How to help your child through university - and beyond!

As A-level results are announced, we look at how parents can help their children cope with the costs of getting a university degree.

Getting a degree these days is an expensive business. UK universities normally charge tuition fees between £6,000 and £9,000 a year. Other costs will probably then push the total bill to £50,000 or more.

These are scary numbers for any teenagers who have just got their A-level results. In fact, they may put some students off from going to university at all.

Now it’s important to stress that the Government’s student loan scheme covers all tuition costs, and there are also maintenance loans available to cover at least some of the ancillary costs. What’s more, former students won’t have to repay any of these loans until they are earning at least £21,000 a year.

Indeed some graduates who work in low-paid jobs may never repay their whole loan debt. Once you reach 50, any outstanding student debt is written off.

Parents still worry

Still, £50,000 is a chunky sum of money in anyone’s book, and many parents will inevitably worry about their child’s finances while they are at university.

For starters, the maintenance loans may not cover all the living costs. And even though some students won’t have to pay back their full loans, debt repayments will still be a significant burden in their 20s and 30s.

So what can parents do to help?

Well, the obvious answer is to provide cash. Some parents might feel able to provide a termly allowance to help with living costs.

Or some parents might want focus on their children’s finances after they leave university.

After all, if a former student is trying to save for a mortgage deposit and repay student loans at the same time, it can be really tough to get on the first rung of the housing ladder. So if parents can help to pay that deposit, they’re doing a massive favour for their kids.

Easier said than done

Of course, finding that extra cash for your kids is easier said than done. At Lovemoney, we believe the answer is budgeting. Effective budgeting can help you find that extra cash to pass on to your children.

And we also think that our MoneyTrack budgeting tool can help you budget more effectively.

Let’s look at how MoneyTrack works:

1. Enter your accounts

First, you should load in all your bank accounts and credit cards into the tool. It’s not a problem if these accounts and cards are operated by more than one provider.

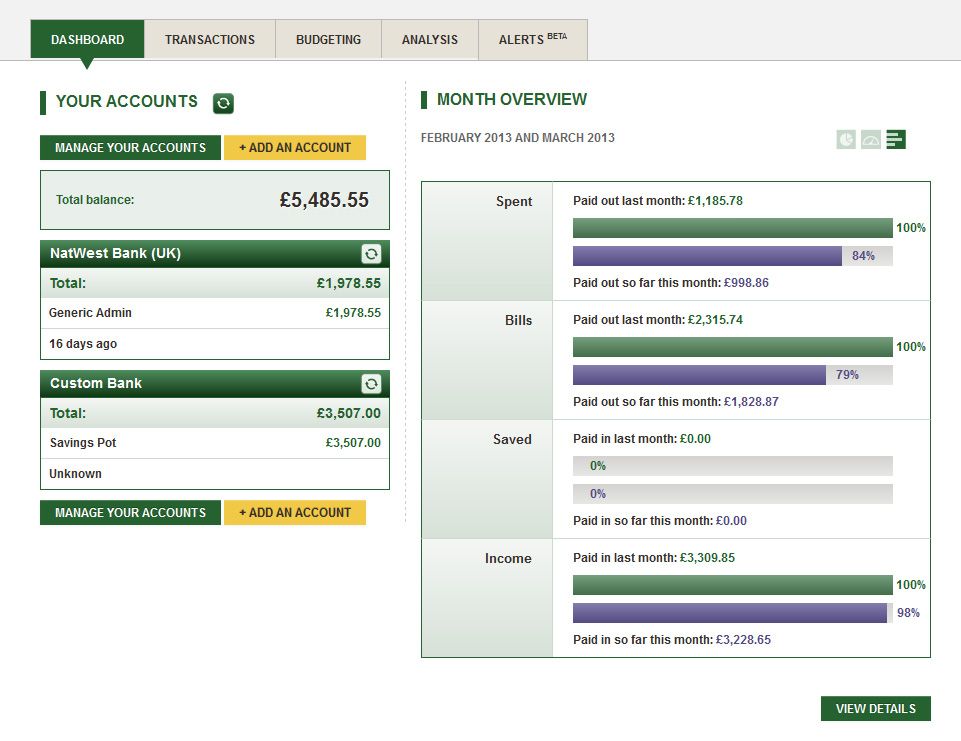

Then you’ll see an overview of how much money you have right now:

You can see the current balances on all your accounts, and you can also see how much money you have spent and received over the last month.

2. Look at your transactions

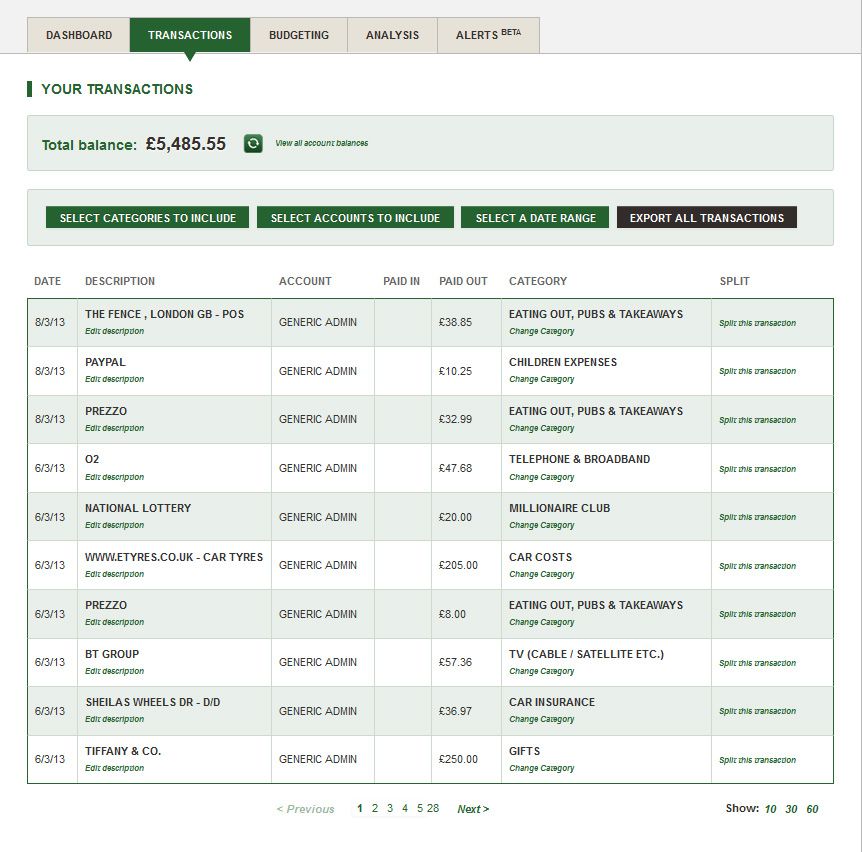

Now click on the ‘transactions’ tab at the top of the page and you can see every purchase you’ve made and when you’ve made them too.

Even better MoneyTrack automatically categorises every item of spending for you. So if you paid a bill for Sky, MoneyTrack would classify that as TV (cable/satellite etc).

You can also amend the categorisation and even create your own categories. MoneyTrack is intuitive and future transactions will be categorised in line with your newly-created categories.

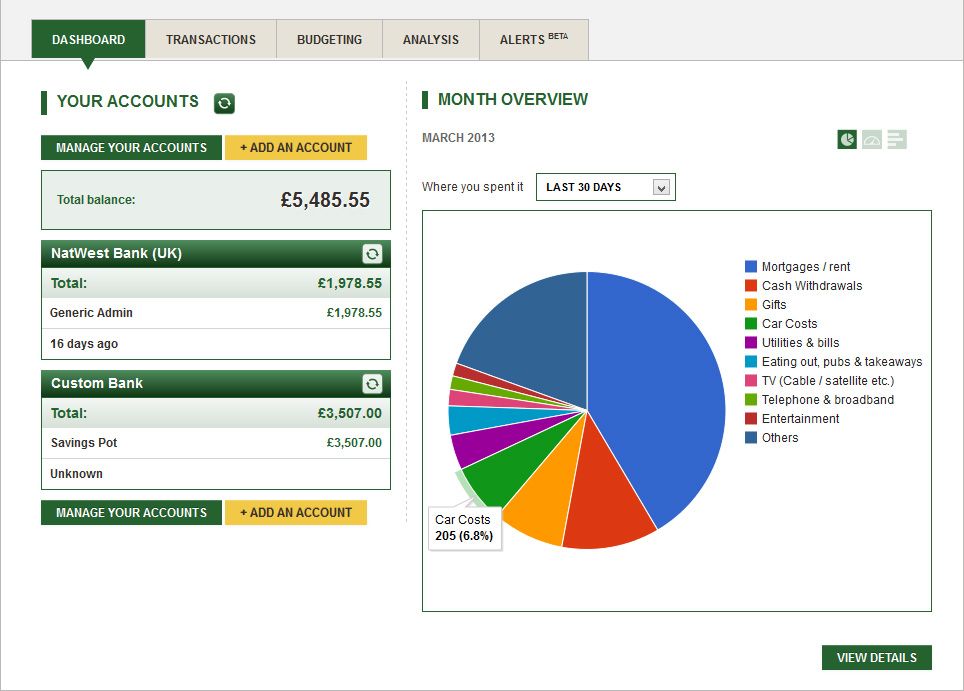

Once you’re happy with your categorisation, it’s really easy to see where your money is going. Hopefully you’ll now be able to spot areas where you could cut back your spending.

3. Budgeting

This is the most important part. Once you’ve found areas where you can cut back on your spending, you should be able to set yourself a new budget that is achievable, but will also save you money.

So if you spent £100 on ‘eating out’ last month, maybe you could cut that back to £50.

You can load your budget goals into MoneyTrack and then regularly check to see whether you’re on track to hit your spending targets. If too much money is leaving your bank account, you can take prompt corrective action.

Hopefully, effective budgeting will enable you to find the cash to pass onto your kids. So if your child is planning to go to university, MoneyTrack shouldmake it just a little bit easier to give your pride and joy a helping hand…

- Check out MoneyTrack

More from Lovemoney:

Do these 20 things and you’ll always be poor

Too many people are no good at budgeting

Rail fares rise 4.1%: can you cut costs by taking the bus instead?

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature