in the past year alone.

McDonald’s blames higher production costs and its refusal to compromise on quality. Even so, CEO Chris Kempczinski has admitted its menu is now too expensive, and the chain recently announced plans to slash combo meal prices in the US.

Pret A Manger menu

UK-based sandwich chain Pret A Manger has also become more expensive in the past 10 years. Escalating costs in the wake of the pandemic, from stiffer energy bills to wage hikes for staff and higher prices for ingredients, have been passed on to customers.

Take the Wiltshire ham and Grevé cheese baguette, a Pret classic. Now costing $6.69 (£4.99) at the chain's central London branches, the sandwich has seen a price increase of 67% since 2015, outpacing general inflation by more than 20%.

Bitcoin

Bitcoin’s rise since 2015 has been nothing short of phenomenal. In late August that year, one coin cost $223.92 (£143). Fast-forward to 2025 and a single coin trades at a staggering $108,367 (£80.2k), a jaw-dropping increase of around 50,000%.

Bitcoin’s meteoric ascent has been powered by its hard cap on supply, growing acceptance as 'digital gold', and a flood of institutional money. Add in waves of speculation, and it’s no wonder prices have rocketed to astronomical levels.

Sponsored Content

Gold

The original safe-haven asset, gold hasn’t come close to Bitcoin’s explosive gains, but its performance has been nothing to scoff at. Since 2015, prices have almost tripled, hitting all-time highs this year.

The biggest surge came in 2023 and 2024, driven by global economic jitters and record-breaking central bank buying that sent demand through the roof. And while the momentum has cooled slightly, prices for the precious metal remain at exceptionally elevated levels.

Silver

With silver prices up by two-and-a-half times since 2015, gold's less flashy and cheaper cousin isn't all that affordable these days.

While gold’s value is driven largely by its role as a safe-haven asset, silver’s fortunes are tied to industrial demand. And that demand has shifted into overdrive, given the metal is used in a wide range of new technologies, from solar panels and smartphones to emerging medical applications.

Oil

Back in 2015, a supply glut sent the price of oil tumbling. In fact, between 2014 and 2016, it sank by around 70%, one of the biggest and fastest declines in modern history.

Prices recovered in the late 2010s, dipped sharply during the early part of the pandemic, and spiked after the lockdowns in 2022. They've since trended down, but the current price of $68.12 (£50.44) per barrel is significantly higher than the 2015 figure, even when inflation is taken into account.

Sponsored Content

Nvidia stock

Chipmaking company Nvidia has been absolutely smashing it. The best performing major stock of the past decade, the company's share price has mushroomed by more than 31,000% since 2015, delighting its exceedingly fortunate long-term investors.

The stock went stratospheric in 2022 as Nvidia chips became the backbone of the AI revolution. After a wobble earlier this year, the share price has been soaring once again, cementing Nvidia as the undisputed star of the semiconductor world.

Selected city rents

Residential rents have been on the rise across the globe over the past 10 years, with some cities seeing eye-popping hikes. Prices have doubled in Lisbon since 2015 as the Portuguese capital has become a haven for digital nomads. Outlays have doubled in Berlin too, despite the introduction of rent control a decade ago.

Prices have also increased well above inflation in Barcelona, Manchester, Chicago, Adelaide and numerous other cities, stretching tenants' budgets to the max.

Disney US theme park prices

Experiencing the magic of Disney has got a whole lot more expensive over the past 10 years. A recent FinanceBuzz analysis of North America’s 20 most popular theme parks found Disney has been leading the pack for price hikes since 2015.

While the national inflation rate over the period was 36%, ticket prices at Disney’s US parks have ticked up by 69%, while parking fees have grown by a staggering 91%. In terms of individual parks, tickets for Disney's Hollywood Studios have increased the most, up by 79%. At the other end of the spectrum is the controversial SeaWorld San Diego, which has actually cut admission fees by 13% since 2015.

Sponsored Content

Netflix subscriptions

A standard ad-free Netflix subscription has more than doubled in many countries since 2015. That very year, then-CEO Reed Hastings vowed there would be “no advertising coming… period.” His successor, Ted Sarandos, flipped that stance, rolling out cheaper ad-supported tiers in 2022 while pushing ad-free plans into premium territory.

A decade ago, Netflix was doubling down on original content after embarking on a massive spending spree. In 2015, it poured $4.6 billion (£3.4bn) into new shows and films, surpassing traditional big spenders including the BBC. This year, the annual outlay has swelled to $18 billion (£13.4bn), which helps explain why viewers who skip the ads are now paying so much.

Concert tickets

Squeezing Swifties, the BeyHive, and even veteran Oasis and Coldplay fans who aren’t typically strapped for cash, concert tickets have become substantially more expensive over the past decade. According to Pollstar, which tracks the world’s top 100 tours, the average ticket price is up more than 50% from 2015, outpacing inflation by around 12%.

The Gen Z-driven post-pandemic live music boom, higher production costs, and the rise of dynamic pricing systems have all played a part in driving this surge, which shows little sign of abating.

US Grand Prix tickets

Attending a top fixture in the US was strikingly cheaper 10 years ago. According to a recent analysis of America's 47 most popular sporting events by Hard Rock Bet, the Formula 1 US Grand Prix has seen the steepest hike in ticket prices, which have increased by over 400% since 2015.

Super Bowl tickets have experienced the second-steepest rise at 215%, while prices for a further 18 major sporting events have at least doubled.

Sponsored Content

Fulham FC premium season ticket

Sports ticket prices have also soared across the pond. Cue Fulham FC. During the 2015/16 season, the football club was playing in the second-tier Championship.

Back then, the most expensive season ticket cost $1,125 (£839). It's now priced at $4,137 (£3.1k), reflecting the club's promotion to the Premier League and expensive redevelopment of its Craven Cottage Riverside stand, not to mention the introduction of a new, high-end seating option. All in all, the price has increased by 268%.

American nose jobs

Cosmetic surgery costs have soared in the US in recent years, according to health site Medical Daily. For instance, the typical surgeon's fee for a rhinoplasty came in at $4,771 a decade ago, as per the American Society of Plastic Surgeons' 2015 Statistics Report. This works out at $6,503 (£4.9k) when adjusted for inflation.

The average fee for the procedure has since risen to $10,000 (£7.5k), which is a nominal increase of 110% and an above-inflation rise of 54%.

Jean-Michel Basquiat paintings

When it comes to the art market's biggest gains, few artists have appreciated as dramatically over the past decade as Jean-Michel Basquiat.

The most noteworthy event was the 2017 sale of his 1982 painting Untitled for a breathtaking $110.5 million, which equates to $150 million (£112m) today. Since then, Basquiat's pieces have consistently commanded enormous figures, driven by relentless demand from collectors for his edgy, graffiti-inspired work.

Sponsored Content

Hermès Birkin bags

The original Hermès Birkin, created in 1985 for Anglo-French singer and actress Jane Birkin, went under the hammer for $10.1 million (£7.4m) earlier this year, smashing the record for the most expensive bag sold at auction. Vintage models have appreciated in value remarkably over the years, and retail prices for new bags have risen accordingly.

In 2015, a Birkin 25 in Togo leather was priced at $5,850, which is $7,800 (£5,812) today. Now, that same bag retails for $12,700 (£9,462), equating to an above-inflation rise of 63%.

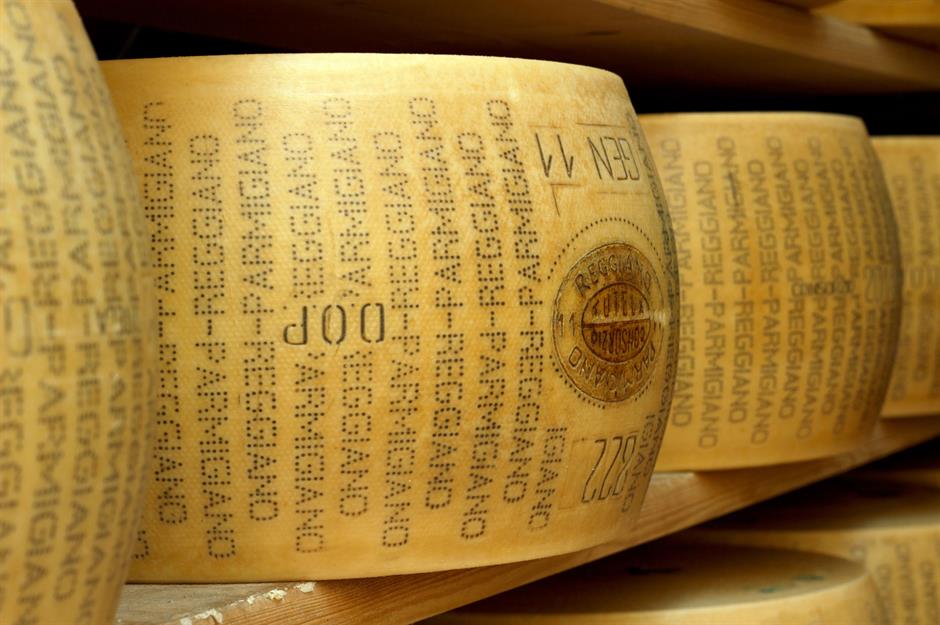

Parmesan cheese

The real-deal Parmigiano Reggiano, which enjoys protected status under EU law, has shot up in price since 2015. Within Italy, increased costs have put heavy upward pressure on prices. For cheese aged under a year, the price has risen by 79%, surpassing inflation by 37%.

Overseas markets are being hit even harder. American shoppers are facing higher prices due to Trump administration tariffs, while consumers in the UK are paying more as a result of post-Brexit red tape. In spite of these headwinds, Parmigiano Reggiano sales have reached record numbers, proving that consumers are willing to pay a premium for what they consider a superior product.

Japanese rice prices

Rice prices have risen spectacularly in Japan since 2015. And prices for the staple have more or less doubled in the past year alone; extreme heatwaves made worse by climate change have hammered harvests, while panic-buying last year amid megathrust earthquake fears has also constrained supply.

With the public up in arms, the Japanese government is going all out to bring down rice prices, from releasing emergency supplies to reversing a policy encouraging farmers to grow alternative crops.

Now discover Eggflation: the countries paying the most and least for eggs, and why

Sponsored Content

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature