These billionaires got a whole lot richer during the pandemic

Profiting despite the pandemic

The coronavirus pandemic has dominated the news for more than a year now and it has impacted everyone's lives – and wallets – in some way. But how did the mega-rich fare? As the world turned to online shopping, virtual meetings and electric cars, some super-wealthy individuals profited spectacularly. Using the Bloomberg Billionaires Index as a guide, click or scroll through as we look at how some billionaires' fortunes have skyrocketed. Latest net worth figures as of 7 May 2021.

MacKenzie Scott, up $21.3 billion

MacKenzie Scott, up $21.3 billion

Amazon has enjoyed stellar sales during the pandemic, which has sent its share price into the stratosphere, as well as Scott's personal fortune. However, the world's fourth richest woman has actually been trying to reduce her wealth. Scott announced in July that she had given $1.7 billion to 116 charities since her divorce and went on to donate more than $4 billion to 380 charities in the last four months of the year, bringing her total giving for 2020 to almost $6 billion. Scott signed Bill and Melinda Gates and Warren Buffett's Giving Pledge just one month after her divorce from Bezos came through. Nonetheless, her net worth has still grown by $21.3 billion to $58.5 billion.

Dan Gilbert, up $26 billion

Dan Gilbert, up $26 billion

Fast-forward to the coronavirus pandemic, and Gilbert’s company has once again boomed in the face of crisis. In March 2020, the Federal Reserve slashed interest rates to help the US economy withstand the COVID-19 outbreak, and that prompted a surge in people taking out new mortgages. Quicken Loans profited immensely from the swell and quickly overtook traditional banks such as Wells Fargo to become the largest mortgage lender in the US. The company then went public for a second time in August and its success helped to bolster Gilbert’s net worth even further. The savvy mortgage magnate was worth $7.2 billion at the beginning of 2020, but now boasts a fortune of $33.2 billion.

Colin Huang, up $27.8 billion

Described by the Financial Times newspaper as “Shanghai’s secretive internet king”, Colin Huang is a Chinese billionaire who keeps a very low public profile. Huang started his career as an intern at Microsoft, before taking on a position at Google, but his most lucrative career move to date has been to found Pinduoduo, an e-commerce business that has grown to become one of the largest in China. During 2020 alone, Huang's wealth grew by $43 billion.

Colin Huang, up $27.8 billion

While Huang’s net worth saw a gigantic spike in 2020, it has since fallen significantly during 2021 – by $15.2 billion to be exact. Pinduoduo has seen its share price fall in the last couple of months from its record peak of $202.82 on 17 February, following Huang’s announcement on 17 March that he would be stepping down as chairman of the company. He had already announced that he would be resigning as CEO last July and has since accelerated plans to step away from the business entirely and hand over the reigns to a new group of leaders. This accounts for the dramatic dip in the company's value and Huang’s net worth, which now stands at $47.5 billion. However, this is still a very healthy $27.8 billion increase since the start of the pandemic.

Bill Gates, up $31.6 billion

Bill Gates co-founded Microsoft in 1975 and just a decade later he was one of the richest men in America. As the coronavirus pandemic pushed everything from work to socialising online, the already-successful Microsoft made big gains and its share price reached an all-time high of $261.97 on 27 April 2021. The company is now closing in on becoming the second American company to reach the highly coveted $2 trillion market valuation, an elite club which so far only Apple is a member of.

Bill Gates, up $31.6 billion

As a result, Gates has seen his net worth soar. Since the start of the COVID-19 outbreak the Microsoft founder’s wealth has swelled by $31.6 billion to an enviable $145 billion, making him the fourth richest person on the planet. The billionaire does use his powers for good though, and is believed to have donated more than $50 billion to charity over his lifetime, predominantly through his own charitable fund, the Bill & Melinda Gates Foundation. However, Gates' wealth could be about to take a hit now that he is getting divorced from wife Melinda after 27 years of marriage, although the financial details are yet to be announced.

Steve Ballmer, up $32.2 billion

Another billionaire riding high from Microsoft’s success is Steve Ballmer, who joined the company in 1980 as its 30th employee and worked as its CEO for 14 years from 2000. Now retired from the computer software company, Ballmer still reaps the profits of his past work through a huge quantity of shares in the firm.

Steve Ballmer, up $32.2 billion

Larry Ellison, up $34.4 billion

Larry Ellison is the founder and majority shareholder of Oracle, a computer software company which generated revenues of $39.5 billion between April 2019 and April 2020. Total revenue dipped slightly in the most recent fiscal year to $39.1 billion, but the fortunes of its founder saw a definite uptick…

Larry Ellison, up $34.4 billion

Ellison has a diverse portfolio that includes a third of Redwood City in California, a sailing team and real estate, including Hawaii’s Lanai island, but his most profitable investment is his stake in Tesla. Ellison purchased the equivalent of 15 million shares in the electric vehicle company before joining its board in 2018. As Tesla’s value soared during the pandemic, Ellison racked up an incredible $12 billion return by January 2021. Factoring in all his stakes, this tech mogul’s fortune has grown by $34.4 billion since the start of 2020, leaving him with an enviable net worth of $93.2 billion.

Mark Zuckerberg, up $41 billion

Mark Zuckerberg, up $41 billion

Gautam Adani, up $50.2 billion

Gautam Adani, up $50.2 billion

The billionaire has been working hard to diversify Adani Group in order to keep with the times, including buying a majority stake in Mumbai International Airport and investing in data centres and defense. In fact, Adani now has control of seven of India's airports. Adani has also revealed plans to boost his renewable energy capacity, a move that will help the Indian government's climate targets. The diversification and expansion of Adani Group has received Indian Prime Minister Narendra Modi’s seal of approval, and investor interest has shot up as a result. Adani's fortune has been boosted by a further $27.7 billion in 2021 to date. This means he is a whopping $50.2 billion richer since the start of the pandemic and currently has a net worth of $61.5 billion.

Zhong Shanshan, up $58.3 billion

Former journalist Zhong Shanshan is the founder and majority shareholder of Nongfu Spring, a bottled water company that floated on the Hong Kong stock market in early September and saw its shares rise in value by 85%. In fact, in 2020 Zhong’s wealth leapt a huge $71.4 billion, both through Nongfu Spring's success and via his stake in Beijing Wantai Biological Pharmacy Enterprise, a company which is making COVID-19 test kits. This pushed Zhong’s net worth to $78.2 billion in January, meaning that he temporarily replaced India's Mukesh Ambani as the richest man in Asia.

Zhong Shanshan, up $58.3 billion

Zhong didn’t get to enjoy the top spot for long however, as his net worth has taken quite the beating in the first quarter of 2021. His wealth is tied up in his business; as Nongfu Spring saw its share price drop following its hugely successful IPO, so too has its chair’s net worth. The bottled water magnate’s wealth is down an enormous $13.1 billion compared to January 2021, but since the start of 2020 Zhong's wealth has increased by a huge $58.3 billion.

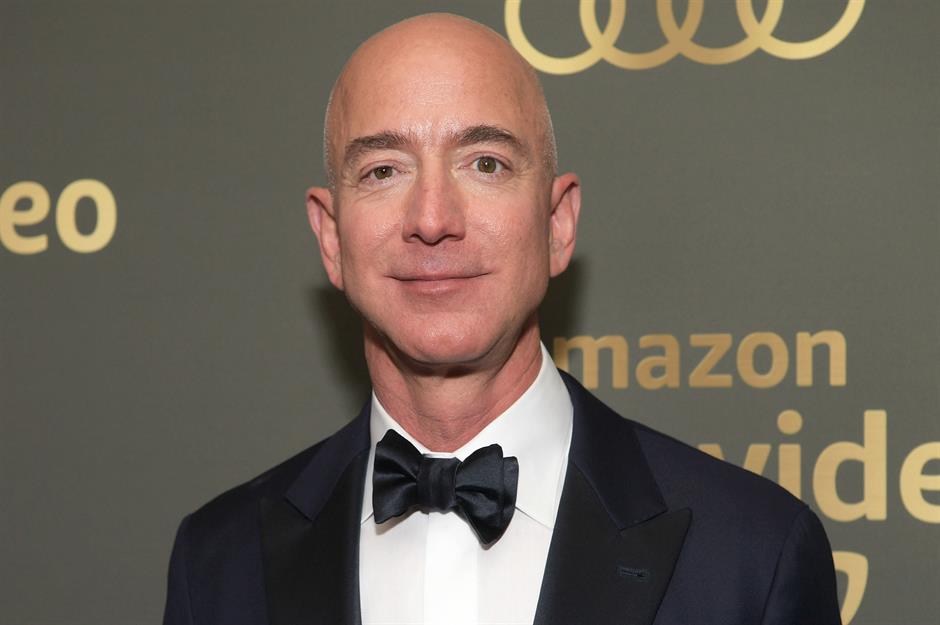

Jeff Bezos, up $77.9 billion

It’s incredible that the world’s best-known and most-used online retailer started out as a small garage bookshop in 1994, and its founder, Jeff Bezos, has accumulated an incredible fortune to match. Amazon sales have flourished while brick-and-mortar stores have been forced to shut and the gargantuan company reported that profits have tripled since this time last year. It’s as if Amazon was designed to thrive during a pandemic, with everything from its video streaming platform to its grocery delivery service seeing an uptick in usage.

Jeff Bezos, up $77.9 billion

At various points throughout the crisis Jeff Bezos took the title of the biggest billionaire winner of the pandemic, but he has since been pushed down into second place. The richest person in the world, Bezos' net worth has increased in tandem with Amazon's success, and it is up by $77.9 billion since the start of 2020, despite his huge divorce settlement. Bezos is forecast to be the world’s first trillionaire by 2026.

Elon Musk, up $154.1 billion

The maestro behind the stock market sensation that is Tesla is unsurprisingly top of the pile when it comes to billionaire winners of the pandemic, as the electric car manufacturer has swerved the plummet in demand that has impacted more traditional automakers across the world. In fact, the company earned record profits in the first quarter of the year, and shares hit an astonishing record price of $883.09 on 26 January 2021, despite the CEO's penchant for penning damaging tweets, including the one he put out on 1 May claiming the Tesla share price was “too high”, which caused it to tank by 10%.

Elon Musk, up $154.1 billion

On 24 November, the South African-born billionaire became the world's second richest person on the Bloomberg Billionaires Index, overtaking Bernard Arnault, chairman of Louis Vuitton, and even surpassed Jeff Bezos' wealth at the start of the year to take the top spot. However, he has since dropped down to second place. One way he has beaten Bezos though is the sheer increase in his wealth in the past year. Since the beginning of 2020 his fortune has grown by a huge $154.1 billion as Tesla's share price has skyrocketed and he has unlocked a series of performance-related rewards. He is now worth $182 billion according to Bloomberg.

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature