10 countries the super-rich are moving to... and 10 they're fleeing

Tracking the movements of the super-rich

Research suggests the super-rich are more mobile than ever. Open economies, the ease of working digitally while abroad, and special citizenship or 'golden visa' schemes are all encouraging record numbers of high-net-worth individuals (HNWIs), who typically have financial assets worth $1 million (£745k) or more, to leave their home nations.

Residency firm Henley & Partners has produced The Henley Private Wealth Migration Report 2025, which reveals the countries predicted to gain and lose the most HNWIs over the course of this year. And the results might just surprise you...

Read on to discover the 10 favoured destinations of the world’s elite today – and the 10 countries they're leaving behind.

All dollar amounts in US dollars.

Australia: 1,000 more millionaires

Australia briefly became the world’s most popular destination for millionaires when it attracted a whopping 12,000 in 2019 alone. According to Henley & Partners, the number of millionaires expected to flock Down Under this year – though impressive – is well below the levels seen in the 2010s, when Australia consistently welcomed around 5,000 HNWIs every year.

However, the country still has much to offer its wealthy newcomers and is widely seen as a politically stable safe haven that offers good healthcare, low crime rates, and no inheritance tax.

That said, the country may have alienated some potential migrants by axing its Golden Visa scheme in January 2024. Since 2012, Australia has issued thousands of significant investor visas, around 85% of which went to wealthy Chinese citizens.

Canada: 1,000 more millionaires

Canada has long been among the most popular destinations for HNWIs, especially those from Europe and Asia. The country's liberal economy, strong legal system, clean streets, and sunnier skies have made it particularly attractive for Chinese migrants, according to data shared by the Hurun Research Institute in 2018.

That said, the number of millionaires projected to relocate to Canada this year is the lowest net inflow on record, suggesting its appeal could be waning. At the same time, a survey by the consultancy firm Arton Capital has found that the number of Canadian millionaires planning to leave the country has increased by 28% over the last four years.

Sponsored Content

Greece: 1,200 more millionaires

Arguably one of the more surprising destinations in our round-up, Greece was expected to welcome 1,200 millionaire migrants in 2024 – a number it's maintained in the latest projections for 2025.

When you consider that most millionaires move to countries with strong economies, Greece might seem an unorthodox choice. Snowballing debt and subsequent austerity measures have plagued the country since 2007, while the nation still has the world's sixth-highest debt-to-GDP ratio, according to data shared by World Population Review.

But the European country has risen in popularity among the super-rich thanks to its Greece Golden Visa Program. Open to non-EU citizens, the program offers residency in exchange for significant Greek investment. This could be in the form of buying property worth at least €250,000 ($290k/£217k), investing at least €500,000 ($582k/£432k) in government bonds or businesses, or signing a 10-year lease with a local hotel or tourist attraction.

Portugal: 1,400 more millionaires

Portugal was forecast to attract 800 new HNWIs in 2024, but this number has ballooned to 1,400 in 2025.

The nation has made changes to its Golden Residence Permit Program, meaning potential migrants can no longer qualify for the visa by investing in real estate or real estate-related funds. But the programme – which is mainly targeted towards non-EU citizens and has been popular with HNWIs from the USA, China, Brazil, South Africa, Türkiye, and Russia over the years – is still a draw, with migrants required to invest a minimum of just €250,000 ($290k/£217k) to qualify.

Dubbed 'the Florida of Europe' by some, Portugal has much to offer incoming millionaires, from a mild climate to low consumer prices.

Singapore: 1,600 more millionaires

Before closing its borders for two years due to COVID-19, Singapore – one of the world's most open economies – welcomed 1,500 new millionaires. That number skyrocketed in the wake of the pandemic, and a further 3,500 HNWIs were forecast to migrate to Singapore in 2024. This figure has since moderated to 1,600 in 2025.

The city-state, which has been dubbed the 'Switzerland of the East', has many draws. It's close enough to China to do business but distant enough to avoid the country's authorities, something increasingly difficult to do in Hong Kong. (In fact, it's widely considered one of the most business-friendly cities in the world).

Henley & Partners has also previously noted that Singapore is the fastest-growing family office hub, mainly thanks to the city's lack of a capital gains tax.

Sponsored Content

Saudi Arabia: 2,400 more millionaires

A newcomer to the top 10, Saudi Arabia is expected to welcome 2,400 more millionaires by the end of 2025 – a staggering increase from the 300 HNWIs that relocated to the Middle Eastern nation in 2024. Henley & Partners has predicted these millionaires will bring a combined $18.4 billion (£14bn) into the nation, where the population of HNWIs has grown by 55% since 2014.

This remarkable rise is partly attributed to Saudi Arabia's attempts to diversify its economy beyond oil, creating new opportunities for the super-rich. Dubbed Vision 2030, the kingdom's diversification framework has introduced a number of reforms which aim to attract foreign direct investment, declaring the country is "open for business".

Switzerland: 3,000 more millionaires

The cost of living in Switzerland may be significantly higher than the global average, but it's a price the super-rich are apparently happy to pay. In return, Swiss millionaires receive a high quality of life, a flourishing financial sector, and beneficial tax laws that contribute to the nation's reputation as a tax haven. In fact, the nation was forecast to have more than a million HNWIs by the end of 2024 – and this number is rising sharply.

Last year ,an estimated 1,500 millionaires relocated to Switzerland, and this year the figure has doubled to 3,000. Geneva, Lugano, and Zug are the most popular Swiss cities for migrating millionaires.

Italy: 3,600 more millionaires

An increase from last year's 2,200, around 3,600 millionaires are expected to relocate to Italy in search of la dolce vita in 2025. Many of these HNWIs are forecast to come from high-tax countries such as the UK, drawn by Italy's modest estate duty that starts at just 4%.

In fact, Italian tax regimes are highly favourable to the super-rich across the board; the country offers a one-off tax of €100,000 ($115k/£86k) for certain residents who make their money overseas, a flat rate that enables wealthy migrants to avoid ordinary yearly tax rates (which would probably work out more expensive in the long run).

Add to this Italy's high quality of life, excellent weather, and world-famous cuisine, and it's easy to see why so many millionaires are drawn to its shores.

Sponsored Content

USA: 7,500 more millionaires

While many American millionaires may be considering moving overseas (Ellen DeGeneres is one recent example), the US still has a powerful appeal. Not only is it the world's leading tech centre, attracting everyone from ambitious entrepreneurs to global leaders, but it's also becoming an increasingly attractive destination for wealthy retirees. Florida, in particular, is a popular retirement hub.

As many as 10,800 millionaires migrated to the US in 2019 alone, which was an increase of 1,800 from the previous year. Though numbers plummeted in the wake of the pandemic, they're back on the rise, with 3,800 millionaires expected to have moved to America in 2024 and a further 7,500 expected in 2025.

The EB-5 visa programme, which offered green cards in exchange for a $800,000 (£602k) investment into a US business, has drawn criticism over potential security and fraud fears. Donald Trump intends to replace the programme with a so-called Gold Card, which will offer residency and even citizenship to wealthy immigrants in exchange for $5 million (£3.8m). A waiting list for the Gold Card was opened earlier this year, and by June, it was announced that 70,000 people had joined.

UAE: 9,800 more millionaires

Topping the list for the fourth year running, the United Arab Emirates (UAE) is expected to receive an influx of 9,800 millionaires by the end of 2025, up from 6,700 in 2024.

The country has long been a magnet for millionaires; in 2022, it was estimated that an incredible 35,000 HNWIs had relocated to the UAE since 2000. But the demographic of those HNWIs is changing. While the UAE has historically attracted the super-rich from comparatively nearby nations, including India, Russia, and other parts of the Middle East and Africa, Henley & Partners notes that more people are choosing to move to the UAE from the UK and Europe, a sign of its rapidly growing appeal.

With a low crime rate, minimal taxes, impressive health care system, and luxury shopping malls galore, it's not hard to see where the appeal lies. But the country has also sparked fierce criticism for its history of human rights abuses.

Where are millionaires moving from?

For the following 10 countries, it's a different story. From historic millionaire hubs to nations slapped with sanctions, many places are losing their super-rich fast – and it's not just a reflection of the whims of the wealthy.

Factors including security, taxes, and geopolitics can all encourage millionaires to migrate, and the next 10 nations are plagued by problems that are chasing off HNWIs in their droves.

Read on to discover the top 10 nations that are likely to see the highest outflow of millionaires in 2025...

Sponsored Content

Israel: 350 fewer millionaires

Israel is expected to lose 350 millionaires this year, though this could be a conservative figure. According to figures published by Henley & Partners and New World Wealth in April, as many as 1,700 HNWIs fled the nation in 2024, reportedly as a result of the ongoing war in the region. While Henley & Partners didn't attribute a reason to the exodus, local media has suggested worsening economic conditions in Israel are prompting millionaires to flee.

In addition to the devastating human cost on both sides, the conflict continues to take a financial toll on the nation. American credit rating agency Fitch downgraded Israel from A+ to A last August, and this year has upheld its A rating "with a negative outlook".

Germany: 400 fewer millionaires

Germany might be Europe's biggest economy, but its millionaire population is only getting smaller, with 400 expected to leave this year. As with Israel, however, the numbers could be much higher. According to wealth migration consultant Sebastian Sauerborn, who wrote a response to the Henley & Partners report, the firm's projection is "laughable" and the real figure is "many multiples" higher. But why?

A report in British newspaper The Telegraph, published in March, claimed "more than a third" of Germany's millionaires were considering leaving the nation due to the rise of the far-right. It's possible these HNWIs are jumping ship to left-leaning Switzerland, which, as mentioned, is expected to welcome 3,000 new millionaires in 2025.

Spain: 500 fewer millionaires

Sun, sea, and sangria are apparently no draw for Spain's millionaires; the country is expected to lose 500 this year. The 2025 Global Wealth report from Capgemini claims the number of HNWIs in Spain fell from 250,600 to 246,600 in 2024 (though the millionaire population gained wealth as a whole), so again, it could be that Henley & Partner's figures are conservative.

With next-door Portugal set to attract 1,400 more millionaires this year, it's likely many Spanish HNWIs are relocating within Europe, perhaps to escape Spain's notorious wealth tax. And it's not just humble millionaires who are looking to take their wealth out of the country. Amancio Ortega, Spain's richest person with a net worth of over $110 billion (£83bn), recently bought a 49% stake in a British ports operator – a significant investment that's exempt from the domestic wealth tax in his home country.

Sponsored Content

France: 800 fewer millionaires

Another European heavyweight that's set to see its millionaire population fall, France could lose an estimated 800 HNWIs in 2025. The country's stock market performed particularly badly last year, with the CAC 40 index dropping 3% despite the European stock index as a whole gaining 6%.

Roland Kaloyan, head of European equity strategy at the French bank Société Générale, has described the downturn as "quite remarkable". Political instability in France, which saw multiple prime ministers in 2024, has been widely attributed as a reason. Add to this ballooning public debt and a downgraded credit rating, and it's perhaps easy to see why French millionaires feel their money might be safer elsewhere.

Brazil: 1,200 fewer millionaires

Brazil is still feeling the after-effects of several political scandals. In 2016, a whopping 8,000 millionaires left the country after the political disruption caused by President Dilma Rousseff's impeachment and the Petrobras corruption scandal. In 2017, around 2,000 more HNWIs followed suit.

A further 1,400 HNWIs left Brazil in 2019 and 2,500 in 2022. The situation significantly improved and "just" 800 were expected to leave in 2024, with the re-election of Luiz Inácio Lula da Silva in January 2023, closely followed by healthy growth in the Brazilian economy, believed to be key factors. But as many as 1,200 millionaires are forecast to leave the nation this year, with many reportedly heading for the United States.

This exodus is being sparked by "the search for greater security (due to high crime), desire for a better quality of life (better infrastructure and services), the need for quality education and healthcare, and pursuit of economic stability with predictable regulations", according to Henley & Partners.

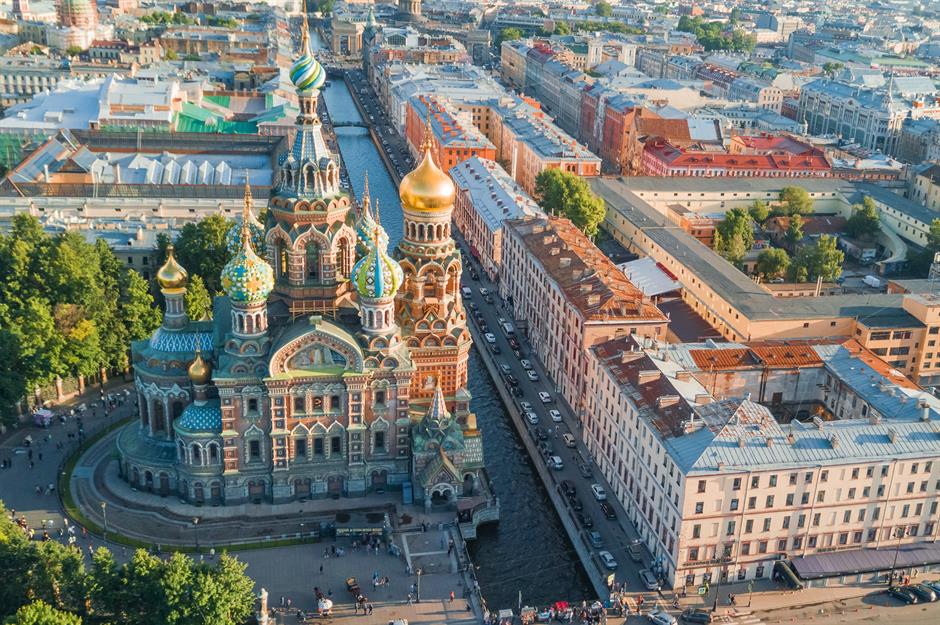

Russian Federation: 1,500 fewer millionaires

Even before the war in Ukraine, wealthy Russians were leaving the country in droves. Around 5,500 HNWIs fled the country in 2019, representing 6% of the nation's super-rich. Fast-forward to 2022 and a record 8,500 HNWIs fled Russia, the equivalent of 15% of Russia's millionaire population.

This number has since fallen to 1,500, but that's likely because there are comparatively few millionaires left in the country. Global companies withdrew from Russia in their thousands after the war began, causing the stock market to crash, and ongoing fears around the economy have proved more than enough to encourage HNWIs to relocate.

Popular destinations for these migrating millionaires include Dubai, Qatar, and Türkiye, all of which have declined to impose sanctions on the country and its residents.

Sponsored Content

South Korea: 2,400 fewer millionaires

South Korea is arguably one of the more surprising countries on the list. An estimated 1,200 HNWIs were expected to leave the nation in 2024, and the number has doubled this year, showing that millionaire migration isn't slowing down anytime soon. Popular destinations for these super-rich relocators include the US, Canada, and Australia, according to Henley & Partners.

Some analysis suggests this trend is a case of 'carrot over stick'; instead of being forced to leave by unfavourable conditions in their home country, a growing number of South Koreans have simply become rich enough to leave, typically choosing Western nations with better opportunities and stronger global connections.

But it could be that ongoing tensions with North Korea are also encouraging South Korea's super-rich to pack up and leave.

India: 3,500 fewer millionaires

A significant number of India's wealthiest residents have decided to leave the country over the last decade. Around 7,000 millionaires left India in 2019, 5,000 left in 2020, and more still in 2022. The country's unpredictable taxation system – in which immediate payment demands are seemingly issued at random – is traditionally one of the main reasons millionaires cite for leaving.

But the tide could be turning. Though a significant 4,300 HNWIs were forecast to leave India last year, Henley & Partners claims the exodus is "not particularly concerning as India continues to produce far more new HNWIs than it loses to emigration". The report adds that the majority of Indian millionaires who leave choose to maintain some assets in the nation.

And more millionaires are deciding to stay; the number of migrating HNWIs fell to 3,500 in 2025, perhaps a testament to India's growing business credentials.

China: 7,800 fewer millionaires

Tens of thousands of millionaires have left China during the last decade, with a staggering 16,000 quitting the country in 2019 alone. In 2024, the figure was expected to reach 15,200.

Interestingly, a 2017 poll conducted by the Hurun Report and Visas Consulting Group found that half of China's millionaires were planning to move overseas eventually, with the majority intent on settling in the US. Reasons cited included the restrictions on personal freedom at home, a lack of good senior management jobs, and concerns about the country's levels of air pollution.

But as in India, the tide is turning. Significantly fewer HNWIs are projected to leave the People's Republic this year (7,800), and fears surrounding the impact of Donald Trump's tariffs could be waning. This is partly because the agreement reached with China is softer than originally threatened, but also because China is emerging as a viable alternative trading partner to the US, which could bring increased business opportunities around the world.

Sponsored Content

United Kingdom: 16,500 fewer millionaires

It's worse news in the UK. While the nation has been on the receiving end of HNWIs over the past 30 years, 2017 was the first time it saw a large number of its super-rich wave goodbye, a trend undoubtedly sparked by Brexit. In 2022, the nation also lost a significant number of its Russian billionaires – including Roman Abramovich – as the West hit wealthy oligarchs with sanctions.

A further 9,500 HNWIs were forecast to leave in 2024, marking a new record. In fact, it's more than double the number of millionaires who left in 2023, which in itself was a record at 4,200. This year heralds another record: not only is the UK forecast to lose 16,500, but it's projected to be the worst affected of any nation in the top 10. It's the first time a European nation has topped the list.

According to Henley & Partners, the most commonly cited reasons for leaving include the ongoing effects of Brexit, government instability, and the implementation of new tax laws under the Labour government.

Now find out which countries have the best and worst pension systems

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature