Top savings accounts 2025: where to find the best rates for your cash

Falling inflation might provide short-term relief, but it also makes a Base Rate cut more likely. Looking to move your cash? Here are some of the best options.

The rate of inflation has dipped for the first time since May, official figures have revealed.

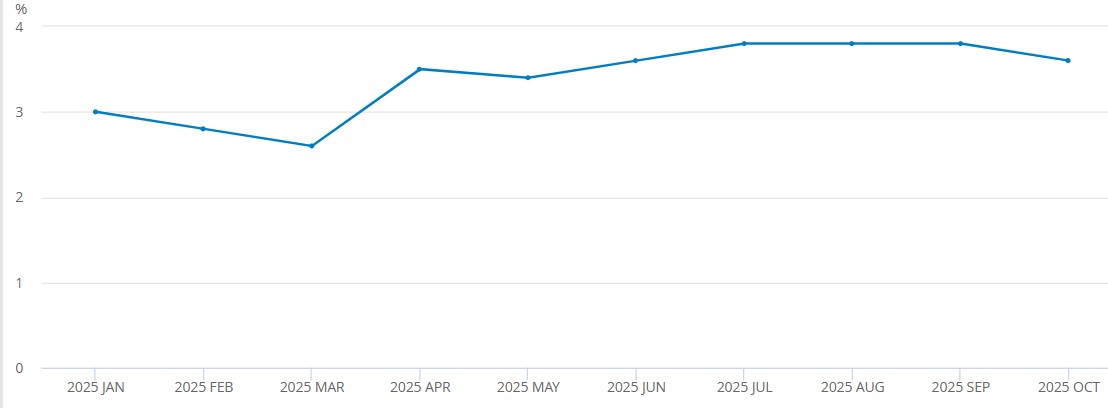

The CPI measure of inflation came in at 3.6% in October, down from 3.8% in the previous month.

While falling inflation will provide some welcome respite for household budgets, it could also indirectly lead to bad news for savers.

That's because, if inflation is on a downward trend, the Bank of England will feel more confident it can cut the Base Rate of interest in the hopes of kick-starting our stagnant economy.

That, in turn, would see banks cutting the savings rates on offer.

George Brown, senior economist at financial firm Schroders, said a cut could come as soon as next month.

“Evidence inflation has peaked should tip the scales towards a December rate cut," he said.

Looking at the longer trend for the Base Rate, Brown added that a lot depended on what the chancellor announced in her Budget speech next week.

"Any further rate cuts will largely depend on the contents of the chancellor’s red box," he said.

"If VAT and green levies are eliminated from household energy bills, inflation could fall by as much as half a percentage point.”

That could spur the Bank of England to cut rates at a faster pace than is currently expected.

Graph: how inflation has changed in 2025

Source: ONS

Inflation your minimum target for savings

Predicting what will happen next with interest rates is notoriously tricky, so let's deal with the here and now.

Following today's inflation announcement, 3.6% is now the absolute minimum rate you should aim to earn on your savings if you want to avoid your money actually losing value in real terms.

Sadly, many of us aren't getting anywhere close to that figure.

Savings app Spring revealed earlier this month that we hold nearly £32 billion in savings accounts earning 1% interest or less.

It added that the majority – 77% – of those funds are held in accounts with balances of £10,000 or more.

The good news is that this problem is easily fixed: there are still numerous attractive savings deals around that comfortably beat inflation.

Whether you want a fixed-rate deal to shield against any potential Base Rate cuts, or a top access account for your emergency funds, there are plenty of accounts paying well over 4%.

So let's take a look at the best options for each type of savings account to help you decide where to move your money.

Manage all your savings accounts in one place with Raisin, the simple savings service

Regular savers: up to 7.5%

Regular savings accounts have long offered the most attractive rates around.

They're generally best suited for new savers as they don't allow you to deposit a lump sum upfront.

Instead, you make regular monthly contributions and get the money back with interest after one year.

So, what rates can you get?

Principality Building Society offers a brilliant 7.5% on its Regular Saver.

Unfortunately, it's just a six-month account and you can only deposit up to £200 per month.

If you'd like to set aside a little more or save for longer, Zopa offers a 7.1% regular saver that's fixed for one year and allows deposits of up to £300 per month.

The catch here is that you'll need to have a Zopa 'Biscuit' current account to qualify (read our review here).

If you are willing to switch accounts to secure a top rate, you'll actually be better off joining First Direct.

While its linked regular savings account is marginally less generous at 7%, the bank is currently offering a generous £175 incentive to new customers, so you'll be far better off overall.

Current accounts: up to 5%

If you'd like to earn interest on your monthly finances, you can bag a handy 5% for 12 months on balances of up to £1,500 with Nationwide's FlexDirect.

Helpfully, it's also offering a £175 bung to anyone who switches current accounts from another bank, further boosting your earnings.

You’ll also have access to a regular saver paying 6.5% AER for one year if you put away more than £200, falling to 1.25% if you make three or more withdrawals per year.

Furthermore, the bank pays 1% cashback for 12 months, although this is capped at £5 per month, or £60 per year.

Find the best alternatives in our roundup of current accounts that pay in-credit interest

Cash ISAs: earn up to 4.56%

Top Cash ISA rates have fallen sharply in recent months. With rates of up to 4.98% available as recently as July, the best rate you can get now is 4.56%, a drop of 0.42%.

That ISA is available through fintech company Trading 212, which can be opened from just £1.

Note the account comes with a 0.66% bonus for the first yearand you’ll need to open an account online or via the app.

It is also a flexible access ISA, allowing you to withdraw and reinvest money within the same tax year.

If you’re looking for a bigger name, Bank of Ireland pays 4.16%, including a 1.15% bonus for the first year.

Notice accounts: up to 4.54%

Oaknorth Bank offers the top notice account, which pays a rate of 4.54%, and comes with a 95-day notice period.

We should note that this account, like many top-paying notice accounts, is linked to the Base Rate of interest.

If, as mentioned at the start, the Bank of England does decide to cut this rate by 0.25% next month, then this account will fall accordingly.

Best easy/instant-access savings: up to 4.51%

An easy-access account can be a great choice if you need to access your money quickly in the event of an emergency or want to withdraw funds regularly.

Moneyment Bank is offering a market-leading rate of 4.51%, which includes a 0.74% bonus for the first year.

Unfortunately, this deal as a sizeable £25,000 minimum deposit, so it certainly won't be for everyone.

If you can't meet that minimum threshold, Cahoot pays a slightly lower rate of 4.4% on its access savings account that can be opened from just £1

Best fixed-rate savings: up to 4.41%

For the past couple of years, the best fixed-rate deals were generally those with shorter terms of 12 months or fewer.

These days, there's not much difference between the shortest and longest-term bonds, so it all depends on how long you want to lock your money away.

At present, Secure Trust Bank pays 4.41% on a five-year fix, allowing deposits of between £1,000 and £1 million.

If you're after a shorter-term bond, the best one-year rate we could find is 4.47% from Monument Bank, but it does require a £25,000 minimum deposit.

LHV Bank offers a fractionally lower rate of 4.46%, but its one-year fix can be opened with just £1,000.

Best savings rates: where to earn the most interest on your cash

Here's a table with all the top deals for you to compare at a glance.

The account you go for will probably be determined by the amount you have to save and whether you want instant access to your money.

Please note that we've only included the highest-paying account from each category.

Remember, sometimes you'll need to open another account with a provider to access certain savings rates.

|

Provider |

Type |

Interest rate |

Maximum/minimum deposit |

|

Principality Building Society |

Regular saver |

7.5%, fixed for six months |

Max: £200 per month |

|

Nationwide |

Current account |

5% on up to £1,500, fixed for 12 months |

Maximum balance of £1,500 |

|

Trading 212 |

Cash ISA |

4.56% |

Max: £20,000 |

|

Oaknorth Bank |

Notice account |

4.54% |

Min: £1 Max: £500,000 |

|

Monument Bank |

Access account |

4.51% |

Min: £25,000 Max: £2m |

|

Monument Bank |

Fixed rate |

4.47% for one year |

Min: £25,000 Max: £2m |

Time to consider investing?

If you're sure you don't need to access your money anytime soon, you'll likely achieve a better return over the long term by investing (five years or more).

If you are comfortable taking on some risk for potentially better returns, you could consider investing in the stock market (capital at risk).

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature